Bangalore / Bengaluru

Absorption in Bengaluru remains healthy; average for the past one-year is more than 6msf per month.

New launches were the least in past one-year. 4msf of new launches compared to monthly average of 7msf for the past one-year.

Inventory level maintained at 80msf, high but not alarming. Inventory level in months of sales is at 15, within the range of 13-15 for past 12 months.

In nutshell, even after series of launches, high absorption has helped inventory level to keep in check. While absorption at ongoing rate and slower pace of new launches can keep the prices stable or help them to rise, a weak quarter in terms of absorption can push the inventory level higher and result in price correction.

Chennai

Absorption in Chennai has come down to 3msf from 5msf six months back; however, it is still much above the level of 1-1.5msf it witnessed two years ago.

Absorption in October was at a respectable level of 3msf, considering the city’s appetite.

New launches have reduced considerably due to lack of approvals from government authorities. Launches in the past three months together were as low as 5msf, which is lower than the average monthly launch a few months back.

The slower pace of new launches and reasonable absorption levels have reduced the inventory level to 32msf from 41msf six months back. Inventory in months of sales is also at a manageable level of 12.

In nutshell, the city is well placed compared to most other metros in the country. Slower pace of new launches combined with reasonable demand has

managed the property prices to stabilise at current levels and we don’t see possibilities of significant property price correction here.

Wednesday, December 28, 2011

Tuesday, December 27, 2011

Mumbai + Pune - Status of Residential Realty

In Mumbai, absorption has been declining since November 2010; absorption at 6msf is at its 25-month low.

New launches at 4.5msf less than half on YoY basis; however, launches can jump up sharply, if the approvals are back on track.

Even though new launches have reduced considerably, the reducing absorption level has kept inventory levels at 99msf. The inventory in months of sales is 16 doubled from 8 in September 2010. Though the inventory level has not increased since the past 20 months, considering large number of projects awaiting approvals, this figure can go up sharply. This is not a good sign for Mumbai property prices.

In nutshell inventory level is currently at a manageable level; however several projects nutshell, however, are awaiting approvals for launch. In case the approval process fastens, there will be a sudden rise in the inventory, which will push the developers to reduce the property prices. The savior is considerable improvement

in absorption, which seems unlikely at the current property price levels.

Pune

Absorption in Pune seems to follow absorption trend in Mumbai. Absorption in October 2011 is 3msf; at 23 months low.

New launches have declined considerably since beginning of the current calendar year. From the peak of 8msf in January, it has come down to as low as 2msf.

Inventory level declined from 61msf in January 2011 to 48msf in October 2011. This is not due to high demand but due of lack of new launches. The inventory in months of sales has started rising back. From the low of 11 in June, it has risen to 15.

In nutshell, Pune seems to follow Mumbai real estate market and we believe it is facing the same problem of possibility of sharp jump in new launches. The

market may witness property price correction unless developers time their launches in such a manner that not many properties hit the market at the same

time (this is unlikely scenario as scenario, most of the developers are keen to monetise their assets at the earliest).

New launches at 4.5msf less than half on YoY basis; however, launches can jump up sharply, if the approvals are back on track.

Even though new launches have reduced considerably, the reducing absorption level has kept inventory levels at 99msf. The inventory in months of sales is 16 doubled from 8 in September 2010. Though the inventory level has not increased since the past 20 months, considering large number of projects awaiting approvals, this figure can go up sharply. This is not a good sign for Mumbai property prices.

In nutshell inventory level is currently at a manageable level; however several projects nutshell, however, are awaiting approvals for launch. In case the approval process fastens, there will be a sudden rise in the inventory, which will push the developers to reduce the property prices. The savior is considerable improvement

in absorption, which seems unlikely at the current property price levels.

Pune

Absorption in Pune seems to follow absorption trend in Mumbai. Absorption in October 2011 is 3msf; at 23 months low.

New launches have declined considerably since beginning of the current calendar year. From the peak of 8msf in January, it has come down to as low as 2msf.

Inventory level declined from 61msf in January 2011 to 48msf in October 2011. This is not due to high demand but due of lack of new launches. The inventory in months of sales has started rising back. From the low of 11 in June, it has risen to 15.

In nutshell, Pune seems to follow Mumbai real estate market and we believe it is facing the same problem of possibility of sharp jump in new launches. The

market may witness property price correction unless developers time their launches in such a manner that not many properties hit the market at the same

time (this is unlikely scenario as scenario, most of the developers are keen to monetise their assets at the earliest).

Monday, December 26, 2011

Delhi NCR - Real State of Realty

As we end the year 2011, here is the Real State of Real Estate in India.

Absorption in NCR at 10msf has reduced considerably from 15-20msf witnessed six months back. However, it is significantly higher than the lows of 3-5msf attained in 2008-09.

The dearth of investor demand has pushed new launches to as low as 8msf, compared to 20-25msf a year back. We do not see any possibilities of this demand coming back in the next six months primarily owing to high property prices and the uncertain economic scenario which will in turn keep a check on NCR months, new launches.

The inventory level at 132msf is higher than other cities; however, it has come down from the peak of 150msf in 2010, due to the slower pace of newer launches. Inventory in months of sales at 12 is higher than the two years average of 9, which is a concern.

In nutshell, inventory level at 132msf is high and in months of sales. It is at 12, higher than the two years average of 9 months. However, a micro analysis suggests that the Gurgaon and Noida markets are well placed with just seven months of sales each. New Delhi has an inventory as low as 2.3msf and being land scarce region, doesn’t have pressure on price. Greater Noida has seen new launches at an aggressive pace, but without adequate absorption. We believe Greater Noida is set to witness price correction, which is unlikely for Gurgaon, Noida and New Delhi.

Absorption in NCR at 10msf has reduced considerably from 15-20msf witnessed six months back. However, it is significantly higher than the lows of 3-5msf attained in 2008-09.

The dearth of investor demand has pushed new launches to as low as 8msf, compared to 20-25msf a year back. We do not see any possibilities of this demand coming back in the next six months primarily owing to high property prices and the uncertain economic scenario which will in turn keep a check on NCR months, new launches.

The inventory level at 132msf is higher than other cities; however, it has come down from the peak of 150msf in 2010, due to the slower pace of newer launches. Inventory in months of sales at 12 is higher than the two years average of 9, which is a concern.

