Like the Delhi NCR market, Bangalore Residential Property market witnessed a Flat Quarter with barely any price hikes. Here is the Latest Residential property Prices in Bangalore - Central (Brunton Road, Artillery Road, Ali Askar Road, Cunningham Road), East (Marathalli, Whitefield, Airport Road), South East (Koramangala, Jakkasandra), Off Central (Vasanth Nagar, Richmond Town, Indiranagar) and North West (Malleshwaram, Rajajinagar)

Chennai witnessed some QoQ hikes in residential prices in the following areas - Rajiv Gandhi Salai, Velachery and Anna Nagar as shown below

Thursday, December 27, 2012

Wednesday, December 26, 2012

Residential Trends - Delhi NCR + Mumbai

Here is a Snapshot of the Latest Residential Capital Values / Prices in Mumbai and in comparison to a Year ago based on QoQ in the following areas - South Central (Altamount Rd., Malabar Hill, Napeansea etc) , Central (Worli, Prabhadevi, Lower Parel / Parel) ,North (Bandra (W), Khar (W), Santacruz (W), Juhu , Far North (Andheri (W), Malad, Goregaon) and the North East (Powai).

Residential Property prices in Delhi NCR in the Last Quarter Have Remained Flat or Subdued. Here is a comparison of price variation on a QoQ basis in the following areas -South East (New Friends Colony, Kalindi Colony, Ishwar Nagar), South Central (Safdarjung Enclave, Sarvapriya Vihar, Panchsheel), Gurgaon and Noida

Residential Property prices in Delhi NCR in the Last Quarter Have Remained Flat or Subdued. Here is a comparison of price variation on a QoQ basis in the following areas -South East (New Friends Colony, Kalindi Colony, Ishwar Nagar), South Central (Safdarjung Enclave, Sarvapriya Vihar, Panchsheel), Gurgaon and Noida

Wednesday, December 19, 2012

Mumbai Residential Market - Going Slow

South-central Mumbai has seen a glut of new (or upcoming) launches over the last two years (e.g., Lodha 3-4 msf + 4msf NTC mills; IBREL 3-4msf; DB 3-4 msf; OBER 2msf), totaling a significant 15+ msf. However, most of these projects have been delayed (on regulatory or other factors), and are planned to be 60-100 stories tall (implying long completion cycle of 5-7 years). Sales volumes have been sluggish so far.

The lack of new deliveries would likely steadily push residential rentals up (still 8-10% below 2008 peak) over the next 2-3 years, which in turn could continue to lift the value of already high ready to move in stock. The situation should normalize with the delivery of the under-construction supply (five years). List of Recent Launches in Greater Mumbai / Bombay by prominent Builders and the Current Ongoing Rate Per Square Feet

The lack of new deliveries would likely steadily push residential rentals up (still 8-10% below 2008 peak) over the next 2-3 years, which in turn could continue to lift the value of already high ready to move in stock. The situation should normalize with the delivery of the under-construction supply (five years). List of Recent Launches in Greater Mumbai / Bombay by prominent Builders and the Current Ongoing Rate Per Square Feet

- Worli Blu IBREL Worli South / Central Mumbai ~42,000

- Orchid Crown - Tower C DB Realty Prabhadevi South / Central Mumbai ~26,000

- Wadhwa Dadar Wadhwa Dadar South / Central Mumbai 25,500

- Crescent Bay L&T + Omkar Parel South / Central Mumbai 17,000

- Lodha Elisium Lodha Wadala South / Central Mumbai 16,500

- Lodha Venezia Lodha Parel South / Central Mumbai 19,980

- Meredia Omkar Kurla South / Central Mumbai 15,500

- Godrej Serenity Godrej Chembur South / Central Mumbai ~16,500

- Alta Monte - Tower C Omkar Malad Western Suburbs 10,500

- The Nest Wadhwa Andheri Western Suburbs 17,100

- Sunteck City Sunteck Goregaon Western Suburbs 12,500

- Runwal Greens - Phase 3 Runwal Mulund Eastern Suburbs 9,300

- Godrej Platinum - Tower 3 Godrej Vikhroli Eastern Suburbs ~14,800

Wednesday, November 21, 2012

India’s Top Residential Destinations To Invest In

According to Knight & Frank Residential real estate will emerge as a promising asset class during the next 5 years with estimated price appreciation ranging from 91% - 145%. With property options starting as low as Rs.15 lakh, investors with a limited budget can also participate in this opportunity.

Listed below are some of the key findings of the latest report India’s Top Residential Destinations To Invest In by Knight Frank India.

Areas and properties in Mumbai - Ulwe, Wadala, Chembur

Areas in Delhi NCR - Nodia Extension, Dwarka Expressway

Hingewadi, Tathawade and Ravet in Pune are set to boom

Medavakkam in Chennai and Hebbal in Bengaluru

Saturday, October 06, 2012

BUY Land Where Gandhi Family Buys for Maximum Appreciation

This Tip is for the HNI who wish to Speculate in the Real Estate Market. Uesterday, India Against Corruption members have unearthed the nexus between DLF and Robert vadra [Son in law of Sonia Gandhi]. Robert has amassed Rs 1,000 Cr of Real Estate which includes some Land Bank. So Real Estate Speculators can BUY Lands near Robert Vadra's and Get Rich Qucikly. Here is list of Land Parcels owned by Robert Vadra's Company,

- Land in Bikaner - Search Bikaner Sub-Registrar's Office and see where "North India IT Parks Pvt. Ltd." has bought 161 Acres of Land in the City and you can start gobbling the neighboring parcels

- Search Bikaner's Sub-Regisrrar office for Lands Owned by these companies Real Earth Estates Pvt. Ltd., Sky Light Realty Private Ltd., Sky Light Hospitality Private Ltd and bUY Land in the Vicinity for jackpot.

- Investment by Gandhi Family in Manesar - Sky Light Hospitality Private Ltd is the Official Land Owner

- Palwal - Sky Light Realty Private Ltd is the Holding company of Land for Gandhi Family

- BUY Land in Hassanpur in the vicinity where Real Earth Estates Pvt. Ltd has bought land

- BUY Land in Mewat (Haryana) wherever Real Earth Estates Pvt. Ltd is holding land

Friday, October 05, 2012

Bangalore - Mid-Size Apartments Rule the Roost

Ears on the Ground Survey indicate to us that that mid-ticket size products are best for the market and this is which has seen the most volume absorption. We could define mid ticket size units as those in the ticket size of Rs5-10m. This segment provides a good combination of investment-worthiness, rental yield and end-user demand. In terms of area, this means unit sizes of 1,800-2,500sft apartments and, in terms of rate, a range of Rs4,000-5,000 psft.

The buyer segment (10-year work experience in IT/ITES sector) has on an average household gross income of Rs1.2-Rs1.8m. This makes price in terms of the household income in the range of 4-5x, which is an affordable pricing bracket in our view.

Over the past couple of years, we have seen a slew of launches in the premium-housing segment with ticket size of Rs30m+, primarily focused in the new-emergent areas of North Bangalore. Observers believe that the market for luxury launches is weak and they have not seen good absorption.

