Spate of new launches in the last 2-3 months, well spread over the city landscape.

Based on the market feedback, we understand that the volume off take was quick at the lower end of these price bands and slow at the upper end. Primary sale prices have risen rapidly (10-20%) over the last 2-3 months, around 15% shy of end 2007 peak levels.

Story will be different this time around, and unlike the previous bull market (prices went up 3-5x) prices will rise gradually. Residential rentals, though up from the bottom, are still at 25-30% below the end 2007 peak level (due to new supply), we believe. Further, Real Estate across the World suggests that rentals are a better reflection of the underlying demand, which will ramp slowly in view of significant supply.

On all India basis, we continue to believe that F10 will be the year of volume recovery, leading to 10% price increase in F11.

Tuesday, December 29, 2009

Friday, December 11, 2009

Mumbai + Delhi Hottest Investment Destinations

According to a survey just published by Colliers Investment, Mumbai and Delhi are the hottest destinations. Here is a complete result of the survey

[City - Preference of Respondents, Upcoming Supply, %of Supply as Affordable homes, Price Trend]

[City - Preference of Respondents, Upcoming Supply, %of Supply as Affordable homes, Price Trend]

- Mumbai - 75%, 56K Units, 8% affordable, Mild Upswing

- Delhi - 53%, 3.3K units, 2% affordable, Still near the trough

- Bangalore - 52%, 45K units, 2% affordable, prices at trough

- Pune - 42%, 22.5K, 45% affordable, prices at trough

- Chennai - 40%, 44K units, 33% affordable and prices at trough

- Hyderabad - 30%, 28K units, 7% affordable, prices at trough

- Kolkata least favored state due to political parties which have hampered growth - 17%, 8.8 units, 45% affordable, prices just off the trough

Wednesday, December 09, 2009

Model Act + Regulations - Potential Problems

We studied the proposed Model Real Estate Act and here are some potential problems.

Prohibits development of land into a colony or construction of apartments for marketing without registration.

This will prove tough on small developers given its inflationary impact on project cost. The key concern here is whether licencing would occur at the Centre or State level licencing at the Centre level could prove detrimental.

Mandatory registration by a regulatory authority prior to each project launch; 36-month licence period; bank guarantee from developers

These steps would safeguard the consumer from false developer claims regarding carpet area, built-up area and flat development plan, as developers would be required to proffer these details to the registration authority prior to launch. Prices, however, may increase due to the bank guarantee clause.

Disallows the issue of advertisements or prospectuses inviting advances or deposits

This could have a negative impact on end consumers since the absence of advertisements would leave buyers in the dark about upcoming projects.

No deposit or advances to be taken by promoters without first entering into an agreement of sale

This will prevent any discrepancies in the sale agreement, thereby protecting the interests of end users. It will also discourage investor-buyers from entering into the market and fuelling price speculation.

The Big Question - How efficient this Regulator will be ? All Developers are Politicians or First / il-legal Blood of Politicians and hence the regulator won't be in a spot to pass orders like SEBI or RBI does.

Prohibits development of land into a colony or construction of apartments for marketing without registration.

This will prove tough on small developers given its inflationary impact on project cost. The key concern here is whether licencing would occur at the Centre or State level licencing at the Centre level could prove detrimental.

Mandatory registration by a regulatory authority prior to each project launch; 36-month licence period; bank guarantee from developers

These steps would safeguard the consumer from false developer claims regarding carpet area, built-up area and flat development plan, as developers would be required to proffer these details to the registration authority prior to launch. Prices, however, may increase due to the bank guarantee clause.

Disallows the issue of advertisements or prospectuses inviting advances or deposits

This could have a negative impact on end consumers since the absence of advertisements would leave buyers in the dark about upcoming projects.

No deposit or advances to be taken by promoters without first entering into an agreement of sale

This will prevent any discrepancies in the sale agreement, thereby protecting the interests of end users. It will also discourage investor-buyers from entering into the market and fuelling price speculation.

The Big Question - How efficient this Regulator will be ? All Developers are Politicians or First / il-legal Blood of Politicians and hence the regulator won't be in a spot to pass orders like SEBI or RBI does.

Tuesday, December 08, 2009

Inventory of Residential Apartments

PropEquity has done an excellent job of taking stock of the residential apartment inventory across various cities in India [Mumbai, Gurgaon, Noida, Thane, Bangalore, Kolkata, Hyderabad and Pune] for projects priced around INR 3 mn. Here is the latest availability chart. [Expandable]

Volume recovery in the residential segment has primarily been driven by improved affordability on the back of aggressive price cuts and reduction in mortgage rate.

Volume recovery in the residential segment has primarily been driven by improved affordability on the back of aggressive price cuts and reduction in mortgage rate.

Sunday, December 06, 2009

Affordable housing - Gripped by Fear of Excess

PropEquity research data highlights that developers who had hurried into this segment, to improve their cash flows at a time when high-end residential segment was suffering, are sitting with >40% unsold stock. Of ~0.1mn units that were launched between Nov08-Oct09, only 57% found buyers.

The real problem is Market has not improved fully and Developers have to tone down their expectations.

Already seems to be a crowded space; we believe this segment will always remain price sensitive and any steep price hikes will kill absorption, especially as competition is stepping up.As many as 11 realty companies have filed their DRHPs with SEBI (of which three have filed in the last week) looking to garner ~Rs 190bn (US$4.1bn) from the primary markets.

The real problem is Market has not improved fully and Developers have to tone down their expectations.

Monday, November 30, 2009

Mumbai Apartment Registration Rise

Mumbai's apartment registrations data reveals that demand remains strong despite 5-30% rise in prices in the past five months. Thus, while prices in many pockets in the city are new highs, registrations in October 2009 were the highest in almost two years. he data suggests that the increase in prices has failed to make a dent in residential demand in the city.

Also, the Reserve Bank of India (RBI) increased risk weightage on commercial real estate lending by 100bps, which is likely to result in a 50-100bps increase in borrowing costs. Mortgage rates could also come under pressure owing to inflation-related concerns. Headwinds of higher prices and mortgage rates are likely to weigh on real estate demand in medium term.

Also, the Reserve Bank of India (RBI) increased risk weightage on commercial real estate lending by 100bps, which is likely to result in a 50-100bps increase in borrowing costs. Mortgage rates could also come under pressure owing to inflation-related concerns. Headwinds of higher prices and mortgage rates are likely to weigh on real estate demand in medium term.