In nutshell, inventory level at 132msf is high and in months of sales. It is at 12, higher than the two years average of 9 months. However, a micro analysis suggests that the Gurgaon and Noida markets are well placed with just seven months of sales each. New Delhi has an inventory as low as 2.3msf and being land scarce region, doesn’t have pressure on price. Greater Noida has seen new launches at an aggressive pace, but without adequate absorption. We believe Greater Noida is set to witness price correction, which is unlikely for Gurgaon, Noida and New Delhi.

Sunday, December 18, 2011

Lodha World One - India's Tallest Residential Tower

We visited the Lodha World One site in Lower Parel (Mumbai), where India's proposed tallest residential building is under construction. We found a lot of activity at the site and currently basement construction work is underway.

The contract is executed by Arabian Construction Company (ACC)- Simplex Infrastructures consortium, with a duration of 48 months from February 2011.

Lodha World One: The total area of 1.3 mn sq ft comprises 290 units (80 units of 7,000 sq ft and around 15 units of 12,500 sq ft, balance 3 and 4-BHK). Lodha expects expects the cost of construction to be in range of Rs 9,000 per sq ft. Layout plan approved/Government car park (CC in place), permission for 80 storeys in place. Current price is Rs32,000-35,000 per sq ft; Launch price of Rs21,800 per sq ft. 60-65% apartments have sold, 40-45% of these are the smaller-sized apartments.

Lodha World Crest:Total area of 0.7 mn sq ft comprises 214 units (3 and 4-BHK), with 60 units sold. The construction contract is yet to be awarded. The current price is Rs24,000-25,000 per sq ft.

The contract is executed by Arabian Construction Company (ACC)- Simplex Infrastructures consortium, with a duration of 48 months from February 2011.

Lodha World One: The total area of 1.3 mn sq ft comprises 290 units (80 units of 7,000 sq ft and around 15 units of 12,500 sq ft, balance 3 and 4-BHK). Lodha expects expects the cost of construction to be in range of Rs 9,000 per sq ft. Layout plan approved/Government car park (CC in place), permission for 80 storeys in place. Current price is Rs32,000-35,000 per sq ft; Launch price of Rs21,800 per sq ft. 60-65% apartments have sold, 40-45% of these are the smaller-sized apartments.

Lodha World Crest:Total area of 0.7 mn sq ft comprises 214 units (3 and 4-BHK), with 60 units sold. The construction contract is yet to be awarded. The current price is Rs24,000-25,000 per sq ft.

Tuesday, December 06, 2011

Residential Sales Hold in Bangalore - Gurgaon slowing down - Mumbai Weak

Residential apartment sales data for the festive season (i.e. Oct/Nov month) is not available as yet, channel checks suggest that festive sales haven’t been encouraging (as compared to last two years).

Bangalore / Chennai continues to witness healthy absorption trends. Launch activity has come down in Nov after witnessing a meaningful pick in Oct (given festive month). In terms of markets, absorption trends remain sluggish in Mumbai; while volumes in Gurgaon are also coming off at the margin. Initial signs of price discounting have started to happen in Mumbai (subvention schemes, waivers etc).

In terms of pricing, Mumbai has seen price discounting primarily in the form of discounts or waivers, while quoted prices remain stable. EMI subvention schemes (80:20 schemes) have gained prominence in NCR/Mumbai. Number of reputed developers in Mumbai have announced these schemes over the past month for under construction projects. However quoted prices have not come down meaningfully as yet. Prices in Gurgaon remain largely stable; while Bangalore / Chennai are witnessing 5-10% appreciation despite high launch activity.

Mortgage rates seem to have peaked out (at 11.5% levels) with few HFCs/banks offering 25bps discount to floating home loan rates.

Bangalore / Chennai continues to witness healthy absorption trends. Launch activity has come down in Nov after witnessing a meaningful pick in Oct (given festive month). In terms of markets, absorption trends remain sluggish in Mumbai; while volumes in Gurgaon are also coming off at the margin. Initial signs of price discounting have started to happen in Mumbai (subvention schemes, waivers etc).

In terms of pricing, Mumbai has seen price discounting primarily in the form of discounts or waivers, while quoted prices remain stable. EMI subvention schemes (80:20 schemes) have gained prominence in NCR/Mumbai. Number of reputed developers in Mumbai have announced these schemes over the past month for under construction projects. However quoted prices have not come down meaningfully as yet. Prices in Gurgaon remain largely stable; while Bangalore / Chennai are witnessing 5-10% appreciation despite high launch activity.

Mortgage rates seem to have peaked out (at 11.5% levels) with few HFCs/banks offering 25bps discount to floating home loan rates.

Monday, November 28, 2011

Land Prices to Rise in 52 Cities with FDI Investments in Retail

51% Foreign Direct Investment(FDI) in Retail is a positive for the Land Owners as well as Commercial Realty & Mall developers as well. In short, it is good for the Real Estate Industry as a whole. However, Government has restricted this investment only for the Following 52 Cities. Also note that if the Government in your State is non-Congress, they may oppose the FDI move as Retailers need permission from State Governments as well. So play your cards accordingly.

Mall Development - Retail mall development in India which has been anguishing for the past three years on low demand and oversupply. Mumbai and NCR (National Capital Region) have witnessed high vacancies in the mall space. We would expect the same to move down over the next three-four years helped by further investments into the retail space through the FDI route. Mall supply in Bangalore and Chennai was limited till date but is expected to increase over the next two years.

Mall Development - Retail mall development in India which has been anguishing for the past three years on low demand and oversupply. Mumbai and NCR (National Capital Region) have witnessed high vacancies in the mall space. We would expect the same to move down over the next three-four years helped by further investments into the retail space through the FDI route. Mall supply in Bangalore and Chennai was limited till date but is expected to increase over the next two years.

Sunday, October 16, 2011

Residential Property Sales in Metros in Past 12 Months

Friday, October 14, 2011

Supreme Court Bans GPA / Agreement for Sale - Land Prices to Fall ?

The much awaited Ban on GPA / SPA / Agreement for Sale used in Land Deals by Politicians and Goons to artificially jack up the price comes to an end by an order of the Supreme court which has termed these documents as il-legal effective dats of the order.

