Thursday, July 31, 2008

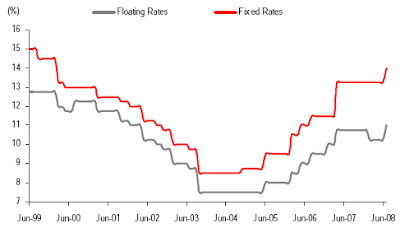

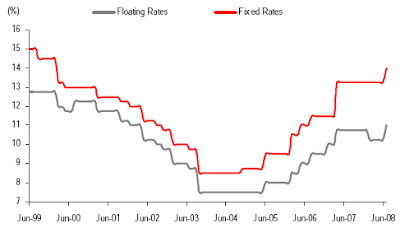

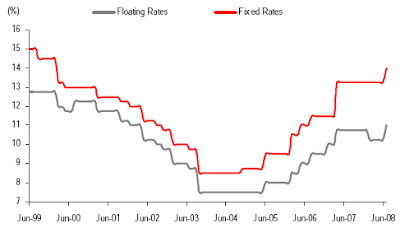

India Historical Home Loan Rates

We are presenting to our readers Historical Home Loan Lending [Fixed Rate and Floating Rate] Home Loan / Mortgage rates in India over the last 10 years. With RBI hiking the Repo Rate by 50 bps on July-29th, we expect the Home Loan Rates to rise by another 0.5%. [This is not indicated in the Graph Plotted Below]

India Property - Worst Not Over

IT space office rentals have, for the first time, declined by 4-13% QoQ in 2Q08. Hiring by Top - 5 IT sector companies declined 48% YoY in 2Q08, indicating a prolonged downturn for the office sector.

With increasing supply, the mall occupancy rates have fallen by an average of 20% in the Top 10 Indian cities. Vatika (a Tier-2 but well known developer in the north) cutting prices by 10%+ in all its new launches. Transferable Development Right (TDR) prices in Mumbai have corrected by 12-15% over the past two months, suggesting a slowdown in the hitherto protected Mumbai market.

All the Property stocks are now rated to quote at a discount to their NAVs due to rising debt on their Balance Sheets [up by 20% QoQ]

Courtesy: CLSA

With increasing supply, the mall occupancy rates have fallen by an average of 20% in the Top 10 Indian cities. Vatika (a Tier-2 but well known developer in the north) cutting prices by 10%+ in all its new launches. Transferable Development Right (TDR) prices in Mumbai have corrected by 12-15% over the past two months, suggesting a slowdown in the hitherto protected Mumbai market.

All the Property stocks are now rated to quote at a discount to their NAVs due to rising debt on their Balance Sheets [up by 20% QoQ]

Courtesy: CLSA

Wednesday, July 30, 2008

40mn sft IT + Commercial Space Mumbai

According to ongoing projects for IT /ITeS, around 40mn sft will be available by the end of 2009 in Mumbai and suburbs. Top 5 Developers of IT /ITeS properties in Mumbai are,

- Royal Palms SEZ - Goregaon - 2.5 mn sft

- 247 Park - Vikhroli by HCC - 2.0 mn sft

- IndiaBulls Realty - Lower Parel - 1.87 mn sft

- Elphinstone Mills by IndiaBulls - 1.54 mn sft

- Bombay Dyeing at Dadar - 1.5 mn sft

Tuesday, July 29, 2008

India SEZ Statewise Statistics

We have compiled the list of Top 8 states which have the largest number of approved SEZs in India.

