Unitech: Are Mutual Funds / FIIs selling Unitech Stock or is it the management selling its own shares and delivering in the market ?

Trading Statistics of Unitech:

Unitech Limited-Promoter Stake 74%

Traded Volume BSE on November 24th: 1.6 crore shares

Delivery Volume: 27 per cent

Delivered Quantity: 50 lakh shares

Traded Volume NSE on November 21st: 4.6 crore shares

Delivery Volume: 29 per cent

Delivered Quantity: 1.36 crore shares

Who Delivered 1.86 crore shares except the Management? Or is it HSBC/LIC?

Unitech Ltd:

Shareholding belonging to the category

"Public" and holding more than 1% of the Total No.of Shares

No. Name of the Shareholder No. of Shares Shares as % of Total No. of Shares

Seepa Investment Consultants Pvt Ltd 39,789,360 2.45

Mukpreet Business Solutions Pvt Ltd 37,775,790 2.33

Narnil Infosolutions Pvt Ltd 32,698,770 2.01

HSBC Global Investment Funds A/C HSBC 26,338,690 1.62

Life Insurance Corporation of India 21,732,016 1.34

Friday, November 28, 2008

Tuesday, November 25, 2008

Highest + Lowest Fall Residential Prices

Which Pockets of your city have witnessed the highest and Lowest Fall in Residential Realty prices ? Here is how the data stands at the end of October-2008.

Highest Fall in Residential Property Prices:

Highest Fall in Residential Property Prices:

- Bhayander, Vasai Road, Nallasopara and Virar in Mumbai West.

- Dombivili, Kalyan, Ambernath, Chembur, Ghatkopar, Mulund, Thane & Vikhroli in Mumbai suburbs and central.

- Noida, Ghaziabad, Gurgaon -Sohan Road, Gurgaon-Golf Course/DLF City and Faridabad in the National Capital Region / NCR

- Whitefield, Marthalli, Old Madras Road and Outer Ring Road - Sarjapur in Bangalore witnessed steep corrections. We CAUTION readers about the Prestige Shantiniketan located in Whitefield Bangalore.

- Baner, Aund, Pashan and Hinjewadi in Pune have suffered the worst

- MG Road, Brigade Road, Brunton Road, Lavelle Road, Richmond Road, RMV Extension, Sadashivnagar and Malleshwaram in Bangalore

- Chanakyapuri and Vasant Kunj in Delhi

- Marine Drive, MG Road and Banargee Road in Kochi

- Banjara Hills, Jubilee Hills in Hyderabad and Sainikpuri, Maredpally in Secundarabad

- Adyar, Saidapet, R K Puram in Chennai

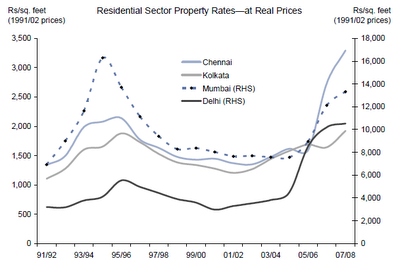

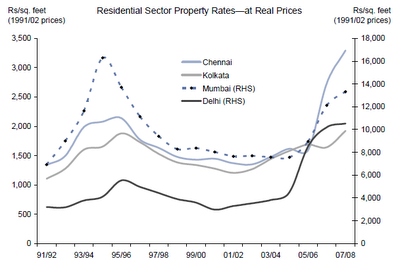

Historical Residential Property Prices of Indian Metros

The following chart shows Historical Grade-A Residential Prices in Delhi, Mumbai, Chennai and Kolkata between 1992 and 2007.

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman Research

Property prices may need to fall by up to 30% in some markets for affordability to improve. But this does not guarantee that they will begin to start moving up again and at the best arrest the FALL.

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman ResearchProperty prices may need to fall by up to 30% in some markets for affordability to improve. But this does not guarantee that they will begin to start moving up again and at the best arrest the FALL.

Monday, November 24, 2008

Past Fall and Recovery analysis in the past decade

In the previous housing downturn in 1996 when real residential prices fell 40% over three years following which the market witnessed a prolonged slump over five years before recovering. Although a sharp slowdown appears underway, mitigating factors such as favorable demographics, low mortgage penetration, falling interest rates and ongoing infrastructure demand may keep the downturn from being protracted.

Risks of a significant correction in primary residential prices mainly due to low affordability in residential sector.