This will weed out parasite money making property agents who neither have business sense nor the will to work hard but make quick buck on some other property.

FreePress has an excellent Coverage on this issue who is unearthing scams and Black money across Indian Governments.

This will weed out parasite money making property agents who neither have business sense nor the will to work hard but make quick buck on some other property.

FreePress has an excellent Coverage on this issue who is unearthing scams and Black money across Indian Governments.

Sunday, October 02, 2011

Kolkata - Residential prices + Rental Yields

The Following Chart Shows the Residential Property Prices / Apartment in various Parts of Kolkata and the Monthly Rental Yields on a 2 BHK Apartment / House.

| Rupees / SFT | Monthly Rent | ||

| BT to Road | 2,200 | 6,000 | |

| DumDum | 2,200 | 4,500 | |

| JessoreRoad | 2,800 | 6,000 | |

| Lake to wn | 3,500 | 10,000 | |

| PaikPara | 3,500 | 5,000 | |

| Sinthimore | 2,300 | 5,500 | |

| VIPRoad | 4,000 | 8,000 | |

| Alipore | 10,000 | to 14000 | 22,000 |

| Ballygung | 9,000 | to 13000 | 25,000 |

| Bansdroni | 2,200 | to 2800 | 8,500 |

| Behala | 1,800 | to 2200 | 5,000 |

| Garia | 1,800 | to 2200 | 6,000 |

| Jadavpur | 2,800 | to 3800 | 12,000 |

| JodhpurPark | 3,500 | to 4500 | 20,000 |

| Joka | 1,700 | to 2200 | 5,000 |

| Narendrapur | 2,000 | to 3200 | 5,000 |

| San to shpur | 2,700 | to 3200 | 8,000 |

| to llygung | 3,000 | to 4200 | 8,000 |

| EM to Bypass | 3,000 | to 7000 | 10,000 |

| Rajarhat | 2,600 | to 5000 | 15,000 |

| SaltLake | 3,500 | to 4200 | 14,000 |

| DobsonRoad(Howrah) | 3,500 | to 4500 | 8,000 |

| KonaExpressway | 2,200 | to 3300 | 8,000 |

| Mahesthala | 2,500 | to 2800 | 6,500 |

| Salkia | 2,500 | to 3500 | 6,000 |

| Shibpur | 1,800 | to 2200 | 5,500 |

| CamacStreet | 10,000 | to 14000 | 30,000 |

| LoudonStreet | 18,000 | to 22000 | 32,000 |

| Park Street | 15,000 | to 20000 | 30,000 |

| TheatreRoad | 16,000 | to 18000 | 30,000 |

Saturday, October 01, 2011

Hyderabad - Residential Property Prices + Rental Yields

The following Table Shows the property Prices in Various Parts of Hyderabad and Monthly Rental Yields for a 2 BHK Residential Apartment / House.

| Price / SFT | Monthly Rent | |

| Alwal | 2,000 | 6,000 |

| Kapra | 2,000 | 5,000 |

| Kompally | 2,300 | 5,500 |

| Medchal | 1,500 | 4,500 |

| Secunderabad | 5,000 | 12,000 |

| Shamirpet | 1,600 | 3,000 |

| Attapur | 2,500 | 5,500 |

| Himayath-Sagar | 2,500 | 4,000 |

| Mehdipatnam | 3,200 | 8,500 |

| Rajendra-Nagar | 2,600 | 5,000 |

| East | ||

| Amberpet | 2,800 | 8,000 |

| Malkajgiri | 2,400 | 6,000 |

| Tarnaka | 3,000 | 9,000 |

| Tirumalghery | 2,600 | 9,000 |

| Uppal | 2,500 | 5,000 |

| Bachupally | 2,100 | 4,500 |

| Gachibowli | 3,700 | 18,000 |

| Kondapur | 3,200 | 18,000 |

| Kukatpally | 2,800 | 8,000 |

| Madhapur | 3,700 | 18,000 |

| Miyapur | 2,500 | 7,000 |

| Nallagandla-Tellapur | 2,700 | 10,000 |

| BanjaraHills | 7,000 | 22,000 |

| Begumpet | 4,800 | 18,000 |

| JubileeHills | 7,200 | 20,000 |

| Lakdi-Ka-pool | 4,200 | 16,000 |

| Narayangunda | 3,700 | 12,000 |

| Punjagutta | 5,500 | 17,000 |

| Somajiguda | 5,500 | 16,000 |

Chennai - Residential Property Prices + Rents

The Following Chart Shows Property Prices in Various Pockets of Chennai,

Residential Property Prices and MOnthly Rental Yields in the Following Areas of Chennai City

Kilpauk Adambakkam Korathur Chromepet Madhavaram Madipakkam

Perambur Medavakkam Tondiarpet Nanmangalam Villivakkam Padur Kelambakkam Karapakkam Sholinganallur Semmencherry

Ambattur Selaiyur Aminjikarai Tambaram Annanagar Urapakkam

Avadi Velachery K K Nagar Manapakkam Adyar Mogappair Alwarpet Nolambur Egmore Porur Kodambakkam Saligramam Mahalingapuram Sriperumbudur Mandaveli Vadapalani Nungambakkam Parrys T Nagar

Residential Property Prices and MOnthly Rental Yields in the Following Areas of Chennai City

Kilpauk Adambakkam Korathur Chromepet Madhavaram Madipakkam

Perambur Medavakkam Tondiarpet Nanmangalam Villivakkam Padur Kelambakkam Karapakkam Sholinganallur Semmencherry

Ambattur Selaiyur Aminjikarai Tambaram Annanagar Urapakkam

Avadi Velachery K K Nagar Manapakkam Adyar Mogappair Alwarpet Nolambur Egmore Porur Kodambakkam Saligramam Mahalingapuram Sriperumbudur Mandaveli Vadapalani Nungambakkam Parrys T Nagar

Bangalore - Property Prices + Rental Yields

Tuesday, September 27, 2011

Delhi NCR - Property prices - Rental values

Here are the latest Property prices in various parts of Delhi NCR. We have also covered the Rentals in these areas. The following chart shows the latest residential property prices and rental yields on the same.