- Maharashtra 126 SEZs spread on 42,714 hectares of land

- Haryana 55 SEZs spread on 29,100 hectares of land

- Gujarat 48 SEZs spread on 22,376 hectares of land

- Rajasthan 17 SEZs spread on 16,029 hectares of land

- Tamil Nadu 71 SEZs occupying 12,419 hectares of land

- Andhra Pradesh 78 SEZs occupying 12,071 hectares of land

- Karnataka 51 SEZs occupying 9,057 hectares of land

- West Bengal 35 SEZs spread on 8,905 hectares of land

Monday, July 21, 2008

India Vs China - Real Estate Development and Policies

CLSA analysts had visited China and here is their take on how Real Estate Development stack up in both India and China after meeting 8 property development companies, across 6 cities including Tier I cities (Shanghai, Beijing, Guangzhou) and Tier II cities (Shenyang, Qingdao and Hangzhou). Our comments appear in Italics.

Government Policies:

China: Chinese real estate development sector is more susceptible to regulatory changes than Indian property sector. government has introduced several measures adversely impacting the real estate sector viz., 70/90 rule, Land Appreciation Tax etc.

India: Regulatory environment remains favorable to Developers due to relationships enjoyed by State and Central government Politicians / Bureaucreats.

India runs a parallel black money economy and Real Estate is one of the first and best heavens for these crooks.

Pre-Selling Properties:

Chinese developers can pre-sell a residential property only when the construction is 1/3rd or 2/3rd complete. Indian developers can pre-sell even before starting to dig.

In the absence of a regulator in Real Estate, Developer is the King and not the consumer.

Landbank:

Chinese developers carry 4-10 years of landbank (taking into account growth targets) is carried by Chinese developers as compared to 8-15 years of landbank by Indian developers putting pressure on cash flow to maintain the same. In China, bulk of landbank is ready to develop with most of the approvals in place, whereas, a large chunk of landbank of Indian companies is agricultural / yet to be possessed.

Land Acquisition:

China has fully transparent Land Acquisition process in which the developer has to acquire land in an open auction / tender mostly from the Government, while Indian counterparts purchase agricultural land from farmers at a much cheaper price.

Poor illiterate farmers are always taken for a ride. Land Sharks can go to any extent and the well connected mafia of Politicians and Bureaucrats can silence anybody. Town and City planning is totally absent.

Payment on Residential Properties:

20-40% of the buyers pay the cost of entire residence in China. This can be attributed to single child policy adopted by China decades ago where the new couple find funding from 2 additional sources [Parents]

Property Inventory / Supply:

Small town like Shenyang with 7mn population had new supply of 100m sf of residential properties in 2007. Compare this to total supply of residential properties in Mumbai including its suburbs, Navi Mumbai and Thane etc will be 85m sf over the next 3 years.

Do we have a Plan and Vision ? Maybe in bits and pieces without any implementation road map.

Retail Rentals:

Prime retail rentals in Shanghai are nearly double those of price retail rentals in Mumbai and Delhi. Shanghai has high concentration of super premium luxury brands such as Louis Vuitton, Hermes, Fendi etc.

Indicates Prosperous Chinese, Good Luck!!!

India is likely to lose its cost advantage very soon and Industrial emigration will be inevitable if the Indian Land Sharks are not eliminated soon. [Read July's Business World]

Government Policies:

China: Chinese real estate development sector is more susceptible to regulatory changes than Indian property sector. government has introduced several measures adversely impacting the real estate sector viz., 70/90 rule, Land Appreciation Tax etc.

India: Regulatory environment remains favorable to Developers due to relationships enjoyed by State and Central government Politicians / Bureaucreats.

India runs a parallel black money economy and Real Estate is one of the first and best heavens for these crooks.

Pre-Selling Properties:

Chinese developers can pre-sell a residential property only when the construction is 1/3rd or 2/3rd complete. Indian developers can pre-sell even before starting to dig.

In the absence of a regulator in Real Estate, Developer is the King and not the consumer.

Landbank:

Chinese developers carry 4-10 years of landbank (taking into account growth targets) is carried by Chinese developers as compared to 8-15 years of landbank by Indian developers putting pressure on cash flow to maintain the same. In China, bulk of landbank is ready to develop with most of the approvals in place, whereas, a large chunk of landbank of Indian companies is agricultural / yet to be possessed.