The buyer base comprises primarily of IT professionals looking to invest surplus cash. At the other end of the spectrum is the Delhi-NCR market, which is entirely broker investor driven, dependent on bulk sales. The Mumbai market is between the two extremes. In the Bangalore market, developers do not bulk-sell to a committed broker-investor base. Rather, they depend upon branding and word-of-mouth from existing buyers to attract new buyers.

Bangalore has developers that are focusing on affordable housing (Purvankara Provident, Value Budget Housing Company) and they have started to offer viable products. However, their scalability and execution challenges are yet to be tested over the longer run.

The buyer segment (10-year work experience in IT/ITES sector) has on an average household gross income of Rs1.2-Rs1.8m. This makes price in terms of the household income in the range of 4-5x, which is an affordable pricing bracket in our view.

Over the past couple of years, we have seen a slew of launches in the premium-housing segment with ticket size of Rs30m+, primarily focused in the new-emergent areas of North Bangalore. Observers believe that the market for luxury launches is weak and they have not seen good absorption.

The buyer base comprises primarily of IT professionals looking to invest surplus cash. At the other end of the spectrum is the Delhi-NCR market, which is entirely broker investor driven, dependent on bulk sales. The Mumbai market is between the two extremes. In the Bangalore market, developers do not bulk-sell to a committed broker-investor base. Rather, they depend upon branding and word-of-mouth from existing buyers to attract new buyers.

Bangalore has developers that are focusing on affordable housing (Purvankara Provident, Value Budget Housing Company) and they have started to offer viable products. However, their scalability and execution challenges are yet to be tested over the longer run.

Robust Sales for Sobha Developers

Management has targeted pre-sales of Rs20 bn and 3.75 mn sqft for FY13. The company has reported Rs10.1 bn (up 28% yoy) and 1.78 mn sqft of presales in the first half of the year, which is traditionally the weaker half. We believe Sobha has maintained its robust sales growth through periodic launches and entry into new markets. Sobha is poised to launch 6 mn sqft in the upcoming 4 quarters in several locations in Bangalore, Thrissur, Pune, and Mysore.

Average prices increased to Rs5,575/sqft in 2QFY13 from Rs5,196/sqft in 2QFY12, up 7%. However pricing declined 3% qoq due to increased sales in Thrissur (lower pricing), while sales in Gurgaon (higher pricing) were flattish qoq.

In 2QFY13, Sobha sold 0.59 mn sqft in Bangalore, 0.14 mn sqft in Gurgaon, 0.12 mn sqft in Thrissur, and 0.1 mn sqft combined in Chennai, Coimbatore, Mysore and Pune. Qoq growth of 13% was driven by strong growth in Thrissur (168% qoq) and Bangalore (14% qoq).

Average prices increased to Rs5,575/sqft in 2QFY13 from Rs5,196/sqft in 2QFY12, up 7%. However pricing declined 3% qoq due to increased sales in Thrissur (lower pricing), while sales in Gurgaon (higher pricing) were flattish qoq.

In 2QFY13, Sobha sold 0.59 mn sqft in Bangalore, 0.14 mn sqft in Gurgaon, 0.12 mn sqft in Thrissur, and 0.1 mn sqft combined in Chennai, Coimbatore, Mysore and Pune. Qoq growth of 13% was driven by strong growth in Thrissur (168% qoq) and Bangalore (14% qoq).

Monday, September 17, 2012

Residential launches continue to see success in Gurgaon, Bangalore

Recent data points indicated continued strong residential demand in Gurgaon and Bangalore.

Various launches in the recent past have been received well: (1) Godrej Properties launched Godrej Summit and sold entire Phase I of 1 mn sq. ft at price point of Rs5,500/sqft, (2) DLF launched Independent Floors in Gurgaon, (3) Phoenix Mills sold 275 apartments in Phase I of “One Bangalore West” at selling rate of Rs7,000+/sqft, and (4) Sobha recently launched 2 new projects in Bangalore – Sobha Morzaria Grandeur, a luxury project at Dairy Circle and Cedar at Sobha Forestview on Kanakpura Road.

Furthermore, selling prices achieved indicate that buoyant sales are not a result of pricing discounts. We believe demand environment can get a further boost in case of improvement in economic sentiment and reduction in interest rates. A 50 bp reduction in interest rates can reduce EMI of 20-year loan by 3%.

Robust demand in Gurgaon will likely help DLF as it launches residential projects with cumulative sales values of Rs60+ bn in 2HFY12. Success of ‘Godrej Summit’ indicates Sobha’s largest project (Sobha International City in Gurgaon, 15% of NAV) will see continued traction. DLF is planning to launch 2.5 mn sqft in Phase V in Gurgaon in 2HFY13.

Various launches in the recent past have been received well: (1) Godrej Properties launched Godrej Summit and sold entire Phase I of 1 mn sq. ft at price point of Rs5,500/sqft, (2) DLF launched Independent Floors in Gurgaon, (3) Phoenix Mills sold 275 apartments in Phase I of “One Bangalore West” at selling rate of Rs7,000+/sqft, and (4) Sobha recently launched 2 new projects in Bangalore – Sobha Morzaria Grandeur, a luxury project at Dairy Circle and Cedar at Sobha Forestview on Kanakpura Road.

Furthermore, selling prices achieved indicate that buoyant sales are not a result of pricing discounts. We believe demand environment can get a further boost in case of improvement in economic sentiment and reduction in interest rates. A 50 bp reduction in interest rates can reduce EMI of 20-year loan by 3%.

Robust demand in Gurgaon will likely help DLF as it launches residential projects with cumulative sales values of Rs60+ bn in 2HFY12. Success of ‘Godrej Summit’ indicates Sobha’s largest project (Sobha International City in Gurgaon, 15% of NAV) will see continued traction. DLF is planning to launch 2.5 mn sqft in Phase V in Gurgaon in 2HFY13.

Thursday, August 09, 2012

Property Buyers Must Also get Access to CERSAI Database

Just like how CIBIL maintains a database of Credit Borrowers from various financial institutions of India, CERSAI maintains a Database of all Properties Mortgaged to any financial institution in India.

It is not uncommon to see Indians involving in selling a pledged property or selling it to multiple people. In all these cases, CERSAI wants to become the central repository and open its Database to Potential BUYERS of Property.

It is not uncommon to see Indians involving in selling a pledged property or selling it to multiple people. In all these cases, CERSAI wants to become the central repository and open its Database to Potential BUYERS of Property.

Tuesday, July 10, 2012

Bangalore Steady Sales + Gurgaon Lowest Unsold Inventory

In Gurgaon Micro Market, Quarterly demand (sales) has been ahead or in-line with supply (new launches) since the last 12 quarters with the exception of Q1CY2011. This clearly indicates robust demand for residential units in the market. We foresee this trend to continue led by large and rising migrant population aspiring to live and work in Gurgaon. In terms of affordability, Gurgaon continues to remain at the cusp of affordability (defined as monthly mortgage installment / monthly income) which has supported resilience in demand.