The Real Estate Cycle - Fall and Rise of 10 Years in Mumbai, Delhi, Chennai, Bangalore, Kolkata and Pune

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman Research

What is the Likely Scenario of Correction this Time ?

Some arrogant Realtors are still licking the A$ of FM without any reduction in property prices. Like I said in my previous post, liquidity is really really tight for Realtors and Banks have said that they will not restructure the loans and want them to be recovered before Feb-09 otherwise they will end up as NPAs in bank's books closing March-09.

The big buyers in Indian Realty was the NRI community, first home in US / Europe, Second and sometimes even Third for speculation in India. But please be assured for now, NRIs are busy protecting their own jobs, forget about them BUYING in Indian Realty.

As we end 2008, Realtors will be under increased pressure and will start liquidating. Caution - Do not opt for the low cost housing which they have started to market [when they will be ready ? god knows]. Go for projects ready to occupy or atleast under execution but at your / CONSUMER rates :-)

Risks of a significant correction in primary residential prices mainly due to low affordability in residential sector.

The Real Estate Cycle - Fall and Rise of 10 Years in Mumbai, Delhi, Chennai, Bangalore, Kolkata and Pune

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman ResearchWhat is the Likely Scenario of Correction this Time ?

Some arrogant Realtors are still licking the A$ of FM without any reduction in property prices. Like I said in my previous post, liquidity is really really tight for Realtors and Banks have said that they will not restructure the loans and want them to be recovered before Feb-09 otherwise they will end up as NPAs in bank's books closing March-09.

The big buyers in Indian Realty was the NRI community, first home in US / Europe, Second and sometimes even Third for speculation in India. But please be assured for now, NRIs are busy protecting their own jobs, forget about them BUYING in Indian Realty.

As we end 2008, Realtors will be under increased pressure and will start liquidating. Caution - Do not opt for the low cost housing which they have started to market [when they will be ready ? god knows]. Go for projects ready to occupy or atleast under execution but at your / CONSUMER rates :-)

Thursday, November 20, 2008

How Realty Stocks Destroy Investors Wealth

We have been tracking this sector for over 2 years now and here is how Real Estate Stocks in India destroyed Investors Wealth over the past 4 months. They have been halving like a Nuclear Fission but the only difference here is [Wealth is Destroyed] Expandable Image Comparing the Values of Realty Stocks Month Over Month.

In the above image [expandable] you see how Indian Realty Stocks have halved in months time :-)

Worst is Not Over for Real Estate:

Corporates have started Defaulting and withdrawing abnormal bids for Land. Citra Developers, a 100 per cent subsidiary of Indiabulls Real Estate, withdrew its Rs 6.76 bn bid for the 134-acre PALPeugeot land in the Dombivli-Kalyan region, about 100 km outside Mumbai.

Jet Airways, which had bid successfully for a prized Bandra-Kurla Complex (BKC) plot in Mumbai for a whopping Rs 8.26 bn, has walked away from the deal.

In the above image [expandable] you see how Indian Realty Stocks have halved in months time :-)

Worst is Not Over for Real Estate:

Corporates have started Defaulting and withdrawing abnormal bids for Land. Citra Developers, a 100 per cent subsidiary of Indiabulls Real Estate, withdrew its Rs 6.76 bn bid for the 134-acre PALPeugeot land in the Dombivli-Kalyan region, about 100 km outside Mumbai.

Jet Airways, which had bid successfully for a prized Bandra-Kurla Complex (BKC) plot in Mumbai for a whopping Rs 8.26 bn, has walked away from the deal.

Restructured Housing Loan is NPA- RBI

RBI in an exclusive directive to strengthen the Nations banking system has asked them to treat Restructured Loans to Builders and Real Estate Developers as NPAs.

What are Restructured Loans ?

When borrowers are facing difficulties in repaying loans, typically banks give borrowers more time to repay the loan by extending the loan tenure, and sometimes, even at reduced interest rates. Such an exercise enables banks to keep their non-performing assets (NPA) ratios under check.

Thus banks are putting pressure on Realty developers to be realistic to market forces on the selling price and dispose of the housing stock so that Banks balance sheet is not weakned, otherwise they will face a lot of difficulties. Mr. Naryansami of BOI said,

Update: Here is how Banks how disbursed Loans to Real Estate and Construction in H1-FY2009 despite slowing economy and Global Crisis. That is why Banks are on their toes to recover those loans before they become an NPA.