Land Acquisition:

China has fully transparent Land Acquisition process in which the developer has to acquire land in an open auction / tender mostly from the Government, while Indian counterparts purchase agricultural land from farmers at a much cheaper price.

Poor illiterate farmers are always taken for a ride. Land Sharks can go to any extent and the well connected mafia of Politicians and Bureaucrats can silence anybody. Town and City planning is totally absent.

Payment on Residential Properties:

20-40% of the buyers pay the cost of entire residence in China. This can be attributed to single child policy adopted by China decades ago where the new couple find funding from 2 additional sources [Parents]

Property Inventory / Supply:

Small town like Shenyang with 7mn population had new supply of 100m sf of residential properties in 2007. Compare this to total supply of residential properties in Mumbai including its suburbs, Navi Mumbai and Thane etc will be 85m sf over the next 3 years.

Do we have a Plan and Vision ? Maybe in bits and pieces without any implementation road map.

Retail Rentals:

Prime retail rentals in Shanghai are nearly double those of price retail rentals in Mumbai and Delhi. Shanghai has high concentration of super premium luxury brands such as Louis Vuitton, Hermes, Fendi etc.

Indicates Prosperous Chinese, Good Luck!!!

India is likely to lose its cost advantage very soon and Industrial emigration will be inevitable if the Indian Land Sharks are not eliminated soon. [Read July's Business World]

Friday, July 18, 2008

Unitech Corporate Park - In Rough Waters

Unitech Corporate Park [Listed on AIM London] is now facing Approval delays and a really difficult business environment. Weak rentals and an increase in interest rates have only added to its woes.

A report released by Deutsche Bank just minutes ago said,

A report released by Deutsche Bank just minutes ago said,

Unitech, has been significantly affected by government delays in regulatory approvals for its five IT SEZ projects, and weak demand delaying its Noida IT park, lower-than–expected rents in four of its six projects, and tightening liquidity resulting in a sharp increase in interest rates – which resulted in a 200bp increase in cap rates to 10% and a 100bp increase in discounting rates to 17%.Deutsche has reduced the target price by 28% in-line with most Realty companies downgrade in India.

Tuesday, July 15, 2008

Private Equity Investments in Indian Real Estate

If you thought Real Estate was the safest investment option, you are so wrong about it. Look at the status of Private Equity investments in the Indian Real Estate, they all are in deep red :-)

- Subhakm Ventures in Madhav group $9.31m [ROI -8.39%] at Rs 84 / share

- Morgan Stanley + GIC + Quantum Fund in Anant Raj Industries $165m[ROI -46.48%] at Rs 246 / share

- Yatra Capital + HSBC + Barclays + T.RowePrice + Trinity Capital + DWS in The Phoenix Mills Ltd - $45m [ROI -51.48%] at Rs 320 / share

- Wachovia in Vipul Ltd $56.65m [ ROI -72%] at Rs 260 /share

Monday, July 14, 2008

Indian Realty Party is Over - HSBC

HSBC in a report on the Indian Realty sector has turned bearish due to prevailing macro factors in the Indian economy. This report is an addendum with deeper survey and analysis than to the one released in March-08. Current report forecasts property prices to fall between 25-30% in most markets across India.

In the graph below [released by HSBC], you can see the property boom in Mumbai between 1990-94 followed by a slump for 4 years before stabilizing between 1999 and 2002. Current forecast is fall of 25-30%.

With interest rates expected to rise, deterioration in affordability is likely to accelerate. If interest rates rise by 200bp, property prices need to fall roughly 13% to maintain the current level of affordability, which already looks stretched.

With interest rates expected to rise, deterioration in affordability is likely to accelerate. If interest rates rise by 200bp, property prices need to fall roughly 13% to maintain the current level of affordability, which already looks stretched.

With housing loan interest rates at 13.5%, EMIs have shot up by 16.9% considering base case home loan rate of 11%. HSBC Research suggests that sales are down by as much as 50-60% y-o-y in the past six months.