Absorption rate was flat in 2Q led by slowdown in new launches (supply). Unsold inventory tapered further in 2Q as demand surpassed supply yet again in Gurgaon. The unsold inventory (represented in # of quarters required to exhaust unsold inventory) has been less than 4 quarters since 1QCY10, which is the lowest compared to other cities across the country.

Sales volume in Bangalore remained steady despite significant reduction in new launches. We believe the same is due to affordable prices which have historically seen annual increments in single digits over last 8-10 years. This particular nature of Bangalore has attracted more end-users and long-term investors over speculative investors as upside from housing projects has remained limited.

Unsold inventory in Bangalore city reduced primarily led by steady sales volume and 30% dip in new project launches. We believe Bangalore developers recognize rise in unsold inventory and some plan to launch new projects once the unsold inventory figure attains more comfortable levels.

Absorption rate was flat in 2Q led by slowdown in new launches (supply). Unsold inventory tapered further in 2Q as demand surpassed supply yet again in Gurgaon. The unsold inventory (represented in # of quarters required to exhaust unsold inventory) has been less than 4 quarters since 1QCY10, which is the lowest compared to other cities across the country.

Sales volume in Bangalore remained steady despite significant reduction in new launches. We believe the same is due to affordable prices which have historically seen annual increments in single digits over last 8-10 years. This particular nature of Bangalore has attracted more end-users and long-term investors over speculative investors as upside from housing projects has remained limited.

Unsold inventory in Bangalore city reduced primarily led by steady sales volume and 30% dip in new project launches. We believe Bangalore developers recognize rise in unsold inventory and some plan to launch new projects once the unsold inventory figure attains more comfortable levels.

Monday, July 09, 2012

Mumbai - Upward Pricing for Premium Properties

Recent new launches in Mumbai MRDA include – Godrej Chembur (BSP - Rs16k psf), Wadhwa Dadar (Rs25.5k psf), Bombay Dyeing Dadar ICC1/2 (roughly Rs28k psf), Lodha Dioro Wadala (Rs15k psf), Godrej Platinum Vikhroli (Rs12k psf) and IBREL Worli Blu

(Rs50k psf).

To us, most of these projects appear to be priced at a meaningful premium (15-40%) to the neighborhood and are, therefore, losing investor demand. Project specifications (large/mixed format, fit outs, common area, amenities) are improving sharply to compare with those in the more advanced cities in the world. These Developers continue to prefer margins (pricing) at the cost of asset turnover (volumes).

(Rs50k psf).

To us, most of these projects appear to be priced at a meaningful premium (15-40%) to the neighborhood and are, therefore, losing investor demand. Project specifications (large/mixed format, fit outs, common area, amenities) are improving sharply to compare with those in the more advanced cities in the world. These Developers continue to prefer margins (pricing) at the cost of asset turnover (volumes).

Monday, July 02, 2012

Mumbai Residential - Lower Prices for New Projects

Here are the views of Mr. Ramesh Nair, Jones Lang LaSalle India on the Mumbai Residential Property Market.

He expects turnaround in Mumbai residential segment in next six months as developers launch new projects at lower prices. The key reason for prices holding up was due to sharp drop of over 50% in new launches which neutralized the 30% drop in absorption. However, with new DCR (Development control regulations) in place, launches are picking pace and should lead to improved sales volume.

The affordability in Mumbai market can improve only if infrastructure projects are implemented opening up new land supply. He believes redevelopment and slum rehab will provide future land supply (up to ~13,000 acres) in Mumbai island city.

He expects turnaround in Mumbai residential segment in next six months as developers launch new projects at lower prices. The key reason for prices holding up was due to sharp drop of over 50% in new launches which neutralized the 30% drop in absorption. However, with new DCR (Development control regulations) in place, launches are picking pace and should lead to improved sales volume.

The affordability in Mumbai market can improve only if infrastructure projects are implemented opening up new land supply. He believes redevelopment and slum rehab will provide future land supply (up to ~13,000 acres) in Mumbai island city.

Wednesday, June 27, 2012

Noida + Gurgaon - Latest Pricing of Residential Projects

Yesterday, we have cautioned our readers about the Developer-Broker-Investor nexus of Real Estate in Delhi NCR.

The Current Residential Property Prices in Noida and Gurgaon for the following projects Amrapali, Zodiac, RG Residency, Unihomes, The Residences, Golf & Country Club- Amber, Amrapali Sapphire, Jaypee Greens - Kalypso Court, Imperial Court Pavillion Heights, Knights Court, Kensington Boulevard, Grand Isles, Krescent Homes, Kosmos Noida, Atharva, International city, Paradiso, Primus, Petioles, Vistas, Exquisite and Alder are as follows.

The Current Residential Property Prices in Noida and Gurgaon for the following projects Amrapali, Zodiac, RG Residency, Unihomes, The Residences, Golf & Country Club- Amber, Amrapali Sapphire, Jaypee Greens - Kalypso Court, Imperial Court Pavillion Heights, Knights Court, Kensington Boulevard, Grand Isles, Krescent Homes, Kosmos Noida, Atharva, International city, Paradiso, Primus, Petioles, Vistas, Exquisite and Alder are as follows.

Tuesday, June 26, 2012

Delhi NCR Property Market Driven by Broker - Investor Nexus

NCR Realty market is a Broker-Investor driven market, especially for new projects with price increases driven by this model rather than robust end-user demand.

Modus Operandi of NCR Realty Market - The syndicate of brokers and investors continues to be the leading cause for developers in NCR touting high booking figures a few days after a project launch. The game plan here is for brokers to submit the booking amount on behalf of their investor clients, wait for the developers to increase prices by 10% in a year's time, by which time construction activity becomes visible on the project and the lock-in period expires off-load the booked apartment to another category of investor, who is willing to invest more for another >20% return, and move the original amount plus the profit to another newly launched project.

Prices have to continually increase for this model to be viable and for investors to remain interested and, in our view, this is the reason why we have seen a sharp ~25% increase in prices in Gurgaon in the past 12-18 months despite a slowing economy and high interest rates.

The developer also has to be careful not to start aggressive construction on the project before most investors have offloaded their holdings, otherwise the investor may balk at putting up more money, which could hurt the project cash flows.

This model is akin to riding a tiger where getting off may mean being swallowed and, we think, we are reaching close to that point. If developers fail to increase prices from hereon, their sales from new launches will slow down as investors will be uninterested and if they increase prices from these already unaffordable levels the end-users / later stage investors will refuse to purchase.

Thus Be EXTRA CAUTIOUS While BUYING Property in Delhi NCR especially with the following Builders who are in this Broker-Developer-Investor Nexus Amrapali, RG-Group, Unitech Jaypee, Raheja, Sobha, Chintels, ATS, DLF and SARE.

Modus Operandi of NCR Realty Market - The syndicate of brokers and investors continues to be the leading cause for developers in NCR touting high booking figures a few days after a project launch. The game plan here is for brokers to submit the booking amount on behalf of their investor clients, wait for the developers to increase prices by 10% in a year's time, by which time construction activity becomes visible on the project and the lock-in period expires off-load the booked apartment to another category of investor, who is willing to invest more for another >20% return, and move the original amount plus the profit to another newly launched project.