Delhi Gate Kashmere Gate Darya Ganj Model Town Pitampura Civil Lines

Delhi Gate Kashmere Gate Darya Ganj Model Town Pitampura Civil Lines

Vasant Vihar Anand Niketan Golf Links Chanakyapuri Panchsheel GK I Jorbagh

Safdarjung South Extension Lajpat Nagar

Preet Vihar Mayur Vihar Gandhi Nagar Vivek Vihar Shahadara

Patel Nagar Rajouri Garden Punjabi Bagh

Gurgaon Faridabad NOIDA Greater NOIDA Ghaziabad

Also check out India Property Forum for the latest trends.

Delhi Gate Kashmere Gate Darya Ganj Model Town Pitampura Civil Lines

Delhi Gate Kashmere Gate Darya Ganj Model Town Pitampura Civil LinesVasant Vihar Anand Niketan Golf Links Chanakyapuri Panchsheel GK I Jorbagh

Safdarjung South Extension Lajpat Nagar

Preet Vihar Mayur Vihar Gandhi Nagar Vivek Vihar Shahadara

Patel Nagar Rajouri Garden Punjabi Bagh

Gurgaon Faridabad NOIDA Greater NOIDA Ghaziabad

Also check out India Property Forum for the latest trends.

Mumbai Property Prices + Rental Values

We would like to present the Property Prices in Various Parts of Mumbai Metro Region along with the Rentals as captured at the end of July-2011. The following Chart Shows the Same,

Mumbai - Mahim, Prabhadevi Worli Lower Mahalaxmi Mumbai Mazgaon Byculla Colaba Peddar Altamont Road Walkeshwar Malabar Napean SEa Road Wadala Sewri Sion

Mumbai - Mahim, Prabhadevi Worli Lower Mahalaxmi Mumbai Mazgaon Byculla Colaba Peddar Altamont Road Walkeshwar Malabar Napean SEa Road Wadala Sewri Sion

Navi Mumbai:

Palm Beach Road Kharghar Koparkhairane Panvel

Western Suburbs

Bandra Khar Santacruz Vile Parle Andheri Goregaon Malad Kandivali Borivali Dahisar

Mira Road

Central Suburbs:

Ghatkopar Kurla Mulund Bhandup Chembur Vikhroli

Thane:

Ghodbunder Road Panchpakhadi Eastern Expressway Teen Haath Naka Vasant Vihar.

Mumbai - Mahim, Prabhadevi Worli Lower Mahalaxmi Mumbai Mazgaon Byculla Colaba Peddar Altamont Road Walkeshwar Malabar Napean SEa Road Wadala Sewri Sion

Mumbai - Mahim, Prabhadevi Worli Lower Mahalaxmi Mumbai Mazgaon Byculla Colaba Peddar Altamont Road Walkeshwar Malabar Napean SEa Road Wadala Sewri SionNavi Mumbai:

Palm Beach Road Kharghar Koparkhairane Panvel

Western Suburbs

Bandra Khar Santacruz Vile Parle Andheri Goregaon Malad Kandivali Borivali Dahisar

Mira Road

Central Suburbs:

Ghatkopar Kurla Mulund Bhandup Chembur Vikhroli

Thane:

Ghodbunder Road Panchpakhadi Eastern Expressway Teen Haath Naka Vasant Vihar.

Sunday, September 25, 2011

2006 vs 2011 - What has Changed ?

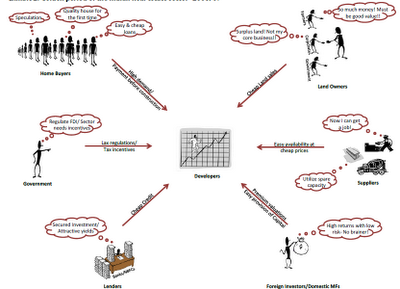

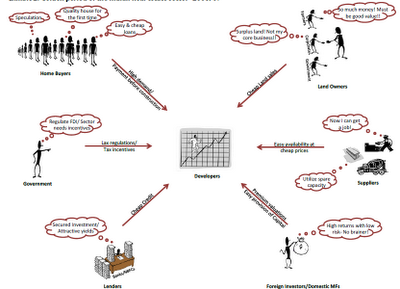

2006 - India Real estate sector was in a sweet spot in 2006/07. With buyers coming in hordes to book apartments, land available at throwaway prices and regulators providing incentives, developers started making supernormal profits. Availability of capital was never a problem with foreign investors eager to invest and banks clearing loans at a rapid pace. All the above Can be summed up in the Chart as shown Below.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

Friday, September 16, 2011

Impact of Land Acquisition Bill 2011 on Developers

Ashutosh Limaye, Head of Research at Jones Lang LaSalle India, discussed the proposed Land Acquisition and Rehabilitation & Resettlement Bill (LARR) 2011.

Residential Real Estate Development:

Mr. Limaye said that Land acquisition cost may not go up, since most transactions are done at market price, which is higher than the prescribed formula (using guidance rate, which could be a lot lower than market price).

According to JLL, there appears to be ambiguity regarding developers' ability to buy land parcels >50/100 acres in urban/rural areas without invoking difficult RR [Rehabilitation & Resettlement] provisions.

This appears contrary to general belief that larger land parcels will invoke RR provisions, making longer-term value creation difficult. If RR provisions are invoked, the Bill will be non-conforming to the township policies of the state government, which provides incentives for 100+ acre land developments.

Infrastructure / Industrial Development:

The land required for these projects will most likely become expensive. Most of these projects will require large tracts of land and government help in land acquisition, invoking both LA and RR provisions.

Residential Real Estate Development:

Mr. Limaye said that Land acquisition cost may not go up, since most transactions are done at market price, which is higher than the prescribed formula (using guidance rate, which could be a lot lower than market price).

According to JLL, there appears to be ambiguity regarding developers' ability to buy land parcels >50/100 acres in urban/rural areas without invoking difficult RR [Rehabilitation & Resettlement] provisions.

This appears contrary to general belief that larger land parcels will invoke RR provisions, making longer-term value creation difficult. If RR provisions are invoked, the Bill will be non-conforming to the township policies of the state government, which provides incentives for 100+ acre land developments.

Infrastructure / Industrial Development:

The land required for these projects will most likely become expensive. Most of these projects will require large tracts of land and government help in land acquisition, invoking both LA and RR provisions.