Tuesday, November 24, 2009

Corruption + Bubble - Allowing FDI Without Lock-In

The government may do away with the lock-in period for foreign direct investment (FDI) in the real estate sector that was imposed earlier in wake of worldwide realty rally and concerns of asset price bubble formation. The Department of Industrial Policy and Promotion (DIPP) has proposed the scrapping of the three-year lock-in for FDI in realty. The DIPP has already drafted a cabinet note on the matter which has been circulated to the Cabinet Committee on Economic Affairs (CCEA).

The lock-in period was a cautionary move as real estate, as a space, is generally more prone to speculative trading. The government, therefore, introduced a lock-in for foreign investment after it liberalized FDI in realty in 2005. The restrictions were also supposed to act as an inbuilt buffer in case of a global real estate crash as it would prevent sudden flight of capital. Well we want Foreign Money for Long Term Investments says Finance Minister, then why are you now removing the Lock-in ?

The move, however, would be counter to the intuition of the Reserve Bank of India which had in the latest quarterly review of its monetary policy raised the provisioning on loans meant for the commercial real estate sector to 1% from 0.40% citing potential of an asset price bubble formation. We wish Dr. Reddy was still the Governor of RBI, however, his strict and principled approach likely irked the then FM and was unfortunately shown the door.

I really hate to see this withdrawal happen under Dr. Manmohan Singh, but it is happening. Looting the Hardworking Indian Middle Class and transferring money to Foreign Investors.

The lock-in period was a cautionary move as real estate, as a space, is generally more prone to speculative trading. The government, therefore, introduced a lock-in for foreign investment after it liberalized FDI in realty in 2005. The restrictions were also supposed to act as an inbuilt buffer in case of a global real estate crash as it would prevent sudden flight of capital. Well we want Foreign Money for Long Term Investments says Finance Minister, then why are you now removing the Lock-in ?

The move, however, would be counter to the intuition of the Reserve Bank of India which had in the latest quarterly review of its monetary policy raised the provisioning on loans meant for the commercial real estate sector to 1% from 0.40% citing potential of an asset price bubble formation. We wish Dr. Reddy was still the Governor of RBI, however, his strict and principled approach likely irked the then FM and was unfortunately shown the door.

I really hate to see this withdrawal happen under Dr. Manmohan Singh, but it is happening. Looting the Hardworking Indian Middle Class and transferring money to Foreign Investors.

Friday, November 06, 2009

DLF - Slowdown in execution & sales

DLF expects a slowdown in the launch of luxury homes in the next 2-3 quarters. Though the mid-income housing business showed sales of c.2.74 msf, higher than 1Q FY09 (c.2.09 msf), they are not robust in comparison to the last quarter of FY08 (c.7.72 msf). A decline in sales coupled with execution delays show signs of a worsening situation. The company indicated significant slowdown in hospitality launches mainly due to funding issues.

DLF plans to focus on the ongoing projects and capital conservation rather than taking on additional risk. The company indicated that it is not driven on buying additional land and would respond to any deals with great caution.

DLF plans to focus on the ongoing projects and capital conservation rather than taking on additional risk. The company indicated that it is not driven on buying additional land and would respond to any deals with great caution.

Monday, October 26, 2009

Ground Reality - Moderate Sales + New Launch Absorption Down

All India monthly residential sales volumes has moderated from an aggregate 19,700 units/month sold in March-May to 16,100 units in June-August across the markets we track. Residential new launch absorption has fallen from between 40%-60% in April-June to about 20%-25% in Jul-Aug.

The inventory of unsold homes in the Rs0.5-Rs3.0 mn/unit range has been increasing through CY2009. Cumulative absorption is encouraging in pockets of NCR but below 40% in some markets like Chennai and Bangalore.

Take-up across the six major markets of Mumbai, Gurgaon, Bangalore, Hyderabad, Chennai and Kolkata in August 2009 was about 70% lower vs. August 2008. However, the trajectory in Mumbai and Bangalore has improved a bit since March.

Property investors have been quite active over the past six months in Chennai and NCR with regard to take-up of new launches, however their is no significant pick-up in volume.

The inventory of unsold homes in the Rs0.5-Rs3.0 mn/unit range has been increasing through CY2009. Cumulative absorption is encouraging in pockets of NCR but below 40% in some markets like Chennai and Bangalore.

Take-up across the six major markets of Mumbai, Gurgaon, Bangalore, Hyderabad, Chennai and Kolkata in August 2009 was about 70% lower vs. August 2008. However, the trajectory in Mumbai and Bangalore has improved a bit since March.

Property investors have been quite active over the past six months in Chennai and NCR with regard to take-up of new launches, however their is no significant pick-up in volume.

Saturday, October 10, 2009

Noida - Residential Project Prices

Noida has witnessed fair amount of new project launches in 2009 from Jaypee, Unitech, Divine India Infrastructure, 3C Group, Amrapali Group etc. Here is the latest update our Analyst from Delhi NCR is filing on the SELLING price of these projects. [Click on IMAGE to Enlarge]

Do let us know your DEALING experience in the above projects as this will help otehr prospective BUYERS.

Do let us know your DEALING experience in the above projects as this will help otehr prospective BUYERS.

Do let us know your DEALING experience in the above projects as this will help otehr prospective BUYERS.

Do let us know your DEALING experience in the above projects as this will help otehr prospective BUYERS.

Friday, October 09, 2009

Gurgaon - New project Launch Prices

Our analyst has done an excellent job touching base with most property developers like - Falcon Builders, M2K, Rahejas, Emmar MGF, Pareena Infrastructure, Pal Infrastructure, Unitech, Vatika, Millenium Spire, Pioneer Urban land, etc in Gurgaon and here is how new Residential projects have been launched in the past 6 months and their SELLING prices / sft for the convenience of all the readers is tabulated as below. [Click to Enlarge] Kindly share your experience in BUYING or DEALING with any of the above property developers so that it will help other readers.

Kindly share your experience in BUYING or DEALING with any of the above property developers so that it will help other readers.

Kindly share your experience in BUYING or DEALING with any of the above property developers so that it will help other readers.

Kindly share your experience in BUYING or DEALING with any of the above property developers so that it will help other readers.

Wednesday, October 07, 2009

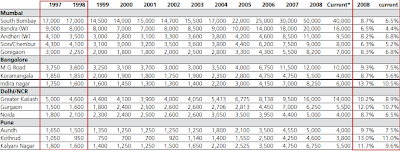

Historical Mumbai Property Prices 1993 to 2009

Residential demand is a function of affordability, direction of selling prices and consumer confidence. As prices and interest rates dropped, we saw affordability improving. If prices remain at current levels, affordability will rise only with an increase in household income as further interest rate reduction is unlikely. But on the contrary, if interest rates start moving up then affordability will start emerging as a big concern again.