Rising inflation and higher interest rates will, in our view, lead to a further deterioration in demand, leading to a 25-30% correction over two years. At that point, affordability levels should start to improve and, in turn, boost demand.

In the graph below [released by HSBC], you can see the property boom in Mumbai between 1990-94 followed by a slump for 4 years before stabilizing between 1999 and 2002. Current forecast is fall of 25-30%.

With interest rates expected to rise, deterioration in affordability is likely to accelerate. If interest rates rise by 200bp, property prices need to fall roughly 13% to maintain the current level of affordability, which already looks stretched.

With interest rates expected to rise, deterioration in affordability is likely to accelerate. If interest rates rise by 200bp, property prices need to fall roughly 13% to maintain the current level of affordability, which already looks stretched.With housing loan interest rates at 13.5%, EMIs have shot up by 16.9% considering base case home loan rate of 11%. HSBC Research suggests that sales are down by as much as 50-60% y-o-y in the past six months.

Rising inflation and higher interest rates will, in our view, lead to a further deterioration in demand, leading to a 25-30% correction over two years. At that point, affordability levels should start to improve and, in turn, boost demand.

Sunday, July 13, 2008

Orbit Properties Mumbai Selling Prices

We have been able to obtain the selling / sold prices of various Real Estate projects of Orbit Corporation in Mumbai. All prices in INR / sq ft

Courtesy: SBI Research

- Orbit Heights Nana Chowk - 17,026

- Orbit Arya Napensea Road - 41,500

- Orbit Eternia Lower Parel - 13,400

- Orbit Grand Lower Parel - 12,269

- Orbit Enclave Prathana Samaj - 14,110

- Orbit Haven Napensea Road - 34,000

- Orbit View Worli Sea Face - 24,225

- Orbit Ambrosia Altamount Road - 25,500

- Daruwala Chawl Lower Parel - 15,000

- Jenson Veneer New Breach Kandy Road - 16,650

- Bhatia House Tardeo Road - 17,000

- Villa Orb Annex Napensea Road - 38,250

- Lalbaug Project-II & III Lalbaug - 7,600

- NS Road Block Napensea Road - 34,850

- Kemps Corner Napensea Road - 33,150

- Orbit Plaza Kalina - 12,900

- Orbit WTC & WTC II BKC - 25,000

Courtesy: SBI Research

Saturday, July 12, 2008

45 Villages, 25,000 Acres Land Acquistion for Maha Mumbai SEZ in Trouble

All the 45 Villages identified by Mukesh Ambani's Maha Mumbai SEZ have turned down the Relief & Rehabilitation package.

What's on Offer ?

Mere Rs 10 Lakh / Acre for cultivable land.

Rs 5 Lakh / Acre for unproductive land

12.5% of the developed land to Association / Company / Co-operative formed by the people of these affected Lands.

The market price per acre of each od these lands is more than 10 times what Mukesh has offered and hence this stiff resistance. Mr. Sudhakar Patil, resident of one of the villages said,

Former, High Court Judge, B G Kolse Patil, a leading activist of anti-SEZ campaign has questioned the rationale behind the government's decision.

What's on Offer ?

Mere Rs 10 Lakh / Acre for cultivable land.

Rs 5 Lakh / Acre for unproductive land

12.5% of the developed land to Association / Company / Co-operative formed by the people of these affected Lands.

The market price per acre of each od these lands is more than 10 times what Mukesh has offered and hence this stiff resistance. Mr. Sudhakar Patil, resident of one of the villages said,

We will not surrender our land. The SEZ is nothing but a land grabbing exercise. The company claims that it is for our benefit but we don't need any help from them. There are many ancillary activities such as fishing, salt farming, manual sand dredging which will come to an halt and affect the livelihood our livelihood.The villagers have reported the matter to Maharashtra Chief Minsiter but are skeptical of any help because they suspect foul play from the CMs office.