Monday, August 08, 2011

Developers + Politicains Controlled Sector in Blood Bath

The Indian Real Estate sector directly under the control of Developer & Politician Nexus is the Worst Performing in India and across Asia. The lack of determination by successive Governments to handover the sector to a STRONG regulator like RBI makes the Government Self Witness in CRIME.

Check out on how the Stocks have Halved over the last 6 months destroying Investors Wealth. Check out Today's Prices [Below] and this reflects the state of Indian Real estate. Do we have to say more ?

Check out on how the Stocks have Halved over the last 6 months destroying Investors Wealth. Check out Today's Prices [Below] and this reflects the state of Indian Real estate. Do we have to say more ?

Thursday, July 07, 2011

Mumbai Property Sales Fall 30% in June

As per the Maharashtra state stamps and registration department, in June'11, 4,272 property sale agreements were registered within the city of Mumbai (excluding Thane and Navi Mumbai), a fall of 30% YoY.

This is the lowest figure in the past six months. Between Jan'11-Jun'11, 29,684 property purchase agreements were registered, a fall of 20% YoY. While this does point towards a slowdown in the Mumbai property market, should this 20% fall be a big worry for investors and developers?

Overall, even though the fall in registration volumes till now may not signal a very worrying situation in the Mumbai property market for developers, the demand slowdown may have intensified further in the interim pressurising developers to cut prices when the festive season starts in Oct'11. For this to happen though, the authorities will have to release approvals for the new projects so that supply in the city increases.

You Start checking the official Real Estate Index of India which reflect the TRUE rates rather than the Lobby of Developers and Back Money Goons.

This is the lowest figure in the past six months. Between Jan'11-Jun'11, 29,684 property purchase agreements were registered, a fall of 20% YoY. While this does point towards a slowdown in the Mumbai property market, should this 20% fall be a big worry for investors and developers?

Overall, even though the fall in registration volumes till now may not signal a very worrying situation in the Mumbai property market for developers, the demand slowdown may have intensified further in the interim pressurising developers to cut prices when the festive season starts in Oct'11. For this to happen though, the authorities will have to release approvals for the new projects so that supply in the city increases.

You Start checking the official Real Estate Index of India which reflect the TRUE rates rather than the Lobby of Developers and Back Money Goons.

Tuesday, June 28, 2011

Challenges - Delayed Approvals or Funding ?

In a Conclave of Real Estate Developers, Banks, Architects, Government representatives the question of Challenges faced by the Indian Realty sector was discussed. So what do you think is the hurdle in executing the projects timely ? Developers opine that delayed approvals and cumbersome processes are the core issues facing the sector [and not to forget the corruption] - regulatory bodies have barely cleared any applications in the last 9-months in Mumbai. This is in line with the developer concerns in other cities.

Funding for Real Estate:Funding for under construction projects is relatively tough. However, loans against lease rentals are available at relatively lower rates. Overall while funding is tight, developers opine that high interest cost is the real challenge.

Premium housing is seeing a slowdown but mid-income/value housing volumes are robust. However, developers suggest that softening of prices is unlikely given the latent demand.

Funding for Real Estate:Funding for under construction projects is relatively tough. However, loans against lease rentals are available at relatively lower rates. Overall while funding is tight, developers opine that high interest cost is the real challenge.

Premium housing is seeing a slowdown but mid-income/value housing volumes are robust. However, developers suggest that softening of prices is unlikely given the latent demand.

Tuesday, May 24, 2011

Mumbai - Development + Policy Clarity - But Prices & Interest Rates Spoil

After a 6-month lull during which very few building plans were approved, municipal authorities in Mumbai recently approved a number of building plans. None of these approved plans deviated from the development control regulations and did not seek any "concessions" that would allow developers to sell more than the applicable FSI on the plot.

New approvals hold promise of new supply. However, the liquidity environment for developers remains extremely tough, with many mid-sized developers resorting to expensive new debt to re-finance maturing ones. Combined with their unwillingness to cut prices to improve volumes, we feel many developers will delay launches, as the demand environment is weak (for which they have only themselves to blame!).

Mumbai Redevelopment FSI 3.0:The government also approved the proposal to increase FSI for redevelopment of cessed buildings from 2.5x to 3x. This increase can be availed by existing projects where construction has not gone beyond the plinth level. Also, the cap on flat size (earlier at 753sq ft) has been removed. However, the new rules require a side space of 6m against 1.5m earlier and require the developers to take permission from the high-rise committee of the BMC in case the height of the building is more than 9 times the breadth of the plot.

New approvals hold promise of new supply. However, the liquidity environment for developers remains extremely tough, with many mid-sized developers resorting to expensive new debt to re-finance maturing ones. Combined with their unwillingness to cut prices to improve volumes, we feel many developers will delay launches, as the demand environment is weak (for which they have only themselves to blame!).

Mumbai Redevelopment FSI 3.0:The government also approved the proposal to increase FSI for redevelopment of cessed buildings from 2.5x to 3x. This increase can be availed by existing projects where construction has not gone beyond the plinth level. Also, the cap on flat size (earlier at 753sq ft) has been removed. However, the new rules require a side space of 6m against 1.5m earlier and require the developers to take permission from the high-rise committee of the BMC in case the height of the building is more than 9 times the breadth of the plot.

Thursday, May 12, 2011

Historical Home Loan Rates India

We present to you the historical Home Loan / Mortgage Rates in India in the past 20 years which are directly coupled to the RBI Monetary Policy. Source of this Data is HDFC, India's leading Housing Finance Provider.

So if you are planning to BUY your house you can use this and see when to enter so that your EMIs are affordable.

So if you are planning to BUY your house you can use this and see when to enter so that your EMIs are affordable.

Wednesday, April 27, 2011

NCR - Noida Residential Apartment Market - Buy or Wait ?

In continuing our Analysis on the Residential Apartment Trends in Delhi NCR Region, we are covering the Noida Market. Here is a brief excerpt of the ground survey,

In continuing our Analysis on the Residential Apartment Trends in Delhi NCR Region, we are covering the Noida Market. Here is a brief excerpt of the ground survey,- Volumes have been high in Greater Noida and Noida Extension because of a low ticket size (a studio apartment can be bought at as low as Rs 1mn).