What are Restructured Loans ?

When borrowers are facing difficulties in repaying loans, typically banks give borrowers more time to repay the loan by extending the loan tenure, and sometimes, even at reduced interest rates. Such an exercise enables banks to keep their non-performing assets (NPA) ratios under check.

Thus banks are putting pressure on Realty developers to be realistic to market forces on the selling price and dispose of the housing stock so that Banks balance sheet is not weakned, otherwise they will face a lot of difficulties. Mr. Naryansami of BOI said,

Just banks reducing interest rates will not help in reviving sentiments; builders will have to bring down prices for buyers.Hopefully, bankers will kick the ass of these greedy and troubled Real Estate Developers and make them sell the housing stock at fair prices affordable by the Indian consumer.

Update: Here is how Banks how disbursed Loans to Real Estate and Construction in H1-FY2009 despite slowing economy and Global Crisis. That is why Banks are on their toes to recover those loans before they become an NPA.

Monday, November 17, 2008

SEZ Bubble Burst - DLF Selling its Noida SEZ

The Largest Real Estate Scam in the World -Special Economic Zones bubble has been burst. Thanks to former RBI Governor Dr. Reddy for keeping the Indian banking and Financial institutions away from these Land Scamsters.

DLF is all set to SELL its IT SEZ in Noida according to reports. Three more developers are seeking to SELL their IT SEZs and several asking them to be de-notified [withdrawl of permission]. Thanks to the global economic crisis :-)

K.P.Singh of DLF seems to have gone Wooly in the head said a blogger,

DLF is all set to SELL its IT SEZ in Noida according to reports. Three more developers are seeking to SELL their IT SEZs and several asking them to be de-notified [withdrawl of permission]. Thanks to the global economic crisis :-)

K.P.Singh of DLF seems to have gone Wooly in the head said a blogger,

Minister of Commerce Kamal Nath inspired the biggest post-Independence land grab in the country through earmarking of Special Economic Zones...But a fallacious premise that SEZs will facilitate Tax Breaks Ad Infinitum made Realtors scrounge up Land at atrocious price across the country. Now, that few can afford the same DLF's Singh has asked the Banks to fund over-priced Reality at low interest rates such that Land Banks can be parceled out to the public. How crazy can the Real Estate mafia get? How far low can Ministers stoop.Finally the world has realized [2 years after we dedicated this blog to expose the SEZ Land Scam] what a big scam SEZs in India are. Hopefully all these land grabbers will perish soon.

Friday, November 14, 2008

Unitech Downgrade + Cash Crunch

Unitech's Debt rating has been downgraded from A+ to A- by rating agency Fitch. Unitech is all set to offload its Delhi office of over 200,000 sft located near Sheraton Hotel at Saket, Delhi. According to reports, Unitech is expected to sell the building between Rs 20,000 to Rs 25,000 / sft to HDFC as the former owes to HDFC in the form of loans.

Arrogant Indian Builders thought that the prices will only rise and are now caught on the wrong foot. They are facing severe cash crunch due to substantial drop in sales. Bankers have turned cautions and stopped lending as Realtors are unwilling to lower the value of their land bank which they deposit as co-lateral guarantee in case of defaults.

Property Prices in Saket, Delhi are expected to be down between 20-30% from the peak in Jan-2008.

Arrogant Indian Builders thought that the prices will only rise and are now caught on the wrong foot. They are facing severe cash crunch due to substantial drop in sales. Bankers have turned cautions and stopped lending as Realtors are unwilling to lower the value of their land bank which they deposit as co-lateral guarantee in case of defaults.

Property Prices in Saket, Delhi are expected to be down between 20-30% from the peak in Jan-2008.

Wednesday, November 12, 2008

Bandra-Kurla Office Price Crash 30%

Price in Mumbai's prestigious Grade - A office space, Bandra Kurla Complex has crashed by a whopping 33% according to latest reports.

Price in Mumbai's prestigious Grade - A office space, Bandra Kurla Complex has crashed by a whopping 33% according to latest reports.StanChart has bought close to 250,000 sft of office space in BKC for Rs 750 crore. The previous and most expensive transaction was that of Rs 45,000 / sft by the British Council.

