Property prices in Ahmedabad are all set to rise in 2007 with an inflow of more than $3 Billion into Ahmedabad Real Estate.

Property prices in Ahmedabad are all set to rise in 2007 with an inflow of more than $3 Billion into Ahmedabad Real Estate.Ahmedabad has witnessed some major infrastructure spending from the state government. The Ahmedbad Urban Development Authority has spent Rs 2,000 crores on city development. Another Rs 3,200 crores will be spent in developing the city, funded by National Urban Renewal Mission.

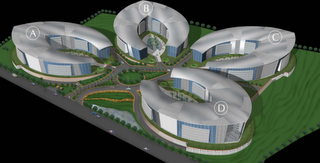

Land Shark, DLF which looted small investors is building a supermall in GandhiNagar near Ahmedabad. DLF is also looking for lands on the banks of river Sabarmati. 2000 more hotel rooms will eb added in the city in 2007.

The Vibrant Gujarat conference has also attracted some big IT / ITeS investments into Ahmedabad. Our survey shows that land prices on CG Road have shot up from Rs 35,000 / square yeard to Rs 50,000 per square yard in a year. Also non-resident Gujarathis are building their second home in Ahmedabad.