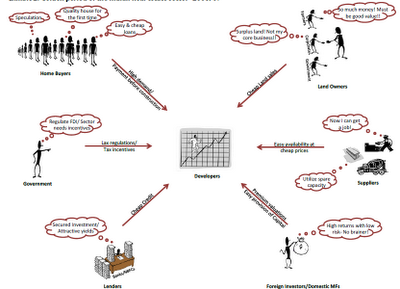

2006 - India Real estate sector was in a sweet spot in 2006/07. With buyers coming in hordes to book apartments, land available at throwaway prices and regulators providing incentives, developers started making supernormal profits. Availability of capital was never a problem with foreign investors eager to invest and banks clearing loans at a rapid pace. All the above Can be summed up in the Chart as shown Below.

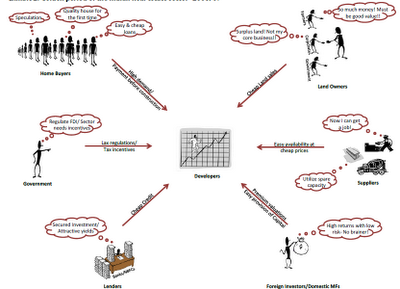

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce.

We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

In 2001, the shift from time-linked payment to construction-linked payments and buyers becoming selective is having a far-reaching impact on developer’s cash flows. Land acquisition has become troublesome with land owners demanding a share in conversion gains while construction costs have seen continuous upward pressures and shortages on emerging bottlenecks. Regulators have increased surveillance on the sector with multiple monitoring tools. Equity capital is scarce with foreign investors disappointed with poor corporate governance and lack of cash flows. Debt and Private Equity funding has become expensive and scarce. We believe 2011 has provided enough empirical data confirming that it is a structural shift rather than mere cyclicality at play.

No comments:

Post a Comment