- We expects residential supply to outstrip the demand generated by commercial activity in the region.

- End-user led demand is higher in Noida in comparison to Gurgaon. However, investors are more interested in the markets of Greater

Noida and Noida Extension where ticket size is low (a studio apartment can be bought at as low as Rs 1mn). - Prices have remained muted in this market. He expects the trend to continue primarily because of high supply.

- While Jaypee projects in Noida/Greater Noida are seeing high volumes, there are doubts on whether the same can be sustained. Sales of low-cost houses from Jaypee are faster than luxury apartments (high-end demand prefers Unitech Grande over Jaypee because of the exclusivity factor).

- Unitech’s Grande (UGCC) is doing well and the execution for UniHomes is good. However, there are issues over allotting possession of some projects (Horizon, Escape) in Greater Noida where current market prices (Rs 3500psf) are lower than launch prices (Rs 4600psf

launched during peak prices). - Jaypee has started increasing prices of its older projects. However, there should be fewer buyers at higher prices because of ample supply at lower pricing points.

Tuesday, April 26, 2011

How Citigroup Squeezed BPTP Developers

We all have read about the India's Sub-Prime Realty Developer - BPTP. Citigroup which came to the sinking ship of Chawla, squeezed with very tough conditions and clauses. Here is an excerpt from the same.

Citigroup has the right to exercise a swap option (Swap Option) if BPTP fails to achieve a listing of its equity shares within 24 months from the closing date. On the exercise of the Swap Option, CPI is entitled to the following:

Citigroup has the right to exercise a swap option (Swap Option) if BPTP fails to achieve a listing of its equity shares within 24 months from the closing date. On the exercise of the Swap Option, CPI is entitled to the following:

- demand that BPTP establish one or more special purpose companies ("Project Companies) for acquiring the assets selected by CPI (Swap Option Projects).

- each Project Company to issue shares to CPI such that the shareholding of CPI and the Chawlas is in the ratio 49.99:50.01.

- demand that BPTP transfer the development rights of the Swap Option Projects to the Project Companies or have the development rights to the Swap Option Projects sold by BPTP for a refund of the swap option amount.

- demand that BPTP or the Chawlas buy back CPI's equity shares.

- if the Swap Option is not implemented in accordance with the investment agreements, CPI has the right to require BPTP to sell the selected Swap Option Projects (Sale Right).

Monday, April 25, 2011

Gurgaon Residential Apartment - Market - Buy or Wait ?

We recently held a road show with a NCR-based broker to enlighten our readers on the Residential Property Trends in Gurgaon. Here are the key takeaways.

We recently held a road show with a NCR-based broker to enlighten our readers on the Residential Property Trends in Gurgaon. Here are the key takeaways.- Established builders with better track records find it easy to sell properties. DLF and Unitech are selling properties faster (and at a premium) than their smaller peers.

- Volumes are likely to remain flat helped by volumes from emerging areas.

- Good demand for Properties nearing completion so that Buyers get immediate possession

- Residential Apartment Investors remain in the market but the investment time frame has changed from 5–12 months earlier to 2–3 years now. Investors include (1) second home buyers, (2) NRIs, (3) service class executives, and 4) professionals.

- Most complained about the Government related approval issues as a key risk to execution

How PE Investors Squeezed Developers During 2008 Bust ?

Following the slump in late 2008, many projects invested in were either significantly delayed or, in some cases, found to be unviable in the changed scenario and it is quite likely that a large number of investments are currently incurring losses.

Most investments have clauses in the form of put or call options which protect the investor and make it mandatory for the developer to buy-back the securities held by the PE investor. Also, there are punitive clauses which enable the investor to take control of the project if it is not completed.

Lodha Developers – HDFC Property Ventures:

Most investments have clauses in the form of put or call options which protect the investor and make it mandatory for the developer to buy-back the securities held by the PE investor. Also, there are punitive clauses which enable the investor to take control of the project if it is not completed.

Lodha Developers – HDFC Property Ventures:

The HDFC Shareholders‟ Agreement provides the Investors on and from the Investors Exit Date (May 2, 2013 if 95% of the cash flows of the project are not received till then), a put option, in which the Investors shall have the right to call upon our Company to purchase from the Investors all the securities held by themLodha Developers – Deutsche Bank (DB)

In the event, other than on the occurrence of a force majeure event or reason approved by a unanimous decision of the board of Lodha Healthy, if the Project is not completed within a period of five years from the date of commencement of the development of the project, then the Investors shall have an additional right to appoint majority directors on the board

DB had granted another Lodha subsidiary the option to purchase the debentures or the converted equity shares of Cowtown prior to Dec’10, failing which DB would be the owner of 99% of Cowtown and, in turn, the owner of the mortgaged land parcels in Thane, Lower Parel and Malabar Hill in the event of a default by LHRB. In our view, this means that if Lodha does not buy back the debentures from the current debenture holders, it would lose control of several valuable land parcels for an amount of just INR16bnParsvnath-Sun Apollo Ventures

our company (Parsvnath) has granted to the investors (Sun-Apollo) an option, exercisable at any time on or subsequent to 48 months after the first closing date, to sell to the promoter, all the securities of Hessa (Parsvnath Exotica-II) held by the investors and upon exercise of such option, our company shall be obliged to purchase the securities on the terms and conditions contained in the investment agreement.Emaar MGF-New York Life Investment (NYLI), Jacob Ballas Capital (JBC) and EIF

the Investors were granted the right to require Emaar to purchase all the Equity Shares subscribed for by the Investors at the per share price at which the Investors had acquired the Equity Shares.Entertainment World Developers Ltd (EWDPL)-ICICI Ventures Ltd

In the event the IPO does not take place by Feb 15, 2011 the investor has the right to require either the promoters of EWDPL or EWDPL itself purchase all equity shares and optionally convertible debentures and/or redeem all optionallyRaheja Universal-Urban Infrastructure Venture Capital (UIVC)

convertible debentures at a fair value.

Raheja Universal is required to provide the investor an exit within seven years from the date of investment, i.e. by March 2014 or such extended period as may be determined by the investor, through an IPO or strategic sale. In the event the company is unable to provide a suitable exit option to the investors, the investor shall be entitled to exercise a put or call option requiring Raheja to purchase all of its shares in the project or to sell all of its shares in the project to the investor.The Evils of Private Equity Capitalism led many of these Greedy Realty Developers to Hold on to abnormally High Property Prices when in reality, they offer no value for the Dream Home the hardworking and Honest Tax Paying Citizens deserve.