The following Chart Shows Historical Property Prices in Mumbai between 1993-2009 at Bhandup Mulund Ghatkopar Goregaon Chembur Powai Andheri (W) Bandra (W) Worli and South Bombay.

The following Chart Shows Historical Property Prices in Mumbai between 1993-2009 at Bhandup Mulund Ghatkopar Goregaon Chembur Powai Andheri (W) Bandra (W) Worli and South Bombay.

Tuesday, October 06, 2009

Government Bill on model real estate

The Union housing and urban poverty alleviation ministry is expected to come out with a bill aimed at taming the demand supply mismatch in housing consumption in big cities. The ministry has invited expert and public opinion for the proposed legislation.

The ministry has already held preliminary discussions with various stakeholders. The government has initiated the process of shaping a model Real Estate (Regulation of Development) Act in this wake. The ministry has targeted to promote planned and healthy real estate development of colonies and apartments, keeping protection of consumer interest in view. The proposed bill is expected to facilitate smooth and speedy urban construction.

More efforts would be taken to encourage institutionalised financing and formal channels of credit. Developing countries are facing increasing effects of climate change, resource depletion, food insecurity, population growth and economic instability.

The ministry has already held preliminary discussions with various stakeholders. The government has initiated the process of shaping a model Real Estate (Regulation of Development) Act in this wake. The ministry has targeted to promote planned and healthy real estate development of colonies and apartments, keeping protection of consumer interest in view. The proposed bill is expected to facilitate smooth and speedy urban construction.

More efforts would be taken to encourage institutionalised financing and formal channels of credit. Developing countries are facing increasing effects of climate change, resource depletion, food insecurity, population growth and economic instability.

Monday, October 05, 2009

Prices in Mumbai Western + Central Suburbs Rise

We attended a property exhibition organised by MCHI, with participation by 75 developers and a number of housing finance companies.

Most developers have raised prices in the past four months, and prices are back to their lifetime highs. Many visitors, however, indicated that prices had shot up beyond their affordability.

Developers too displayed a sense of uncertainty, primarily showcasing their existing projects and going slow on new launches.

Western Suburbs Residential Realty Prices:

All prices have risen and the percentage rise is provided.

Oberoi Oberoi Springs Andheri 20,765 19,000 9% [20,765 is the current price]

Oberoi Oberoi Splendor Andheri 11,860 10,200 16%

Mantri Mantri Park Goregaon 5,999 5,590 7%

Rustomjee Elanza Malad 9,500 9,000 6%

Ackruti Gardenia Mira Road 3,350 2,950 14%

prices in Central suburbs are up 5-25%

Lodha Imperia Bhandup 6,500 6,300 3% [6500 is current price]

Kalpataru Aura Ghatkopar 7,000 6,700 4%

Runwal Pride Mulund 8,000 7,000 14%

Runwal Anthrium Mulund 6,600 6,100 8%

Gundecha Zenith Mulund 5,991 5,300 13%

Hiranandani Estates Thane 5,350 5,032 6%

Hiranandani Meadows Thane 5,450 5,200 5%

Runwal Pearl Thane 4,500 3,700 22%

Most developers have raised prices in the past four months, and prices are back to their lifetime highs. Many visitors, however, indicated that prices had shot up beyond their affordability.

Developers too displayed a sense of uncertainty, primarily showcasing their existing projects and going slow on new launches.

Western Suburbs Residential Realty Prices:

All prices have risen and the percentage rise is provided.

Oberoi Oberoi Springs Andheri 20,765 19,000 9% [20,765 is the current price]

Oberoi Oberoi Splendor Andheri 11,860 10,200 16%

Mantri Mantri Park Goregaon 5,999 5,590 7%

Rustomjee Elanza Malad 9,500 9,000 6%

Ackruti Gardenia Mira Road 3,350 2,950 14%

prices in Central suburbs are up 5-25%

Lodha Imperia Bhandup 6,500 6,300 3% [6500 is current price]

Kalpataru Aura Ghatkopar 7,000 6,700 4%

Runwal Pride Mulund 8,000 7,000 14%

Runwal Anthrium Mulund 6,600 6,100 8%

Gundecha Zenith Mulund 5,991 5,300 13%

Hiranandani Estates Thane 5,350 5,032 6%

Hiranandani Meadows Thane 5,450 5,200 5%

Runwal Pearl Thane 4,500 3,700 22%

Thursday, October 01, 2009

Unitech Homes - No Constrcution Activity

BNP Paribas analysts visited the sites of newly launched Unitech Homes projects and were shocked to find that the company has not launched any Construction Activity. Here is an excerpt from the report of various projects of Unitech Ltd.

Uniworld Gardens II Residential - Apartments Gurgaon Fully Sold Mar-09 No construction activity

The Villas Individual Bunglows Gurgaon na Aug - Sep 09 No construction activity

The Residences Residential - Apartments Gurgaon Fully Sold May-09 No construction activity

Sunbreeze Residential - Apartments Gurgaon Fully Sold Aug - sep 09 No construction activity

Unitech Vistas Residential - Apartments Kolkata 20-25% sold Jul-09 Preliminary construction activity

Gateway Phase 2 Residential - Apartments Kolkata 5 - 10% sold Aug-09 No construction activity

Unihomes Residential - Apartments Kolkata 0-5% sold Aug-09 No construction activity

Unihomes Residential - Apartments Noida 80% sold Jul-09 No construction activity

Uniworld Gardens Residential - Apartments Noida more than 70% sold Jul-09 No construction activity

Willows @ Grande Residential - plots Noida 40% sold Jul-09 Preliminary construction activity

Unihomes Plots Residential - plots Greater Noida Fully Sold Jul - Aug 09 No construction activity

Unihomes Residential - Apartments Greatern Noida ~ 5% sold Sep-09 No construction activity

Unihomes Residential - Apartments Chennai 300 units sold Aug-09 No construction activity

Ananda Residential - Apartments Chennai Fully Sold May-09 No construction activity

Brahma Residential - Apartments Chennai Fully Sold May-09 No construction activity

With Real Estate Regulator coming into force, Unitech will have a tough time if it continues such practices.