Sunday, November 09, 2008

Orange Properties - Desperate Move to Raise Cash

India witnesses a different boom every few years - Finance companies, Garment Exporters, BPO & Technology etc. This time around the property boom is quite widespread and with global economic crisis, builders are desperate to raise crash.

Have a look at these Big Advertisements from Bangalore based Orange Properties who is seeking desperate bookings. Until the last week of October-08, Orange offered Rs 15,000 returns / Month on investment of Rs 3.75 Lakhs. Today they are offering Rs 7,500 on Rs 1.00 Lakh till the date of project completion.

Image Courtesy: TOI, B'Lore edition

Image Courtesy: TOI, B'Lore edition

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

Have a look at these Big Advertisements from Bangalore based Orange Properties who is seeking desperate bookings. Until the last week of October-08, Orange offered Rs 15,000 returns / Month on investment of Rs 3.75 Lakhs. Today they are offering Rs 7,500 on Rs 1.00 Lakh till the date of project completion.

Image Courtesy: TOI, B'Lore edition

Image Courtesy: TOI, B'Lore edition At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

Saturday, November 08, 2008

Mumbai Property Update

Mumbai is witnessing a steep decline in property prices for the second time, the first being in Mid-90s.

According to Mr. Mufatraj Munot of Kalpataru, new projects are not viable, sales are slow and buyers are sitting on the fence. Every developer is looking at his own cash flow and many projects have slowed down. Even the once lucrative TDR (Transfer of Development Rights) market has lost its sheen. Till about 6-months ago, builders used to purchase slum TDR at Rs4,000/sq ft but now there are only a few takers although prices have come down to Rs1,200/sq ft. Moreover, builders who have bought TDR have been unable to pay sellers. It is estimated that about 100 builders owe close to Rs2bn to TDR owners and traders.

Oberoi Constructions is offering new projects in Goregaon East from Rs7,500/sq ft onwards as against Rs12,000/sq ft for ready flats. Lok Group too plans to offer discounts of 20% on new constructions in Malad and Khar. Last month Orbit Corp offered a 20% discount on bookings for a new project at Lower Parel but received a lukewarm response.

Home Loan Defaults on the Rise:

According to ARCIL [Asset Reconstruction Company India Ltd], between Apr-Sept-2008, 20% of the Loan Defaults occurred in the Home Loan Segment. Asset reconstruction companies expect a further jump in housing loan defaults in the coming quarters.

According to Mr. Mufatraj Munot of Kalpataru, new projects are not viable, sales are slow and buyers are sitting on the fence. Every developer is looking at his own cash flow and many projects have slowed down. Even the once lucrative TDR (Transfer of Development Rights) market has lost its sheen. Till about 6-months ago, builders used to purchase slum TDR at Rs4,000/sq ft but now there are only a few takers although prices have come down to Rs1,200/sq ft. Moreover, builders who have bought TDR have been unable to pay sellers. It is estimated that about 100 builders owe close to Rs2bn to TDR owners and traders.

Oberoi Constructions is offering new projects in Goregaon East from Rs7,500/sq ft onwards as against Rs12,000/sq ft for ready flats. Lok Group too plans to offer discounts of 20% on new constructions in Malad and Khar. Last month Orbit Corp offered a 20% discount on bookings for a new project at Lower Parel but received a lukewarm response.

Home Loan Defaults on the Rise:

According to ARCIL [Asset Reconstruction Company India Ltd], between Apr-Sept-2008, 20% of the Loan Defaults occurred in the Home Loan Segment. Asset reconstruction companies expect a further jump in housing loan defaults in the coming quarters.

Thursday, November 06, 2008

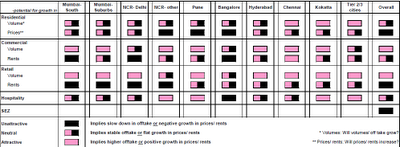

Residential Prices + Retail Rentals to Fall

According to latest research report released by Macquarie on the Indian Real Estate sector, they expect Retail Rentals and Residential Prices to fall across India. The chart below shows how various pockets of Real Estate - Residential, Commercial Office Space, Retail are expected to perform in various Indian cities. [Expandable Image] We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

This is not Mr. Chidambaram's Reserve Bank. Dream Home Buyers can hit the street and remember there is only one mantra in this scenario - Reject all Gifts by developers and squeeze them to come down to your price. Show Realty Developers CASH and they will drool.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.This is not Mr. Chidambaram's Reserve Bank. Dream Home Buyers can hit the street and remember there is only one mantra in this scenario - Reject all Gifts by developers and squeeze them to come down to your price. Show Realty Developers CASH and they will drool.