Prices have to continually increase for this model to be viable and for investors to remain interested and, in our view, this is the reason why we have seen a sharp ~25% increase in prices in Gurgaon in the past 12-18 months despite a slowing economy and high interest rates.

The developer also has to be careful not to start aggressive construction on the project before most investors have offloaded their holdings, otherwise the investor may balk at putting up more money, which could hurt the project cash flows.

This model is akin to riding a tiger where getting off may mean being swallowed and, we think, we are reaching close to that point. If developers fail to increase prices from hereon, their sales from new launches will slow down as investors will be uninterested and if they increase prices from these already unaffordable levels the end-users / later stage investors will refuse to purchase.

Thus Be EXTRA CAUTIOUS While BUYING Property in Delhi NCR especially with the following Builders who are in this Broker-Developer-Investor Nexus Amrapali, RG-Group, Unitech Jaypee, Raheja, Sobha, Chintels, ATS, DLF and SARE.

Property Absorption Low + Prices Rise

The weak trend in property volumes continued in Apr’12 with volumes declining 32% YoY, a trend seen for the last eight months, indicating no sign of an improvement in demand. Six of the seven major cities recorded a YoY decline in volumes viz., MMR (-50% YoY), Gurgaon (-45% YoY), Bangalore (-12% YoY), Chennai (-11% YoY), Hyderabad (-34% YoY) and Pune (-32% YoY). Kolkata was the only city with a marginal (+1% YoY) improvement in volumes. MMR and Gurgaon continue to remain the weakest markets while volumes in Bangalore and Chennai appear to be relatively holding up better. We maintain our view that the weakness in volumes will continue throughout CY12 unless property prices correct meaningfully from the current levels.

The Following Chart Shows Average Property Price Curve Vs Absorption in India.

Price Rise Continues

Price Rise Continues

Average property prices have continued to see a YoY increase across most property markets despite the slowdown in volumes, which is resulting in a further weakening of demand. Gurgaon has seen the most price appreciation (7% MoM and 32% YoY) consequently leading to a worsening demand environment today. Bangalore (+13% YoY, +1% MoM), Chennai (+9% YoY, +2% MoM) and Pune (+16% YoY, +1% MoM) have also seen a double-digit YoY increase in prices although the pace of appreciation appears to be moderating in the recent months.

The Following Chart Shows Average Property Price Curve Vs Absorption in India.

Price Rise Continues

Price Rise ContinuesAverage property prices have continued to see a YoY increase across most property markets despite the slowdown in volumes, which is resulting in a further weakening of demand. Gurgaon has seen the most price appreciation (7% MoM and 32% YoY) consequently leading to a worsening demand environment today. Bangalore (+13% YoY, +1% MoM), Chennai (+9% YoY, +2% MoM) and Pune (+16% YoY, +1% MoM) have also seen a double-digit YoY increase in prices although the pace of appreciation appears to be moderating in the recent months.

Thursday, June 14, 2012

Mumbai property registrations show recovery signs

Property registrations in Greater Mumbai declined ~10% YoY and ~3% QoQ in the quarter. However, QoQ decline is attributed to the higher registrations in Q3FY12 due to the December effect.

Property registrations for March and April were 5830 and 5150, respectively, which are well above the Jan‐Feb numbers of ~4100‐4300, indicating an uptrend in registrations. The Maharashtra government’s recent decision to introduce the amended Development Control Regulations (DCR) for Mumbai city/suburbs is a significant positive. We believe this development will spur new launches in the city which had been on hold for over a year. We expect new launches to be attractively priced (~5‐10% lower than prevailing rates), which along with softer interest rates, will drive volumes in the city.

Property registrations for March and April were 5830 and 5150, respectively, which are well above the Jan‐Feb numbers of ~4100‐4300, indicating an uptrend in registrations. The Maharashtra government’s recent decision to introduce the amended Development Control Regulations (DCR) for Mumbai city/suburbs is a significant positive. We believe this development will spur new launches in the city which had been on hold for over a year. We expect new launches to be attractively priced (~5‐10% lower than prevailing rates), which along with softer interest rates, will drive volumes in the city.

Tuesday, June 12, 2012

Residential Property Trends for 8 Years - Mumbai Vs Bangalore

India witnessed high volitality in Property Prices in the last 8 years. Breaking this time period (2004 – 2012) in four phases will help in understanding these movements better. Hence we have segregated this period into four phases.

Phase I (2004 to mid 2007): In just three years, property prices along with absorption increased considerably. Though the data for this period is not available, as per our discussion with industry experts, the price rise was very sharp during this period.

Phase II (Mid 2007 to end of 2008): In mid 2007, the absorption started reducing on the back of some sharp up move in property prices. The downward trend continued for 15 - 16 months

Phase III (End of 2008 to end of 2010): Post 2008, the prices started cooling off and resulted in increase in absorption. This continued for almost 2 years (till end of 2010). Till this time, scenario was similar across all major cities in the country. However; post 2010, two of the major real estate markets i.e. Bengaluru and Mumbai started showing opposite trends.

Phase IV (End of 2010 to mid 2012): While the prices continued to rise sharply in Mumbai, Bengaluru witnessed stable pricing levels. This helped Bengaluru to enjoy sustainable absorption against Mumbai, which witnessed considerable reduction in the absorption levels. This continued for almost 13 – 14 months and during this period, Bengaluru witnessed considerably increase in the area launched while Mumbai, coupled with lack of government approvals, witnessed dearth.

Phase I (2004 to mid 2007): In just three years, property prices along with absorption increased considerably. Though the data for this period is not available, as per our discussion with industry experts, the price rise was very sharp during this period.

Phase II (Mid 2007 to end of 2008): In mid 2007, the absorption started reducing on the back of some sharp up move in property prices. The downward trend continued for 15 - 16 months

Phase III (End of 2008 to end of 2010): Post 2008, the prices started cooling off and resulted in increase in absorption. This continued for almost 2 years (till end of 2010). Till this time, scenario was similar across all major cities in the country. However; post 2010, two of the major real estate markets i.e. Bengaluru and Mumbai started showing opposite trends.

Phase IV (End of 2010 to mid 2012): While the prices continued to rise sharply in Mumbai, Bengaluru witnessed stable pricing levels. This helped Bengaluru to enjoy sustainable absorption against Mumbai, which witnessed considerable reduction in the absorption levels. This continued for almost 13 – 14 months and during this period, Bengaluru witnessed considerably increase in the area launched while Mumbai, coupled with lack of government approvals, witnessed dearth.

Saturday, June 02, 2012

Supply + Absorption in Bangalore Residential Market

Residential Realty Supply in Bangalore

As of March 2012, nearly 119000 residential units are under various stages of construction in the Bangalore market. About 35% of the upcoming supply in Bangalore is expected to be ready for possession by end of CY 2012.

The micro-market of Sarjapur Road shall contribute 31% to the total upcoming supply in the southern region, while another emerging micro-market Kanakapura Road shall be responsible for around 16%. [Both do not have Water Supply and are dependent on tankers] North Bangalore, meanwhile, will contribute 21% to the total upcoming residential supply in Bangalore, followed by the eastern region with 15% and West

Bangalore with 10%.