Uniworld Gardens II Residential - Apartments Gurgaon Fully Sold Mar-09 No construction activity

The Villas Individual Bunglows Gurgaon na Aug - Sep 09 No construction activity

The Residences Residential - Apartments Gurgaon Fully Sold May-09 No construction activity

Sunbreeze Residential - Apartments Gurgaon Fully Sold Aug - sep 09 No construction activity

Unitech Vistas Residential - Apartments Kolkata 20-25% sold Jul-09 Preliminary construction activity

Gateway Phase 2 Residential - Apartments Kolkata 5 - 10% sold Aug-09 No construction activity

Unihomes Residential - Apartments Kolkata 0-5% sold Aug-09 No construction activity

Unihomes Residential - Apartments Noida 80% sold Jul-09 No construction activity

Uniworld Gardens Residential - Apartments Noida more than 70% sold Jul-09 No construction activity

Willows @ Grande Residential - plots Noida 40% sold Jul-09 Preliminary construction activity

Unihomes Plots Residential - plots Greater Noida Fully Sold Jul - Aug 09 No construction activity

Unihomes Residential - Apartments Greatern Noida ~ 5% sold Sep-09 No construction activity

Unihomes Residential - Apartments Chennai 300 units sold Aug-09 No construction activity

Ananda Residential - Apartments Chennai Fully Sold May-09 No construction activity

Brahma Residential - Apartments Chennai Fully Sold May-09 No construction activity

With Real Estate Regulator coming into force, Unitech will have a tough time if it continues such practices.

Saturday, September 19, 2009

Ahmedabad + Indore + Bhopal - Reviews

The following projects meet our guidelines for recommendation and are also affordable :-)

Ahmedabad:

Bakeri Sanatan Residency Vejalpur 1,900

Bakeri Sulay Deluxe Row Houses Vejalpur 2,450

Indore:

DLF Garden city near bypass 1,850

Emaar Indore Greens (Plots) near Airport 800

Ansal Ansal Town near Agra Mumbai Rd 1,500

Bhopal:

Unitech Unihomes Kolar Road 1,360

Bhubaneshwar:

Vipul Vipul Gardens Kalinga Nagar 2,250

Ahmedabad:

Bakeri Sanatan Residency Vejalpur 1,900

Bakeri Sulay Deluxe Row Houses Vejalpur 2,450

Indore:

DLF Garden city near bypass 1,850

Emaar Indore Greens (Plots) near Airport 800

Ansal Ansal Town near Agra Mumbai Rd 1,500

Bhopal:

Unitech Unihomes Kolar Road 1,360

Bhubaneshwar:

Vipul Vipul Gardens Kalinga Nagar 2,250

Bangalore + Chennai - Housing Reviews

Here are the latest Housing Projects that are available in Bangalore and Chennai for Home buyers. All prices are in INR / sft as quoted by the Developer directly.

DLF New Town Bangalore, BTM Ext. 2,100

Puravankara Purva Venezia Bangalore, Yehalanka 2,800

Puravankara Provident Welworth City Bangalore, Yehalanka 1,800

DLF Garden City Chennai, OMR 2,550

Puravankara Purva Swan Lake Chennai, OMR 2,590

Puravankara Provident Cosmo City Chennai, Near Siruseri IT Park 1,940

Sobha Sunscape Bangalore, Off Kanakpura Rd 1,978 - 2,128

Sobha Sunbeam I & II Bangalore, Off Kanakpura Rd 2,254

Unitech Ananda - North Town Chennai, Perambur 3,100

Unitech Brahma - North Town Chennai, Perambur 3,100

Unitech Unihomes Chennai, Nallambakkam, OMR 1,845

Kindly negotiate and try to get a Deal. Reviews on Indian Real Estate can be logged on here.

DLF New Town Bangalore, BTM Ext. 2,100

Puravankara Purva Venezia Bangalore, Yehalanka 2,800

Puravankara Provident Welworth City Bangalore, Yehalanka 1,800

DLF Garden City Chennai, OMR 2,550

Puravankara Purva Swan Lake Chennai, OMR 2,590

Puravankara Provident Cosmo City Chennai, Near Siruseri IT Park 1,940

Sobha Sunscape Bangalore, Off Kanakpura Rd 1,978 - 2,128

Sobha Sunbeam I & II Bangalore, Off Kanakpura Rd 2,254

Unitech Ananda - North Town Chennai, Perambur 3,100

Unitech Brahma - North Town Chennai, Perambur 3,100

Unitech Unihomes Chennai, Nallambakkam, OMR 1,845

Kindly negotiate and try to get a Deal. Reviews on Indian Real Estate can be logged on here.

Friday, September 18, 2009

Kochi Housing Review

Kochi Housing Market has gained lot of visibility from all the leading developers of India. In our research, we have gathered the prices for various projects quoted directly by the Developer to us. Kindly negotiate for your Deal.

DLF New Town Heights Kakkanad INR 2,500

Puravanakara Moonreach Kakkanad INR 3,090

Puravanakara Eternity Kakkanad INR 2,290

Puravanakara Grandbay Marine Drive INR 4,590

DLF New Town Heights Kakkanad INR 2,500

Puravanakara Moonreach Kakkanad INR 3,090

Puravanakara Eternity Kakkanad INR 2,290

Puravanakara Grandbay Marine Drive INR 4,590

Thursday, September 17, 2009

Hot Housing Projects in Pune

Well they are sort of a affordable housing projects, though we wouldn't classify them as Purely Affordable which enjoy incentives from the Govrnment of India on various Loan products.

All prices in INR / sft, unless otherwise specifically mentioned

Kumar Builders 45 Nirvana Hills Paud Phata, Karve Road INR 4,900 for a bare shell unit is 4,500 psf

Kumar Builders Kubera Sankul Hadapsar INR 2,750

Kumar Builders Sublime Kondwa INR 3,225

K Raheja Vistas Kondwa INR 3,000

Sobha Sobha Carnation Kondwa INR 3,555

Mahindra Lifespace Royale Pimpri INR 2950-3050

Magarpatta Trillium Magarpatta City INR 3,250

Magarpatta Sylvania Magarpatta City INR 3,250

Magarpatta Laburnum Park Magarpatta City INR 4,000

Sobha Sobha Carnation Pune, Kondwa INR 3,555

All prices in INR / sft, unless otherwise specifically mentioned

Kumar Builders 45 Nirvana Hills Paud Phata, Karve Road INR 4,900 for a bare shell unit is 4,500 psf

Kumar Builders Kubera Sankul Hadapsar INR 2,750

Kumar Builders Sublime Kondwa INR 3,225

K Raheja Vistas Kondwa INR 3,000

Sobha Sobha Carnation Kondwa INR 3,555

Mahindra Lifespace Royale Pimpri INR 2950-3050

Magarpatta Trillium Magarpatta City INR 3,250

Magarpatta Sylvania Magarpatta City INR 3,250

Magarpatta Laburnum Park Magarpatta City INR 4,000

Sobha Sobha Carnation Pune, Kondwa INR 3,555

Tuesday, September 15, 2009

Key projcts in Chandigarh - Mohali

Larger players are gradually expanding to new city markets (Tier II/III) to strengthen their pan-India positioning. Here are the key projects in Chandigarh - Mohali region worth looking at.