Total Private Equity Investment in Property

Here is an excellent piece of data that shows historical Private Equity Investments in the Indian Real Estate sector which has now touched a whopping $8.8 Bn.

The following Charts Show the Data.

Chart - 2

You can also download the same data sheet here. [PDF}

The following Charts Show the Data.

Chart - 2

You can also download the same data sheet here. [PDF}

Wednesday, April 13, 2011

Residential Boom - Spectulator Driven

PropEquity data suggests a recovery in sales volumes in CY11 ytd. But our channel checks suggest this is speculator driven and not sustainable as home buyer sentiment remains weak.

Ears on the Ground suggest that rising speculative demand (encouraged by the low down payments), especially in cities, such as Gurgaon, could be boosting sales volumes which we believe is not sustainable. We believe that the sentiment of genuine home buyers remains weak and are holding back on purchases in anticipation of a 15-20% price correction. The affordability [Price vs Mortgage Rates] remains under pressure and, hence, real buying sentiment remains weak.

Financial Institutions and Banks turning cautious towards rescheduling debt or issuing fresh loans, developers are approaching Non Banking Financial Companies (NBFC) which are issuing Non Convertible Debentures (NCD) at 16-20%. As per National Securities Depository Ltd (NSDL) and various press reports, real estate companies like Puravankara and Kalpatru have raised funds at 16% pa while Century real estate has raised funds at 20% pa.

There is a talk to bring Real Estate Developers, Builders and all bad sections of the society indulging in Black Money transactions under the ambit of "Prevention of money Laundering Act" as they have evaded massive taxes much more than 2G Telecom Spectrum Scam in India.

Ears on the Ground suggest that rising speculative demand (encouraged by the low down payments), especially in cities, such as Gurgaon, could be boosting sales volumes which we believe is not sustainable. We believe that the sentiment of genuine home buyers remains weak and are holding back on purchases in anticipation of a 15-20% price correction. The affordability [Price vs Mortgage Rates] remains under pressure and, hence, real buying sentiment remains weak.

Financial Institutions and Banks turning cautious towards rescheduling debt or issuing fresh loans, developers are approaching Non Banking Financial Companies (NBFC) which are issuing Non Convertible Debentures (NCD) at 16-20%. As per National Securities Depository Ltd (NSDL) and various press reports, real estate companies like Puravankara and Kalpatru have raised funds at 16% pa while Century real estate has raised funds at 20% pa.

There is a talk to bring Real Estate Developers, Builders and all bad sections of the society indulging in Black Money transactions under the ambit of "Prevention of money Laundering Act" as they have evaded massive taxes much more than 2G Telecom Spectrum Scam in India.

Tuesday, March 29, 2011

Gurgaon Sales Up - Mumbai Flat

The residential volumes in Gurgaon increased 50% MoM on account of higher sales in new markets, while Mumbai volumes remained flat MoM.

Gurgaon recorded strong volumes in February at 7.7msf (vs. 5.2msf in January ―11) backed by absorption in New Gurgaon (prices at Rs 3,000–4,000psf, Fig 9) and Southern Periphery Road (Rs 5,000–7,000psf). There have been a number of pre-launches with actual roll-out slated for March-April ―11. Even though the general sense in the market remains cautious, a good product at a fair price is usually well received (~1msf launched by Alpha G Corp in Sec-84, Gurgaon was rapidly sold off).

Volumes in Mumbai came in at ~4msf (vs. 3.9msf in January and 4.4msf in December ―10) mainly on account of steady sales in the western suburbs (mainly Virar) and New Mumbai (Panvel, Ulwe). Prices are muted and we see a few developers offering deals though this is not widespread as yet.

Commercial Real EstateEven though the interest in commercial properties seems to be improving, volumes remain flattish. Inventory levels remained high both in Gurgaon and Mumbai. Rentals seem to have bottomed out and a material uptick may not become visible until inventory levels climb down.

Real estate developers may see some debt repayment–related pressure over Q1FY12, which in turn may trigger a further reduction in property prices.

Gurgaon recorded strong volumes in February at 7.7msf (vs. 5.2msf in January ―11) backed by absorption in New Gurgaon (prices at Rs 3,000–4,000psf, Fig 9) and Southern Periphery Road (Rs 5,000–7,000psf). There have been a number of pre-launches with actual roll-out slated for March-April ―11. Even though the general sense in the market remains cautious, a good product at a fair price is usually well received (~1msf launched by Alpha G Corp in Sec-84, Gurgaon was rapidly sold off).

Volumes in Mumbai came in at ~4msf (vs. 3.9msf in January and 4.4msf in December ―10) mainly on account of steady sales in the western suburbs (mainly Virar) and New Mumbai (Panvel, Ulwe). Prices are muted and we see a few developers offering deals though this is not widespread as yet.

Commercial Real EstateEven though the interest in commercial properties seems to be improving, volumes remain flattish. Inventory levels remained high both in Gurgaon and Mumbai. Rentals seem to have bottomed out and a material uptick may not become visible until inventory levels climb down.

Real estate developers may see some debt repayment–related pressure over Q1FY12, which in turn may trigger a further reduction in property prices.

Friday, February 04, 2011

Gurgaon + Noida + Chennai Property Markets Lead in Recovery

A comparison of volumes during the peak 2007 and end of 2010 data suggests that Gurgaon, Noida / Greater Noida and Chennai property Markets recovered to cross the previous peak volumes consistently for the last 6 months while the rest of India exhibited mixed trends.

Noida / Greater Noida - Sold 2 Mn SFT / Month in 2007. The figure went up as high as 10 Mn SFT / Month in the last 6 months and has started to cool off with rising interest rates.

Gurgaon - From a lull in mid-CY10, demand for residential property in Gurgaon has recovered smartly. Price correction may still be staved off for another 4-6 months, post which prices may correct by 15%, we believe. The key here would be to watch for supply from investors in the secondary market, as this could lead to an earlier price correction.