Central Bangalore understandably has presence only in the higher end of the ticket size split, mainly in the INR 40-80 million ticket size due to the dearth of developable space in the region.

Overall Bangalore residential market has been relatively resilient and has a somewhat healthy sales level.

Absorption

60% of their units under development have been sold. The sharpest decline in absorption level was witnessed by the southern and northern micro-market of the city. Central Bangalore was not impacted by any external factor and witnessed steady growth in absorption.

It has been observed that nearly 34% of the absorption in FY 2012 has been in the ticket size range of INR 2.5-5 million, followed by the ticket size of INR 5-7.5 million at 31%. Only 5% of the absorption has taken place in the INR 20-40 million ticket size.

As of March 2012, nearly 119000 residential units are under various stages of construction in the Bangalore market. About 35% of the upcoming supply in Bangalore is expected to be ready for possession by end of CY 2012.

The micro-market of Sarjapur Road shall contribute 31% to the total upcoming supply in the southern region, while another emerging micro-market Kanakapura Road shall be responsible for around 16%. [Both do not have Water Supply and are dependent on tankers] North Bangalore, meanwhile, will contribute 21% to the total upcoming residential supply in Bangalore, followed by the eastern region with 15% and West

Bangalore with 10%.

Central Bangalore understandably has presence only in the higher end of the ticket size split, mainly in the INR 40-80 million ticket size due to the dearth of developable space in the region.

Overall Bangalore residential market has been relatively resilient and has a somewhat healthy sales level.

Absorption

60% of their units under development have been sold. The sharpest decline in absorption level was witnessed by the southern and northern micro-market of the city. Central Bangalore was not impacted by any external factor and witnessed steady growth in absorption.

It has been observed that nearly 34% of the absorption in FY 2012 has been in the ticket size range of INR 2.5-5 million, followed by the ticket size of INR 5-7.5 million at 31%. Only 5% of the absorption has taken place in the INR 20-40 million ticket size.

Friday, June 01, 2012

Market Activity of Bangalore Residential Segment

Bangalore has typically been an enduser driven market with moderate price appreciation leading to stability in the market, as well as minimal speculation.

Demand for residential units has been more evident in the mid-end category. In FY2012, Bengaluru witnessed the launch of approximately 9700 units which are scheduled to be completed in the next 2-3 years.

It has been observed that majority of the residential units launched during FY 2012 are concentrated towards the southern part of the city, particularly along Sarjapur Road. Developers such as LGCL, Shriram Properties, Shanders, Mahaveer and Confident Group have initiated their projects in South Bangalore. This region is followed by North Bangalore.

The western part of the city, however, did not see much residential activity in FY 2012. Not surprisingly, no residential projects were reported to have launched in the central part of the city in FY 2012.

What is the Budget of Apartment Buyers in Bangalore ?

On the pricing front, nearly 39% of the total number of residential units launched in FY 2012 fall under the INR 2.5-5 million ticket size category, thereby emphasizing the acknowledgment of developers towards the fact that customers in the mid-end segment are the prime demand drivers of residential market in the city.

Residential units with ticket size ranging between INR 2.5-7.5 million were altogether responsible for around 70% of the total number of units launched during FY 2012.

What about Affordable Housing in Bangalore ?

Ticket size of the Apartment is less than Rs 25 Lakh is bare minimum in the Bengaluru Residential Market.

Demand for residential units has been more evident in the mid-end category. In FY2012, Bengaluru witnessed the launch of approximately 9700 units which are scheduled to be completed in the next 2-3 years.

It has been observed that majority of the residential units launched during FY 2012 are concentrated towards the southern part of the city, particularly along Sarjapur Road. Developers such as LGCL, Shriram Properties, Shanders, Mahaveer and Confident Group have initiated their projects in South Bangalore. This region is followed by North Bangalore.

The western part of the city, however, did not see much residential activity in FY 2012. Not surprisingly, no residential projects were reported to have launched in the central part of the city in FY 2012.

What is the Budget of Apartment Buyers in Bangalore ?

On the pricing front, nearly 39% of the total number of residential units launched in FY 2012 fall under the INR 2.5-5 million ticket size category, thereby emphasizing the acknowledgment of developers towards the fact that customers in the mid-end segment are the prime demand drivers of residential market in the city.

Residential units with ticket size ranging between INR 2.5-7.5 million were altogether responsible for around 70% of the total number of units launched during FY 2012.

What about Affordable Housing in Bangalore ?

Ticket size of the Apartment is less than Rs 25 Lakh is bare minimum in the Bengaluru Residential Market.

Wednesday, May 23, 2012

Land Acquisition Bill will Make Non-Government Acquistions Expensive

The new proposed land acquisition bill, in our view, makes private land acquisition far more difficult to achieve than it already is. Land, under the proposed legislation, can be acquired by the state only for public purposes (highways, etc) and not for any "for profit” enterprise including any PPP project, thus leaving the private sector to fend for itself.

The matter will likely be debated by the parliament before it becomes a law. Nonetheless, even on a "watered down" basis, land prices will likely increase as a result.

The standing committee, in its review of last year' proposed land bill, has rejected a key provision of allowing the government to acquire plots for private companies.

Given that land is also a state subject, in a Federal structure such as India, a lot of “progressive” states are likely to bring in their own land acquisition acts, which the respective governments may think is more progressive than the Central act in order to aid industry and job creation. These provisions thus additionally may temper down the potential impact of the central act.

Land aggregation and conversion was one of the most complicated part of any industrial activity in the best of times and post this bill becomes potentially even more difficult.

The matter will likely be debated by the parliament before it becomes a law. Nonetheless, even on a "watered down" basis, land prices will likely increase as a result.

The standing committee, in its review of last year' proposed land bill, has rejected a key provision of allowing the government to acquire plots for private companies.

Given that land is also a state subject, in a Federal structure such as India, a lot of “progressive” states are likely to bring in their own land acquisition acts, which the respective governments may think is more progressive than the Central act in order to aid industry and job creation. These provisions thus additionally may temper down the potential impact of the central act.

Land aggregation and conversion was one of the most complicated part of any industrial activity in the best of times and post this bill becomes potentially even more difficult.

Saturday, April 21, 2012

Gurgaon Residential Prices Rising - High End Converge with South Delhi

Realty Ears on the Ground Suggests that prime Gurgaon projects, have the dominant theme that came out from the discussions was a "price convergence" of South Delhi and Gurgaon. While at first instance this suggestion looks lofty, we note that price appreciation for DLF's Golf course and Ambience projects has been far better than South Delhi. DLF's finished golf course inventory now retails between Rs 20-30K (Aralias and Magnolias) psf and non golf course facing between Rs 11-14K psf (Belaire / Park place)

Residential volumes in the markets have been driven by infrastructure initiatives to improve the connectivity to Delhi and relatively affordable price points. Most project launches in these regions have met with good success and have seen sharp appreciation over the last 2 years. The demand at this point seems to be more investor driven and speculative. However, as commercial activity picks up in the region as envisaged in the master plan, end user demand should pick up in the medium term.