All prices in INR / sft

Unitech Unihomes Sector 107 INR 2000-2400

Unitech Executive Floors Sector 97 INR 2500-3000

Emaar Terraces Sector 108 INR 2400-3000

Emaar Bungalows Sector 108-109 6.6 mln for For G+2 units with GF built-up area of 1700sf and roof right for 1st and 2nd floors

Ansal Club Class Floors Sector 114 INR 2000-2300

Do let us know your views as this will help other readers make their choice for their dream home.

All prices in INR / sft

Unitech Unihomes Sector 107 INR 2000-2400

Unitech Executive Floors Sector 97 INR 2500-3000

Emaar Terraces Sector 108 INR 2400-3000

Emaar Bungalows Sector 108-109 6.6 mln for For G+2 units with GF built-up area of 1700sf and roof right for 1st and 2nd floors

Ansal Club Class Floors Sector 114 INR 2000-2300

Do let us know your views as this will help other readers make their choice for their dream home.

Monday, September 14, 2009

12 Months - Fall and Rise

Here is what happened in the past 12 months in the Indian Real Estate Space.

Bad to Worse Market Conditions 20-Oct-08

First Official Price Cut in the Sector 23-Nov-08

Price Softening Becomes More Widespread 7-Dec-08

Price Cuts Accelerating, Land Bank Contraction Begins 19-Feb-09

Price Cut Party Getting Bigger; New Launch Pickup 6-Mar-09

Lo-Behold, Oversupply Coming In Mumbai, Gurgaon 8-Apr-09

Price Correction Sets In Central Mumbai, Volumes Modest 10-May-09

Vol Trends In New Launch Surge 15-Jun-09

Commercial/Retail Demand Remains Subdued 2-Jul-09

Mumbai And NCR Update Plus Contours of Recovery 5-Aug-09

Price Cuts Barely Lifting Volumes in Metros (BCHK) 27-Aug-09

Tier II/III Cities: New Launch Pickup but Modest Volumes 16-Sep-09

The study takes into account real estate market in 7-8 key Tier II/III cities including Pune, Chandigarh, Kochi, Indore, and Bhubaneshwar.

Bad to Worse Market Conditions 20-Oct-08

First Official Price Cut in the Sector 23-Nov-08

Price Softening Becomes More Widespread 7-Dec-08

Price Cuts Accelerating, Land Bank Contraction Begins 19-Feb-09

Price Cut Party Getting Bigger; New Launch Pickup 6-Mar-09

Lo-Behold, Oversupply Coming In Mumbai, Gurgaon 8-Apr-09

Price Correction Sets In Central Mumbai, Volumes Modest 10-May-09

Vol Trends In New Launch Surge 15-Jun-09

Commercial/Retail Demand Remains Subdued 2-Jul-09

Mumbai And NCR Update Plus Contours of Recovery 5-Aug-09

Price Cuts Barely Lifting Volumes in Metros (BCHK) 27-Aug-09

Tier II/III Cities: New Launch Pickup but Modest Volumes 16-Sep-09

The study takes into account real estate market in 7-8 key Tier II/III cities including Pune, Chandigarh, Kochi, Indore, and Bhubaneshwar.

Thursday, September 10, 2009

Omaxe into a MoU with Bulandshahar Development Authority

Omaxe’s subsidiary Rivaj Infratech – a private limited company – has entered into a Memorandum of Understanding with Bulandshahar Development Authority for the development of a Hi-Tech Township in Bulandshahar, Uttar Pradesh.

The Hi-Tech Township will be built on land area of 3601.19 acres.

The proposed Hi-Tech Township is well connected to Delhi, located in the NCR Region adjoining Greater Noida adjacent to proposed Eastern Peripheral Expressway and North-East Railway Freight Corridor.

The revenue out of this project is estimated over Rs 7,500 crore and will be executed in phases over a period of five to seven years.

The Hi-Tech Township will be built on land area of 3601.19 acres.

The proposed Hi-Tech Township is well connected to Delhi, located in the NCR Region adjoining Greater Noida adjacent to proposed Eastern Peripheral Expressway and North-East Railway Freight Corridor.

The revenue out of this project is estimated over Rs 7,500 crore and will be executed in phases over a period of five to seven years.

Tuesday, September 08, 2009

Land registration + approvals - Reforms

Real estate developers in India spend on average 1.5-2 years in obtaining all necessary approvals. In contrast, developers in Thailand and Malaysia receive all their approvals in 6 and 9 months respectively. Thus, by the time a developer in Thailand obtains all the relevant permits/approvals, its Indian counterpart would still be awaiting its building plan approval. An Indian developer interacts with more than 30 agencies to receive the required (50-70) approvals.

A developer in India needs 12-18 months from the time it commences work on a new launch to open the project for bookings. If the approval process is rationalized, many more projects could get approved within that time frame, increasing supply manifold, leading to a drop in real estate prices. The labyrinthine approval process ensures that supply lags demand during up-cycles, keeping prices elevated.

A developer needs to finance land cost for 18-24 months before it can launch the project. This financing cost is passed on to the consumer. Developers take longer to bring in enough supply in the up-cycle and cannot cut back supply quickly in a down-cycle. This leads to sharp run-ups in prices during up-cycles, followed by sharp falls during down-cycles. Forecasting quarterly revenues is also tricky, as revenue recognition from pre-sold projects could get delayed for want of approvals.

A developer in India needs 12-18 months from the time it commences work on a new launch to open the project for bookings. If the approval process is rationalized, many more projects could get approved within that time frame, increasing supply manifold, leading to a drop in real estate prices. The labyrinthine approval process ensures that supply lags demand during up-cycles, keeping prices elevated.

A developer needs to finance land cost for 18-24 months before it can launch the project. This financing cost is passed on to the consumer. Developers take longer to bring in enough supply in the up-cycle and cannot cut back supply quickly in a down-cycle. This leads to sharp run-ups in prices during up-cycles, followed by sharp falls during down-cycles. Forecasting quarterly revenues is also tricky, as revenue recognition from pre-sold projects could get delayed for want of approvals.