Wednesday, November 05, 2008

Prestige Shantiniketan Whitefield Tower Collapse

Tuesday, November 04, 2008

Hyderabad + Pune + Kolkata - Office Rentals

In Hyderabad, demand has been low in Banjara Hills, Jubilee Hills, Secunderabad and Himayatnagar. Demand has also been subdued in the IT corridor of Madhapur and Gachibowli and rentals have remained stable.

Begumpet, Rajbhavan Rd, Jubilee Hills and Banjara Hills Grade A Office Rentals have been stable at Rs 65. INR 42 at Hitech City, Gachibowli. Rs 30 - Rs 35 at Ameerpet, Pocharam, Shamshabad, Himayatnagar.

Pune is witnessing a slowdown. Some IT SEZ developers have deferred their decision to commence construction. Going forward rentals are expected to remain either stable or undergo a

correction in certain pockets.

Grade A Offices in Shivaji Nagar, Bund Garden Rd commanded rentals of Rs 100. Kalyani Nagar, Shankarsheth Rd were next in line at INR 70 while IT corridors of Hinjewadi, Kharadi, Hadapsar can fetch Rs 50.

Kolkata - The city which witnessed the shifting of Tata's Nano car is likely to undergo some deeper correction according to industry insiders. We have already written how Land Prices crashed in the vicinity of Singur and Salt Lake.

Park Street and Camac Street havs witnessed fall in Grade A office space rentals from Rs 150 to Rs 120 while Salt Lake and Rajarhat have been stable at least until Sept around 50.

Begumpet, Rajbhavan Rd, Jubilee Hills and Banjara Hills Grade A Office Rentals have been stable at Rs 65. INR 42 at Hitech City, Gachibowli. Rs 30 - Rs 35 at Ameerpet, Pocharam, Shamshabad, Himayatnagar.

Pune is witnessing a slowdown. Some IT SEZ developers have deferred their decision to commence construction. Going forward rentals are expected to remain either stable or undergo a

correction in certain pockets.

Grade A Offices in Shivaji Nagar, Bund Garden Rd commanded rentals of Rs 100. Kalyani Nagar, Shankarsheth Rd were next in line at INR 70 while IT corridors of Hinjewadi, Kharadi, Hadapsar can fetch Rs 50.

Kolkata - The city which witnessed the shifting of Tata's Nano car is likely to undergo some deeper correction according to industry insiders. We have already written how Land Prices crashed in the vicinity of Singur and Salt Lake.

Park Street and Camac Street havs witnessed fall in Grade A office space rentals from Rs 150 to Rs 120 while Salt Lake and Rajarhat have been stable at least until Sept around 50.

Monday, November 03, 2008

20% Price Fall - According to Citi

According to Citigroup Analysts tracking the Indian Real Estate Space, till now there has been 20% correction in Realty Prices which they account for in estimating the NAV of various Realty stocks. What is really surprising is Sobha Developers land bank has fallen from around 4,000 acres to about 3,300 acres as the company is reconsidering some of its land deals where it has not fully paid up, given current difficult markets.

Here are the excerpts from the reports,

Citi on Bangalore / Chennai based Purvankara Projects,

Here are the excerpts from the reports,

Citi on Bangalore / Chennai based Purvankara Projects,

....NAV estimate of Rs104 is based on the following assumptions: 1) 20% decline in property prices; 2) 15-24month delay in project execution.....Similarly for Delhi NCR and North India based Parsvnath Developers and Ansal Properties and Infrastructure,

....Our NAV estimate assumes: a) 20% decline to current market prices; b) development....Goldman Sachs in its report said 2Q earnings reflect slowdown. Citi has cut the target prices substantially for all Realty Stocks. DLF's new target is Rs 340 from Rs 585 and that for Unitech is Rs 57 from Rs 193 :-)

Sunday, November 02, 2008

Bangalore + Chennai - Office Rentals

Bangalore / Bengaluru CBD Office Space has hardly witnessed corrections like that in Mumbai. However, peripheral business districts have seen a fall due to pathetic infrastructure and continuous negligent attitude from successive state Governments in improving the same. There is huge supply coming up in Whitefield, Outer Ring Road, Electronics City and North Bangalore. ~5m sq ft of office space is currently available in Whitefield and much more is under construction and will be ready for occupancy by 1Q09.