Overall sales activity in the city is much better than rest of the country. Inventory levels are reasonably sound. Gurgaon, however, is expected to witness large number of deliveries in 2012. This could potentially result in sales activity shifting to the secondary market from the primary market.

DLF has close to 40-45 msf in the Phase V location (residential/commercial etc) and above 100 msf in New Gurgaon. Indeed these two locations are the company's biggest projects and hence it should then be a prime beneficiary of these rising asset

values.

Further down Gurgaon, in Sohna Road, completed rates in Unitech and competition projects are between RSs 6-7K psf and this rate used to be between Rs 3500-4000psf during 2009 (Nirvana Country I). Land rates here are near 10-12cr/acre (township land parcels).

New Gurgaon Current Residential Market Price is between Rs 3,500-6,000 psft

Sohna Road Current Residential Market Price s between Rs 5000-7000 psft

Residential volumes in the markets have been driven by infrastructure initiatives to improve the connectivity to Delhi and relatively affordable price points. Most project launches in these regions have met with good success and have seen sharp appreciation over the last 2 years. The demand at this point seems to be more investor driven and speculative. However, as commercial activity picks up in the region as envisaged in the master plan, end user demand should pick up in the medium term.

Overall sales activity in the city is much better than rest of the country. Inventory levels are reasonably sound. Gurgaon, however, is expected to witness large number of deliveries in 2012. This could potentially result in sales activity shifting to the secondary market from the primary market.

DLF has close to 40-45 msf in the Phase V location (residential/commercial etc) and above 100 msf in New Gurgaon. Indeed these two locations are the company's biggest projects and hence it should then be a prime beneficiary of these rising asset

values.

Further down Gurgaon, in Sohna Road, completed rates in Unitech and competition projects are between RSs 6-7K psf and this rate used to be between Rs 3500-4000psf during 2009 (Nirvana Country I). Land rates here are near 10-12cr/acre (township land parcels).

New Gurgaon Current Residential Market Price is between Rs 3,500-6,000 psft

Sohna Road Current Residential Market Price s between Rs 5000-7000 psft

Thursday, April 19, 2012

Rise of Gurgaon to Support New Delhi Part - I

Gurgaon has risen from being a small manufacturing suburb of Delhi to now a full fledged city of its own. Starting as an early auto manufacturing / IT center, the city now has most of the top corporates in North India with their head offices in Gurgaon as the city now has 3x the office space of entire Delhi city combined with a population that is a fraction of Delhi.

From being a suburb, the place has developed into a city in its own right. Despite the perceived “urban” mess the city does have a master plan to aid development till year 2025. Gurgaon has followed the classic Indian model of city development wherein the infrastructure problems are being sorted out after population has started to move in.

Key infrastructure Projects in Gurgaon are,

From being a suburb, the place has developed into a city in its own right. Despite the perceived “urban” mess the city does have a master plan to aid development till year 2025. Gurgaon has followed the classic Indian model of city development wherein the infrastructure problems are being sorted out after population has started to move in.

Key infrastructure Projects in Gurgaon are,

- Monorail development which will connect Cyber city developments of DLF with the existing metro thus reducing traffic congestion

- Road extension between Cybercity and DLF Golf course project in a JV between DLF and Government which should improve connectivity to DLF's phase V development

- Metro extension till New Gurgaon both from Dwarka and Gurgaon towards new Gurgaon office space (Northern Peripheral Road and Via Golf course extension).

- Southern Peripehery and Central periphery (4-6 lane roads) connecting Unitech's Sohna Road and Emaar's golf course extension land to the new upcoming office space in Sec 74 and 75 and Sector 88

- A 500MW power plant in the state should ease the electricity supply situation. Against the present electricity supply of 15-16 MM units daily, Gurgaon will get 20-22 MM units by the end of June 12

Saturday, March 17, 2012

TDS on Property Sale to Catch BlackMoney

The Government of India just a while ago introduced the new Finance Bill in the Parliament where it Orders all the authorities across India to deduct Income Tax at source for the following property transactions.

The Bill States As Follows,

194LAA. (1)Any person, being a transferee, responsible for paying (other than the person referred to in section 194LA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land), shall, at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to one per cent. of such sum as income-tax thereon.

(2) No deduction under sub-section (1) shall be made where consideration paid or payable for the transfer of an immovable property is less than fifty lakh rupees in case such immovable property is situated in a specified area, or is less than twenty lakh rupees in case such immovable property is situated in any area other than the specified area.

(3) Where the consideration paid or payable for the transfer of an immovable property is less than the value adopted or assessed or assessable by any authority of a State Government for the purpose of payment of stamp duty in respect of transfer of such immovable property, the value so adopted or assessed or assessable shall, for the purposes of sub-section (1) or sub-section (2), be deemed to be the consideration paid or payable for the transfer of such immovable property.

(4) Notwithstanding anything contained in any other law for the time being in force, where any document required to be registered under the provisions of clause (a) to clause (e) of sub-section (1) or sub-section (1A) of section 17 of the Indian Registration Act, 1908, purports to transfer, assign, limit or extinguish the right, title or interest of any person to or in any immovable property and in respect of which tax is required to be deducted under sub-section (1), no registering officer shall register any such document, unless the transferee furnishes the proof of deduction of income-tax in accordance with the provisions of this section and payment of sum so deducted to the credit of the Central Government in the prescribed form.

(5) The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.

Explanation. - For the purposes of this section,-

(a) “agricultural land” means agricultural land in India, not being land situated in any area referred to in items (a) and (b) of sub-clause (iii) of clause (14) of section 2;

(b) “immovable property” means any land (other than agricultural land) or any building or part of a building;

(c) “specified area” shall mean an area comprising-

(i) Greater Mumbai urban agglomeration;

(ii) Delhi urban agglomeration;

(iii) Kolkata urban agglomeration;

(iv) Chennai urban agglomeration

(v) Hyderabad urban agglomeration;

(vi) Bangaluru urban agglomeration;

(vii) Ahmedabad urban agglomeration;

(viii) District of Faridabad;

(ix) District of Gurgaon;

(x) District of Gautam Budh Nagar;

(xi) District of Ghaziabad;

(xii) District of Gandhinagar; and

(xiii) City of Secunderabad;

The Bill States As Follows,

194LAA. (1)Any person, being a transferee, responsible for paying (other than the person referred to in section 194LA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land), shall, at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to one per cent. of such sum as income-tax thereon.

(2) No deduction under sub-section (1) shall be made where consideration paid or payable for the transfer of an immovable property is less than fifty lakh rupees in case such immovable property is situated in a specified area, or is less than twenty lakh rupees in case such immovable property is situated in any area other than the specified area.

(3) Where the consideration paid or payable for the transfer of an immovable property is less than the value adopted or assessed or assessable by any authority of a State Government for the purpose of payment of stamp duty in respect of transfer of such immovable property, the value so adopted or assessed or assessable shall, for the purposes of sub-section (1) or sub-section (2), be deemed to be the consideration paid or payable for the transfer of such immovable property.