Monday, August 31, 2009

Parsvnath Developers - Rohtak Township receives LoI

Realty major Parsvnath Developers has received the Letter of Intent (LoI) for grant of licence from director, Town and Country Planning, Chandigarh in Haryana for developing approximately 118 acres of integrated township in Sector 33 A, Rohtak, Haryana.

The project, with a realization value of around Rs 700 crore, will have approximately 4 million square feet (sq ft) of saleable area and would comprise plots, affordable homes, row houses, independent villas shopping, commercial along with school, dispensary, etc, as mentioned in its filing with the BSE.

The company has already acquired 118 acres land and intends to start the development, construction and marketing activities soon after receiving all the approvals and completing all necessary formalities of obtaining the licence.

This will be the first residential offering by the realty major in Rohtak.

The project, with a realization value of around Rs 700 crore, will have approximately 4 million square feet (sq ft) of saleable area and would comprise plots, affordable homes, row houses, independent villas shopping, commercial along with school, dispensary, etc, as mentioned in its filing with the BSE.

The company has already acquired 118 acres land and intends to start the development, construction and marketing activities soon after receiving all the approvals and completing all necessary formalities of obtaining the licence.

This will be the first residential offering by the realty major in Rohtak.

Wednesday, August 26, 2009

Malls in Gurgaon + Location Map

Gurgaon has witnessed India's first successful retail and mall revolution combined with hospitality and entertainment. Realtors like DLF, MGF, Omaxe etc have had a big hand in this success story. Here is list of Malls and Rtail / Recreational destinations in Gurgaon [some of them which will go live for business in a year of two].

1. Ambi Mall

2. DLF Mall of India 2012

3. DLF Star Mall

4. Galaxy

5. MGF Metropolitan

6. DLF City Centre

7. MGF Metropolis 2010

8. JMD Corporate Suites

9. DLF South Point

10. DLF Mega Mall

11. Metro World

12. Omaxe Gurgaon Mall

13. JMD Galleria

14. House to Home

15. Raheja Mall

16. Orris Commercial-1 2011

17. Orris Commercial-2 2012

18. Exact Promoters

19. Amrapali Corporate Hub

20. Savoys Mall

21. Uppal Element-9

22. Eros Corporate Park 2012

1. Ambi Mall

2. DLF Mall of India 2012

3. DLF Star Mall

4. Galaxy

5. MGF Metropolitan

6. DLF City Centre

7. MGF Metropolis 2010

8. JMD Corporate Suites

9. DLF South Point

10. DLF Mega Mall

11. Metro World

12. Omaxe Gurgaon Mall

13. JMD Galleria

14. House to Home

15. Raheja Mall

16. Orris Commercial-1 2011

17. Orris Commercial-2 2012

18. Exact Promoters

19. Amrapali Corporate Hub

20. Savoys Mall

21. Uppal Element-9

22. Eros Corporate Park 2012

Affordable Housing Projects in Hyderabad

Compared to Bangalore, Hyderabad is offering real good affordable homes and good public infrastructure which may take away IT / BPO investments from the crowded and polluted Bangalore city.

Sr.No Project Name Developer Location May '09 Rate (Rs./sq.ft.) Unit Size Range (sq.ft.)

1 Nile Valley Janapriya Engineers Syndicate Madinaguda 1,600 940-1,350

2 Metropolis Janapriya Engineers Syndicate Moti nagar 2,650 625-1,250

3 Arcadia Janapriya Engineers Syndicate Kaukur 1,895 585-1,500

4 Utopia Janapriya Engineers Syndicate Attapur 2,300 700-1,490

5 Celestia Mantri Gachibowli 2,640 1,000-1,198

6 Rainbow Vistas Ashoka & Cybercity developers Near Hitech city 2,679 1,045-1,515

7 Gulmohar Park II Modi Properties & Investment Pvt Ltd Mallapur 2,000 1,197-1,453

8 May Flower Heights Modi Properties & Investment Pvt Ltd Nacharam 2,300 1,260-1,695

9 Indu Aranya Indu Group LB Nagar 1,850 1,602-1,900

10 Commune Golden gate Kollur 1,800 1,060-1,750

11 Manjeera Smart Homes Manjeera group Qutbullapur 2,100 1,100-1,665

12 Greenwood Residency Modi Properties & Investment Pvt Ltd Kaukur 1,799 1,081-1,462

13 Ushodayam Green Homes Satyavani Group Annojiguda 2,200* 1,100-1,691

Sr.No Project Name Developer Location May '09 Rate (Rs./sq.ft.) Unit Size Range (sq.ft.)

1 Nile Valley Janapriya Engineers Syndicate Madinaguda 1,600 940-1,350

2 Metropolis Janapriya Engineers Syndicate Moti nagar 2,650 625-1,250

3 Arcadia Janapriya Engineers Syndicate Kaukur 1,895 585-1,500

4 Utopia Janapriya Engineers Syndicate Attapur 2,300 700-1,490

5 Celestia Mantri Gachibowli 2,640 1,000-1,198

6 Rainbow Vistas Ashoka & Cybercity developers Near Hitech city 2,679 1,045-1,515

7 Gulmohar Park II Modi Properties & Investment Pvt Ltd Mallapur 2,000 1,197-1,453

8 May Flower Heights Modi Properties & Investment Pvt Ltd Nacharam 2,300 1,260-1,695

9 Indu Aranya Indu Group LB Nagar 1,850 1,602-1,900

10 Commune Golden gate Kollur 1,800 1,060-1,750

11 Manjeera Smart Homes Manjeera group Qutbullapur 2,100 1,100-1,665

12 Greenwood Residency Modi Properties & Investment Pvt Ltd Kaukur 1,799 1,081-1,462

13 Ushodayam Green Homes Satyavani Group Annojiguda 2,200* 1,100-1,691

Tuesday, August 25, 2009

Affordable Housing Projects in Pune

Pune seem really affordable compared to Mumbai. Lekin Mumbai mein Jaga Milta Kidar Hey Baap :-)

Sr.No Project Name Developer Location May '09 Rate Unit Size Range

(Rs./sq.ft.) (sq.ft.)