Former, High Court Judge, B G Kolse Patil, a leading activist of anti-SEZ campaign has questioned the rationale behind the government's decision.

Tuesday, July 08, 2008

Sobha Developers Hosahalli, Bangalore gets PE Funding

Distressed Realty major from Bangalore / Bengaluru, Sobha Developers Ltd [SDL] is now seeking funding from VCs and PEs to keep its cash register ringing on the backdrop of slowing residential sales.

We have some Insider Information on the deal Pan Atlantic LLC's investment in Hoshalli, Bangalore project of Sobha. SDL will sell this land bank to SPV at consideration of Rs 670 mn while the cost of this land bank for SDL is Rs 420 mn resulting in a profit of Rs 250 mn on sale of this land. SDL will continue to benefit from the development of this property since it will hold 60% in this SPV.

The SPV is likely to spend Rs 1,900 / sft on the entire development of the project and SDL has set very high expectations of Rs 3,500 / sft as the selling price which we are really skeptical about.

We have some Insider Information on the deal Pan Atlantic LLC's investment in Hoshalli, Bangalore project of Sobha. SDL will sell this land bank to SPV at consideration of Rs 670 mn while the cost of this land bank for SDL is Rs 420 mn resulting in a profit of Rs 250 mn on sale of this land. SDL will continue to benefit from the development of this property since it will hold 60% in this SPV.

The SPV is likely to spend Rs 1,900 / sft on the entire development of the project and SDL has set very high expectations of Rs 3,500 / sft as the selling price which we are really skeptical about.

Saturday, July 05, 2008

Metrozone of Ozone Projects in Chennai on Disputed Land

A reader of our blog has alerted that Metrozone of Ozone Projects Kyoembedu [Near Anna Nagar] at Chennai is building apartments on a disputed land. Ozone projects seems to have eye washed the public with backing from HDFC property Fund, Reliance Land Ltd and Urban Infrastructure Fund. However, the land under construction by Ozone is disputed and stay being obtained by Advocate R. Neelakandan on behalf of his clients.

Interim Injunction from any carrying on any construction activity vide I.A No 9758/2008 and O.S.No 4215/2008 has been obtained on June-25th-08 from the City Civil Court of Chennai. Additionally, CMDA has issued "Stop Work Notice" to Ozone on 29th of June-08.

Apartment buyers in the said project need to exercise caution before they commit their funds as it may lead to litigations.

Interim Injunction from any carrying on any construction activity vide I.A No 9758/2008 and O.S.No 4215/2008 has been obtained on June-25th-08 from the City Civil Court of Chennai. Additionally, CMDA has issued "Stop Work Notice" to Ozone on 29th of June-08.

Apartment buyers in the said project need to exercise caution before they commit their funds as it may lead to litigations.

Tuesday, July 01, 2008

SELL Unitech - Goldman Sachs

In a report released just minutes ago, Goldman Sachs retains SELL on Unitech Ltd due to weakening property market and shakened management which is reporting very poor sales.

Just yesterday I had said how bad the situation was especially with Unitech [Project Launches Postponed and analysis by City wise]. Goldman Sachs Analyst in a Research note said,

Just yesterday I had said how bad the situation was especially with Unitech [Project Launches Postponed and analysis by City wise]. Goldman Sachs Analyst in a Research note said,

Unitech sold close to 7 mn sq ft and an implied 3700 units in FY08 which is a marked slowdown from the 7000 units sold in FY07. The Management has indicated that this reflects a fall in speculative demand and that end-user demand is still strong in NCR. However, we do not find the significant fall in units sold reassuring.We believe Unitech has to adapt to a changing environment with lower sales volumes, and may need to realign its product portfolio.Goldman Sachs has maintained a SELL on Unitech. In a separate development, ICICI and HDFC have hiked lending rates including for Home and Property Loans.

Subscribe to:

Posts (Atom)