(4) Notwithstanding anything contained in any other law for the time being in force, where any document required to be registered under the provisions of clause (a) to clause (e) of sub-section (1) or sub-section (1A) of section 17 of the Indian Registration Act, 1908, purports to transfer, assign, limit or extinguish the right, title or interest of any person to or in any immovable property and in respect of which tax is required to be deducted under sub-section (1), no registering officer shall register any such document, unless the transferee furnishes the proof of deduction of income-tax in accordance with the provisions of this section and payment of sum so deducted to the credit of the Central Government in the prescribed form.

(5) The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.

Explanation. - For the purposes of this section,-

(a) “agricultural land” means agricultural land in India, not being land situated in any area referred to in items (a) and (b) of sub-clause (iii) of clause (14) of section 2;

(b) “immovable property” means any land (other than agricultural land) or any building or part of a building;

(c) “specified area” shall mean an area comprising-

(i) Greater Mumbai urban agglomeration;

(ii) Delhi urban agglomeration;

(iii) Kolkata urban agglomeration;

(iv) Chennai urban agglomeration

(v) Hyderabad urban agglomeration;

(vi) Bangaluru urban agglomeration;

(vii) Ahmedabad urban agglomeration;

(viii) District of Faridabad;

(ix) District of Gurgaon;

(x) District of Gautam Budh Nagar;

(xi) District of Ghaziabad;

(xii) District of Gandhinagar; and

(xiii) City of Secunderabad;

Thursday, March 15, 2012

Puravankara's Purva Seasons in Bengaluru

Puravankara Projects launches Purva Seasons in Bangalore.

Puravankara Projects, one of the leading real estate companies of the country, has launched Rs 700 crore, city centre super-luxury project Purva Seasons in Bengaluru. This property institutes the idea of 24+ hours Lifestyle.

With its inviting landscape and prime location, these 2 and 3 BHK apartments ranging from 1392 square feet to 1980 square feet are the epitome of luxury, comfort and convenience. The project development totals a 1.08 million square feet and has 660 units.

Purva Seasons with its well-planned and aesthetically designed apartments is undeniably an elite setting in the heart of the city. The project offers a state-of-the art building with world-class specifications. The amenities include a very large one of its kind clubhouse, swimming pool, outdoor sport facilities amongst others for a modern living, in a neighborhood that lets the homebuyer experience an enriching lifestyle.

Wait for the Pricing and Other Details.

Puravankara Projects, one of the leading real estate companies of the country, has launched Rs 700 crore, city centre super-luxury project Purva Seasons in Bengaluru. This property institutes the idea of 24+ hours Lifestyle.

With its inviting landscape and prime location, these 2 and 3 BHK apartments ranging from 1392 square feet to 1980 square feet are the epitome of luxury, comfort and convenience. The project development totals a 1.08 million square feet and has 660 units.

Purva Seasons with its well-planned and aesthetically designed apartments is undeniably an elite setting in the heart of the city. The project offers a state-of-the art building with world-class specifications. The amenities include a very large one of its kind clubhouse, swimming pool, outdoor sport facilities amongst others for a modern living, in a neighborhood that lets the homebuyer experience an enriching lifestyle.

Wait for the Pricing and Other Details.

Friday, March 09, 2012

Top 10 Builders of Bangalore

Friday, March 02, 2012

DLF Worth just 50% of its Vaulation - Veritas

DLF known for its controversial IPO where small investors were looted is facing irk from professional Investment Research firm based out of Canada and very well known for its unbiased and bold SELL Reports due to bad management practices.

Veritas does not believe in the the disclosed book equity and asset base of the Company. DLF via its dealings with DLF Assets Ltd, from FY07 to FY11, the Company inflated sales by at least INR 11,236 Cr and its profit before tax (PBT) by INR 7,233 Cr. DLF has undertaken questionable related party transactions to boost the value of DAL prior to its acquisition by DLF, thereby subverting the interest of minority shareholders via a higher purchase price for DAL.

Fake Promises of DLF Management:

JV with Hilton has ended and Silverlink Resorts is up for sale

build mega townships (exited Bidadi in Karnatka and Dankuni in West Bengal)

build a mega convention center in the NCR region (exited in 2009)

None of the above have materialized.

Veritas finally concludes the report with a best case valuation of DLF is worth INR 100/share - less than half its current stock price of INR 226.9.

Ministry of Corporate Affairs Orders Inquiry: The MCA has ordered an inquiry to Audit the Books of Accounts of DLF after it has received complaints from Investors.

Veritas does not believe in the the disclosed book equity and asset base of the Company. DLF via its dealings with DLF Assets Ltd, from FY07 to FY11, the Company inflated sales by at least INR 11,236 Cr and its profit before tax (PBT) by INR 7,233 Cr. DLF has undertaken questionable related party transactions to boost the value of DAL prior to its acquisition by DLF, thereby subverting the interest of minority shareholders via a higher purchase price for DAL.

Fake Promises of DLF Management:

JV with Hilton has ended and Silverlink Resorts is up for sale

build mega townships (exited Bidadi in Karnatka and Dankuni in West Bengal)

build a mega convention center in the NCR region (exited in 2009)

None of the above have materialized.

Veritas finally concludes the report with a best case valuation of DLF is worth INR 100/share - less than half its current stock price of INR 226.9.

Ministry of Corporate Affairs Orders Inquiry: The MCA has ordered an inquiry to Audit the Books of Accounts of DLF after it has received complaints from Investors.

Tuesday, February 28, 2012

Price List of Various Sobha Developers Projects

Here is Price List of Various Projects of Sobha Developers in Bangalore / Bengaluru, Chennai and Pune.

Price List of Sobha Developers Projects in Bangalore

Bangalore Sobha City - Phase II Near Hebbal flyover - 4500 / sft

Bangalore Sobha Pristine Belandur, ORR Residential apartments 4500 / sft

Bangalore Sobha City - Phase I Near Hebbal flyover Mixed-use residential 4500

Bangalore Sobha Signature Off Sarjapur Road Residential apartments 4500

Bangalore Sobha Forestview Kanakpura Road Residential apartments 4500

Bangalore Sobha Habitech Hopefarms, Whitefiled Residential apartment 4750

Bangalore Hosakerehalli Property Hosakerehalli, Mysore road Residential apartments 3500

Bangalore Sobha Tranquility Hosahalli, Kanakpura Road Residential apartments 3500

Bangalore Sobha Gladiola Thalaghattapura, Kanakpura Road Residential apartments 3500

Bangalore Dairy Circle Property Bannerghatta road Mixed use residentia 4000

Bangalore City Property Minerva Mills, Gopalapura Mixed-use residential 8000

Price List of Sobha Developers Projects in Chennai

Chennai Sobha Serene Seneerkuppam, Porur Residential apartments 4500

Chennai Sobha Meritta Pudupakkam Residential apartments 4500

Price List of Sobha Developers Projects in Pune

Pune Sobha Garnet NIBM Kondwa 3900

Pune Sobha Ivory NIBM, Kondhwa 3500

Pune Thergaon property Thergaon 3000

Price List of Sobha Developers Projects in Bangalore

Bangalore Sobha City - Phase II Near Hebbal flyover - 4500 / sft

Bangalore Sobha Pristine Belandur, ORR Residential apartments 4500 / sft

Bangalore Sobha City - Phase I Near Hebbal flyover Mixed-use residential 4500

Bangalore Sobha Signature Off Sarjapur Road Residential apartments 4500

Bangalore Sobha Forestview Kanakpura Road Residential apartments 4500

Bangalore Sobha Habitech Hopefarms, Whitefiled Residential apartment 4750

Bangalore Hosakerehalli Property Hosakerehalli, Mysore road Residential apartments 3500