1 Sanskruti - Phase I & II Gini Const. Co. Hadapsar - Handewadi Road 2,750 1,045-1,400

2 Seagul - Phase I & II Runwal Housing Hadapsar - Handewadi Road 2,400-2,500 700-1,362

3 Ashok Nagar Phase I Harshad Const. Hadapsar - Handewadi Road 2,200 885- 1,255

4 Elegance Phase I & II Dreams Group Hadapsar - Handewadi Road 2,250-2,500 800 - 953

5 Green City Phase I Arihant Venkateshwara Hadapsar - Handewadi Road 1,900 552-2,300

Housing

6 Rose Wood Kolte Patil Developers Ltd. Undri 2,500 1,115 -1,890

7 Skyheights Phase I Lushlife & Undri - Pisoli Road 2,250 568 -1,025

Trimurti Developers

8 Sankalp and Lotus Ranjeet Developers Undri 2,000 572-1,500

9 Sunshine Hills Phase I Tricon Builders Undri - Pisoli Road, Pisoli 2,200 600-830

10 Ganga Sparsh and Goel Ganga Group Undri 2,500 530-1,325

Ganga Elika

11 Raheja Vistas K Raheja Corp. Mohammadwadi 2,750 1,095-1,515

12 Hill View Anand Shelters Kondhwa Khurd 2,700 804-930

13 Akruti Countrywoods Phase I Akruti Jay Developers Kondhwa Budruk 2,250 565-885

14 Bellagio Mirchandani Group Undri 2,575 1,250-1,650

Sr.No Project Name Developer Location May '09 Rate Unit Size Range

(Rs./sq.ft.) (sq.ft.)

1 Sanskruti - Phase I & II Gini Const. Co. Hadapsar - Handewadi Road 2,750 1,045-1,400

2 Seagul - Phase I & II Runwal Housing Hadapsar - Handewadi Road 2,400-2,500 700-1,362

3 Ashok Nagar Phase I Harshad Const. Hadapsar - Handewadi Road 2,200 885- 1,255

4 Elegance Phase I & II Dreams Group Hadapsar - Handewadi Road 2,250-2,500 800 - 953

5 Green City Phase I Arihant Venkateshwara Hadapsar - Handewadi Road 1,900 552-2,300

Housing

6 Rose Wood Kolte Patil Developers Ltd. Undri 2,500 1,115 -1,890

7 Skyheights Phase I Lushlife & Undri - Pisoli Road 2,250 568 -1,025

Trimurti Developers

8 Sankalp and Lotus Ranjeet Developers Undri 2,000 572-1,500

9 Sunshine Hills Phase I Tricon Builders Undri - Pisoli Road, Pisoli 2,200 600-830

10 Ganga Sparsh and Goel Ganga Group Undri 2,500 530-1,325

Ganga Elika

11 Raheja Vistas K Raheja Corp. Mohammadwadi 2,750 1,095-1,515

12 Hill View Anand Shelters Kondhwa Khurd 2,700 804-930

13 Akruti Countrywoods Phase I Akruti Jay Developers Kondhwa Budruk 2,250 565-885

14 Bellagio Mirchandani Group Undri 2,575 1,250-1,650

Monday, August 24, 2009

Rajiv Gandhi Salai - Affordable Homes colony in Chennai

Rajiv Gandhi Salai has become the colony of affordable housing. If you have bought an apartment there, then touch base with Sonia Gandhi and you may get real good public infrastructure.

Sr.No Project Name Developer Location May '09 Rate (Rs./sq.ft.) Unit Size Range (sq.ft.)

1 Mantri Synergy II Mantri Developers Rajiv Gandhi Salai 2,800 870-1,140

2 Cosmo City Provident Housing Rajiv Gandhi Salai 1,780 983-1,062

3 Pushpadhruma Marg Construcions Rajiv Gandhi Salai 2,099 847-1,077

4 India Bulls Greens India Bulls Properties Rajiv Gandhi Salai 3,000 650-1,700

5 Bollineri Hillside View BSCPL Rajiv Gandhi Salai 2,500 800-1,000

6 Gold City Duggar Housing Rajiv Gandhi Salai 1,790 444-1,069

Sr.No Project Name Developer Location May '09 Rate (Rs./sq.ft.) Unit Size Range (sq.ft.)

1 Mantri Synergy II Mantri Developers Rajiv Gandhi Salai 2,800 870-1,140

2 Cosmo City Provident Housing Rajiv Gandhi Salai 1,780 983-1,062

3 Pushpadhruma Marg Construcions Rajiv Gandhi Salai 2,099 847-1,077

4 India Bulls Greens India Bulls Properties Rajiv Gandhi Salai 3,000 650-1,700

5 Bollineri Hillside View BSCPL Rajiv Gandhi Salai 2,500 800-1,000

6 Gold City Duggar Housing Rajiv Gandhi Salai 1,790 444-1,069

Thursday, August 20, 2009

Affordable Housing Projects in Mumbai

Sr.No Project Name Developer Location May '09 Rate* (Rs./sq.ft.) Unit Size Range (sq.ft.)

1 Garden View Apartments Royal Palms Goregaon (E) 4,800 483-1,259

2 Acme Amrut Acme Group Dahisar (E) 3,000 657-795

3 Orchid Ozone DB Realty Dahisar (W) 3,168 574-882

4 Lodha Aqua Lodha Group Dahisar (E) 3,800 616-2,232

5 Viceroy Park Tower B Vijay Associates Dahisar (W) 4,950 778-958

(Wadhwa) Developers

6 NG Shelter RNA Builders (NG) Mira Road 2,750 629-996

7 Gardenia Akruti City Mira Road 3,000 585 -1,010*

8 Mittal Enclave Mittal Builders Naigaon (E) 2,000 370-770

9 Sigrun Splendour Sigrun Vasai (E) 2,200 543-1,044

10 Virar Gardens Mayfair Housing Virar (W) 2,100* 370-510

11 Rustomjee Estate Rustomjee Virar (W) 1,660-2,054 523-604

12 Gokul Sapphire Agarwal Group Virar (W) 2,300 660-1,000

13 Viva Vrindavan Agarwal Group Virar (W) 2,050 885-1,100

14 Galaxy Apartment HDIL Kurla (E) 4,551 650-920

15 Rustomjee Rustomjee Thane (W) 3,960 780

Township-Atelier A Wing

16 Rustomjee Rustomjee Thane (W) 3,960-4,050 910

Township-Acura A & B Wing

17 Rustomjee Rustomjee Thane (W) 3,929 422-430

Township-Atelier E Wing

18 Dosti Vihar Dosti Group Thane (W) 4,241 837-1,212

19 Cosmos Lounge- Orchid Cosmos Builders Thane (W) 3,500 1,005-1,025

& Promoters Ltd.