Grade A office Rentals in Bengaluru June-08 to Sept-08 [INR / SFT / Month]

Grade A office Rentals in Chennai:

Grade A office Rentals in Bengaluru June-08 to Sept-08 [INR / SFT / Month]

- MG Road, Residency Road - Stable at Rs 85

- Koramangala, Indiranagar - Down from rs 70 to Rs 65

- Outer Ring Road stable around Rs 45

- Whitefield, Electronic City Stable around Rs 30

- North Bangalore - Witnessed a Rise in early 2008 but now stable around Rs 45

Grade A office Rentals in Chennai:

- Annai Salai, Nungambakkam - Stable between Rs 70 to Rs 80

- Velachery, Taramani - Stable at Rs 40

- Siruseri, Ambattur, GST Rd - Rs 30 to Rs 35

Saturday, November 01, 2008

Mumbai Commercial / Office Rentals

Mumbai, the aspiring financial capital of Asia which had rentals comparable to New York and Tokyo is now witnessing corrections. Excerpts from CB Richard Ellis

In CBD, rentals across premium buildings have witnessed a correction and this trend is likely to continue over the next quarter. In BKC, new enquiries have slowed and some developers are showing more flexibility in structuring commercial terms. Andheri-Kurla Road, Powai and Malad have not seen substantial activity in the office sector in the current quarter while Thane and Navi Mumbai remain the preferred locations for IT and back office operations are the only locations in Mumbai that have not witnessed a correction in rentals so far.

Mumbai Grade A Office Space Rentals Jun-08 and Sept-08 [INR / SFT / Month]

In CBD, rentals across premium buildings have witnessed a correction and this trend is likely to continue over the next quarter. In BKC, new enquiries have slowed and some developers are showing more flexibility in structuring commercial terms. Andheri-Kurla Road, Powai and Malad have not seen substantial activity in the office sector in the current quarter while Thane and Navi Mumbai remain the preferred locations for IT and back office operations are the only locations in Mumbai that have not witnessed a correction in rentals so far.

Mumbai Grade A Office Space Rentals Jun-08 and Sept-08 [INR / SFT / Month]

- Nariman Point, Fort, Cuffe Parade - Down from Rs 475 to Rs 415

- Worli, Lower Parel, Prabhadevi - Down from Rs 375 to Rs 315

- BKC, Kalina - Down from Rs 415 to Rs 375

- Andheri, Vile Parle, Jogeshwari - Down from Rs 220 to Rs 200

- Malad, Powai - Down from rs 100 to Rs 80

- Thane, Navi Mumbai - Stable around Rs 50

Commercial / Office Rentals - Delhi - NCR

The realty sector has finally witnessed the much needed correction for genuine industries and offices to expand and help the Indian economy grow. Here is an excerpt from CB Richard Ellis recent report on Delhi NCR Commercial / office Space Realty World.

There has been some correction in rentals, and leasing volumes have been low. In Gurgaon, pre-leasing has been quite slow, a situation that was uncommon before but which clearly highlights lower demand. IT/ITES rentals are expected to be under pressure while rentals for commercial office space are likely to remain stagnant. Noida has significant supply but slow leasing activity because of which rentals are expected to remain low in the next 2-3 quarters.

Delhi NCR - Grade A Office Space Rentals - In June-2008 and Sept-2008

There has been some correction in rentals, and leasing volumes have been low. In Gurgaon, pre-leasing has been quite slow, a situation that was uncommon before but which clearly highlights lower demand. IT/ITES rentals are expected to be under pressure while rentals for commercial office space are likely to remain stagnant. Noida has significant supply but slow leasing activity because of which rentals are expected to remain low in the next 2-3 quarters.

Delhi NCR - Grade A Office Space Rentals - In June-2008 and Sept-2008

- Connaught Place - Down from Rs 340 to Rs 300

- Nehru Place - Down from Rs 270 to Rs 240

- Jasola - Down from Rs 175 to Rs 160

- Gurgaon - Commercial - Stable around Rs 90

- Gurgaon - IT - Stable around Rs 50

- Noida IT - Down from Rs 50 to Rs 42

Subscribe to:

Posts (Atom)