Chennai - Volumes in Chennai are currently at their best ever in history. We believe Chennai volumes should remain strong vs. FY09 levels, driven by the IT industry and good affordability in the suburbs. Inventory levels though remain a worry, in our opinion.

Bangalore - The Bangalore residential market seems to have entered a rut with volumes unable to break out of the 3-4 mn sqft range. An interesting feature is that the size of homes sold has come down in the past 3-4 months suggesting that buyers in Bangalore are downtrading in the face of a 150bp increase in interest rates and a 15% rise in prices. Affordability in Bangalore is little high and hence buyers are not willing to stretch themselves with the Poorest City Infrastructure compared to all other Tier-I cities in India.

Hyderabad - Hyderabad continues its poor performance as the uncertain political situation and the consequent lack of clarity on Hyderabad’s status as the capital city seem to have led to buyers staying away.

Kolkata - Kolkata witnessed a good demand environment in 2H CY10, with volumes consistently above 1mn sqft. The unsold stock with developers has come off significantly over the last 2.5 years

Mumbai Metro Region - Demand for residential property in MMR slowed down considerably since the early part of the year. While the slowdown in square feet terms looks muted, in terms of units sold at 3,101, Dec 2010 was the second-slowest month since Dec 2008 (2,925). This is because sales of larger-sized apartments (premium homes) are continuing; the slowdown seems to be more in mid-segment homes due to rising interest rates.

Noida / Greater Noida - Sold 2 Mn SFT / Month in 2007. The figure went up as high as 10 Mn SFT / Month in the last 6 months and has started to cool off with rising interest rates.

Gurgaon - From a lull in mid-CY10, demand for residential property in Gurgaon has recovered smartly. Price correction may still be staved off for another 4-6 months, post which prices may correct by 15%, we believe. The key here would be to watch for supply from investors in the secondary market, as this could lead to an earlier price correction.

Chennai - Volumes in Chennai are currently at their best ever in history. We believe Chennai volumes should remain strong vs. FY09 levels, driven by the IT industry and good affordability in the suburbs. Inventory levels though remain a worry, in our opinion.

Bangalore - The Bangalore residential market seems to have entered a rut with volumes unable to break out of the 3-4 mn sqft range. An interesting feature is that the size of homes sold has come down in the past 3-4 months suggesting that buyers in Bangalore are downtrading in the face of a 150bp increase in interest rates and a 15% rise in prices. Affordability in Bangalore is little high and hence buyers are not willing to stretch themselves with the Poorest City Infrastructure compared to all other Tier-I cities in India.

Hyderabad - Hyderabad continues its poor performance as the uncertain political situation and the consequent lack of clarity on Hyderabad’s status as the capital city seem to have led to buyers staying away.

Kolkata - Kolkata witnessed a good demand environment in 2H CY10, with volumes consistently above 1mn sqft. The unsold stock with developers has come off significantly over the last 2.5 years

Mumbai Metro Region - Demand for residential property in MMR slowed down considerably since the early part of the year. While the slowdown in square feet terms looks muted, in terms of units sold at 3,101, Dec 2010 was the second-slowest month since Dec 2008 (2,925). This is because sales of larger-sized apartments (premium homes) are continuing; the slowdown seems to be more in mid-segment homes due to rising interest rates.

Tuesday, January 25, 2011

Residential demand Weakens

Recent data suggests absorption (demand) volume in India’s top 7 cities has either been flat or declined over the past two quarters. The Mumbai region and Pune have reported sharp drops, while Gurgaon and Bangalore have shown flat-marginally negative growth.

While developers could hold prices firm in the near term due to stable balance sheet liquidity, we think this will only hurt demand as interest rate rises and higher property prices will curtail affordability.

Likely stringent measures by RBI towards the sector could curtail credit to the sector and hurt execution. Looking ahead, the risks of sticky inflation, further rise in interest rates and more stringent RBI policies imply further downside risk to demand. However, the Job market is looking really good and hence Developers should reduce their margins a little bit which will get the consumers back to their doors.

While developers could hold prices firm in the near term due to stable balance sheet liquidity, we think this will only hurt demand as interest rate rises and higher property prices will curtail affordability.

Likely stringent measures by RBI towards the sector could curtail credit to the sector and hurt execution. Looking ahead, the risks of sticky inflation, further rise in interest rates and more stringent RBI policies imply further downside risk to demand. However, the Job market is looking really good and hence Developers should reduce their margins a little bit which will get the consumers back to their doors.

Monday, January 17, 2011

Private Equity in Indian Realty

After a weak 2009, private Equity Funding in Realty saw a pick-up in 2010. ~$1.5 b (~Rs68 b) was invested across 46 deals in the sector vs $749m across 23 deals in 2009. To put this in perspective of sector funding, $1.7b equity was raised through IPO/QIP route in CY10. Of the total PE pool.

Developers are increasingly approaching PE funds, likely due to lack of other options. As an after math of the bribe-for-loan scam, banks are tightening lending to real estate firms. Also, falling sales volumes and lack of appetite for equity raisings have worsened their case. Hence, more developers across India now are turning to PE funds.

Recent PE Deals Include - Parsvnath raised Rs1.0b by selling 49.9% stake in Ghaziabad project to SUN-Apollo India RE; 2) ASK's Property Fund is investing in two Pune Projects of Rs5.25b; 3) Red Fort Capital is looking to invest Rs1.5b in Ansal API’s “Esencia” township Gurgaon; 4) Kumar Urban may raise Rs1.1b by divesting stakes in five Mumbai and two Pune projects.

Developers are increasingly approaching PE funds, likely due to lack of other options. As an after math of the bribe-for-loan scam, banks are tightening lending to real estate firms. Also, falling sales volumes and lack of appetite for equity raisings have worsened their case. Hence, more developers across India now are turning to PE funds.

Recent PE Deals Include - Parsvnath raised Rs1.0b by selling 49.9% stake in Ghaziabad project to SUN-Apollo India RE; 2) ASK's Property Fund is investing in two Pune Projects of Rs5.25b; 3) Red Fort Capital is looking to invest Rs1.5b in Ansal API’s “Esencia” township Gurgaon; 4) Kumar Urban may raise Rs1.1b by divesting stakes in five Mumbai and two Pune projects.

Subscribe to:

Posts (Atom)