Bangalore Sobha Tranquility Hosahalli, Kanakpura Road Residential apartments 3500

Bangalore Sobha Gladiola Thalaghattapura, Kanakpura Road Residential apartments 3500

Bangalore Dairy Circle Property Bannerghatta road Mixed use residentia 4000

Bangalore City Property Minerva Mills, Gopalapura Mixed-use residential 8000

Price List of Sobha Developers Projects in Chennai

Chennai Sobha Serene Seneerkuppam, Porur Residential apartments 4500

Chennai Sobha Meritta Pudupakkam Residential apartments 4500

Price List of Sobha Developers Projects in Pune

Pune Sobha Garnet NIBM Kondwa 3900

Pune Sobha Ivory NIBM, Kondhwa 3500

Pune Thergaon property Thergaon 3000

Monday, February 27, 2012

Bangalore Strong Commercial Today = Residential Tomorrow

Bengaluru absorbed 11.7 mn sq ft of commercial space in CY2011, 33% of the overall absorption of India’s top seven cities. Bengaluru outperformed as it is

an IT hub and IT/ITES absorbed 35% of the commercial space across the top seven Indian cities. Bengaluru is likely to add 22-23 mn sq. ft of commercial space over CY2012-14, implying demand will outpace supply, leading to lower vacancies and rising rentals.

Strong demand for commercial space augurs well for residential volumes in the coming years. In CY2011, Bengaluru created 0.12 mn (assuming 100 sq ft of space per person) future customers for residential space, who can potentially consume 70 mn sq ft (1,200 sq ft per person assuming 50% will buy) of residential space.

Residential sales have been steady in Bengaluru at 4mn sq ft/month in CY2011, which is 20% of total sales in India’s top seven cities.

an IT hub and IT/ITES absorbed 35% of the commercial space across the top seven Indian cities. Bengaluru is likely to add 22-23 mn sq. ft of commercial space over CY2012-14, implying demand will outpace supply, leading to lower vacancies and rising rentals.

Strong demand for commercial space augurs well for residential volumes in the coming years. In CY2011, Bengaluru created 0.12 mn (assuming 100 sq ft of space per person) future customers for residential space, who can potentially consume 70 mn sq ft (1,200 sq ft per person assuming 50% will buy) of residential space.

Residential sales have been steady in Bengaluru at 4mn sq ft/month in CY2011, which is 20% of total sales in India’s top seven cities.

Wednesday, February 15, 2012

Delhi NCR - 4 Year Property Price Trends

Tuesday, February 14, 2012

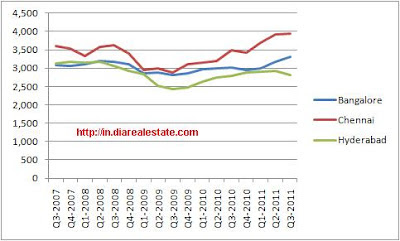

4 Years Property Price - Chennai Vs Bangalore Vs Hyderabad

Monday, February 13, 2012

Last 4 Years Bangalore Property Price Vs Sales - Analysis

We would like to share with our readers Home / Apartment Prices Vs Sales in Bangalore in the last 4 years 2007 to 2011. Doesn't include Luxury Apartments. The Average ones that are being sold for the Middle Class is the focus of our study.

In the Chart Below

Maroon Line - Average Property / Apartment Price / SFT LHS

Blue Line - Sales in Mn SFT / RHS

As evident from the Graph above, Bangaloreans / Bengalurueans made their Home Purchases in-line with the Rising Property Prices. Except in Q2/Q3 2009 when the property prices bottomed out, over 7.5 Mn SFT of apartments were absorbed and now when the prices have hit an all time High of Rs 3300 / SFT, Sales has also shot up. The herd mentality of Software Engineers ;-)

As evident from the Graph above, Bangaloreans / Bengalurueans made their Home Purchases in-line with the Rising Property Prices. Except in Q2/Q3 2009 when the property prices bottomed out, over 7.5 Mn SFT of apartments were absorbed and now when the prices have hit an all time High of Rs 3300 / SFT, Sales has also shot up. The herd mentality of Software Engineers ;-)

In the Chart Below

Maroon Line - Average Property / Apartment Price / SFT LHS

Blue Line - Sales in Mn SFT / RHS

As evident from the Graph above, Bangaloreans / Bengalurueans made their Home Purchases in-line with the Rising Property Prices. Except in Q2/Q3 2009 when the property prices bottomed out, over 7.5 Mn SFT of apartments were absorbed and now when the prices have hit an all time High of Rs 3300 / SFT, Sales has also shot up. The herd mentality of Software Engineers ;-)

As evident from the Graph above, Bangaloreans / Bengalurueans made their Home Purchases in-line with the Rising Property Prices. Except in Q2/Q3 2009 when the property prices bottomed out, over 7.5 Mn SFT of apartments were absorbed and now when the prices have hit an all time High of Rs 3300 / SFT, Sales has also shot up. The herd mentality of Software Engineers ;-)

Monday, January 23, 2012

Price correction eminent in Mumbai Property Market

Mumbai residential prices registered CAGR of 14.6% over the last 8 years. Anecdotal analysis shows CAGR growth of 9-10% over the last 2-3 decades. We believe the unprecedented growth in Mumbai prices is not sustainable and will undergo mean revision over the next 1-2 years.

Ears on the Ground and site-visits verified availability of discounts up to 5-7% depending on the project. Developers have launched promotions such as absorption of pre-EMI interest till delivery, floor rise waivers, partly furnished apartments to attract customers. Significant discounts are only available to those who are ready to make advance payments. We continue to believe developers will oblige with further discounts (15-25%) as volumes continue to dip in 1HCY12.

The new FSI rules have increased the developable area by 35%. For example – If the permissible FSI on a land parcel was 1.33 earlier, it will now be 1.8. Similarly FSI for Mumbai suburbs capped at 2.0 will now translate to developable area using FSI of 2.0 X 1.35 = 2.7. This is good news for developers and buyers as well.

Ears on the Ground and site-visits verified availability of discounts up to 5-7% depending on the project. Developers have launched promotions such as absorption of pre-EMI interest till delivery, floor rise waivers, partly furnished apartments to attract customers. Significant discounts are only available to those who are ready to make advance payments. We continue to believe developers will oblige with further discounts (15-25%) as volumes continue to dip in 1HCY12.

The new FSI rules have increased the developable area by 35%. For example – If the permissible FSI on a land parcel was 1.33 earlier, it will now be 1.8. Similarly FSI for Mumbai suburbs capped at 2.0 will now translate to developable area using FSI of 2.0 X 1.35 = 2.7. This is good news for developers and buyers as well.

Sunday, January 15, 2012

Historical Housing Loan Accounts Data

Subscribe to:

Posts (Atom)