20 Akruti Greenwoods Akruti Nirman Ltd. Thane (W) 3,900 565-990

21 Everest Countryside Everest Developers Thane (W) 2,780-3,140 587-831

22 Mittal Park Mittal Builders Thane (W) 3,500 880-2,100

23 Bhoomi Acres Bhoomi Group Thane (W) 3,500 625-925

24 Niharika Kanakia Builders Thane (W) 3,500 1,030-1,190

1 Garden View Apartments Royal Palms Goregaon (E) 4,800 483-1,259

2 Acme Amrut Acme Group Dahisar (E) 3,000 657-795

3 Orchid Ozone DB Realty Dahisar (W) 3,168 574-882

4 Lodha Aqua Lodha Group Dahisar (E) 3,800 616-2,232

5 Viceroy Park Tower B Vijay Associates Dahisar (W) 4,950 778-958

(Wadhwa) Developers

6 NG Shelter RNA Builders (NG) Mira Road 2,750 629-996

7 Gardenia Akruti City Mira Road 3,000 585 -1,010*

8 Mittal Enclave Mittal Builders Naigaon (E) 2,000 370-770

9 Sigrun Splendour Sigrun Vasai (E) 2,200 543-1,044

10 Virar Gardens Mayfair Housing Virar (W) 2,100* 370-510

11 Rustomjee Estate Rustomjee Virar (W) 1,660-2,054 523-604

12 Gokul Sapphire Agarwal Group Virar (W) 2,300 660-1,000

13 Viva Vrindavan Agarwal Group Virar (W) 2,050 885-1,100

14 Galaxy Apartment HDIL Kurla (E) 4,551 650-920

15 Rustomjee Rustomjee Thane (W) 3,960 780

Township-Atelier A Wing

16 Rustomjee Rustomjee Thane (W) 3,960-4,050 910

Township-Acura A & B Wing

17 Rustomjee Rustomjee Thane (W) 3,929 422-430

Township-Atelier E Wing

18 Dosti Vihar Dosti Group Thane (W) 4,241 837-1,212

19 Cosmos Lounge- Orchid Cosmos Builders Thane (W) 3,500 1,005-1,025

& Promoters Ltd.

20 Akruti Greenwoods Akruti Nirman Ltd. Thane (W) 3,900 565-990

21 Everest Countryside Everest Developers Thane (W) 2,780-3,140 587-831

22 Mittal Park Mittal Builders Thane (W) 3,500 880-2,100

23 Bhoomi Acres Bhoomi Group Thane (W) 3,500 625-925

24 Niharika Kanakia Builders Thane (W) 3,500 1,030-1,190

Sunday, August 16, 2009

Delhi NCR Residential Rates - June-09

Here are the rates INR / SFT in Delhi NCR region for Grade - I or Grade II residential properties.

Greater Kailash I&II/ New Friends Colony 11,000 to 15,000

Janakpuri 4150 to 7000

Dwarka 4000 to 6000

Rohini/Pitampura 4000 to 6000

Gurgaon-Sushant Lok 1 - 3500 to 6000

Gurgaon-Sushant Lok II & III - 2400 to 4000

Gurgaon-Golf Course Road Sectors 52/ 56/58 and 61 3500 to 7200

Gurgaon-Extended Golf Course Road/Sohna Road - 2100 to 3800

Gurgoan-DLF Phase 1-4 4000 to 7000

Gurgaon-Near NH-8 2100 to 3500

Old Ghaziabad-Mohan Nagar/ Raj Nagar/Kavi nagar 2800 to 4500

Indirapuram-Ghaziabad 2200 to 3000

Vaishali/Vasundhara-Ghaziabad 2000 to 3000

NH-24 Ghaziabad 1900 to 2400

Old Faridabad 15, 16, 17,21 4000 to 6000

Faridabad-Suraj kund 3400 to 4400

Faridabad (Sectors 70-88) 1800 to 2400

NH-2 Faridabad 3500 to 4200

Noida-Sectors 93 A & B, 119, 137, 151 2100 to 4200

Noida-Sectors - 50, 61, 62, 63, - 3800 to 6000

Greater Noida 1700 to 2600

Greater Kailash I&II/ New Friends Colony 11,000 to 15,000

Janakpuri 4150 to 7000

Dwarka 4000 to 6000

Rohini/Pitampura 4000 to 6000

Gurgaon-Sushant Lok 1 - 3500 to 6000

Gurgaon-Sushant Lok II & III - 2400 to 4000

Gurgaon-Golf Course Road Sectors 52/ 56/58 and 61 3500 to 7200

Gurgaon-Extended Golf Course Road/Sohna Road - 2100 to 3800

Gurgoan-DLF Phase 1-4 4000 to 7000

Gurgaon-Near NH-8 2100 to 3500

Old Ghaziabad-Mohan Nagar/ Raj Nagar/Kavi nagar 2800 to 4500

Indirapuram-Ghaziabad 2200 to 3000

Vaishali/Vasundhara-Ghaziabad 2000 to 3000

NH-24 Ghaziabad 1900 to 2400

Old Faridabad 15, 16, 17,21 4000 to 6000

Faridabad-Suraj kund 3400 to 4400

Faridabad (Sectors 70-88) 1800 to 2400

NH-2 Faridabad 3500 to 4200

Noida-Sectors 93 A & B, 119, 137, 151 2100 to 4200

Noida-Sectors - 50, 61, 62, 63, - 3800 to 6000

Greater Noida 1700 to 2600

Affordable Housing Projects in NCR

Project Name Developer Location May '09 Rate (Rs /SFT) Unit Size (SFT)

1 Omaxe Height Omaxe Ltd Sec 86,Faridabad 1,900 1,165-1,475

2 Omaxe New Height Omaxe Ltd Sec 78,Faridabad 1,720 850-1,350

3 Era Divine Court Era Group Sec 76,Faridabad 1,792 890-1,225

4 Redwood Residency Era Group Sec 78,Faridabad 1,900 1,150-1,470

5 Princess Park BPTP Ltd Sec 86,Faridabad 2,250 1,289-1,835

6 Park Floors II BPTP Ltd Sec 78, Faridabad 2,050 1,170-1,414

7 Imperial Estate SPR Buildtech Sec 82, Faridabad 1,950 1,881

8 ILD Spire Green ILD Group Sec 37C, Gurgaon 2,222 1,208-2,510

9 Park Serene BPTP Ltd Sec 37D, Gurgaon 2,250 1,488-2,450

10 Era Divine Era Group Sec-68, Gurgaon 2,550 1,290-1,700

11 Tulip Orange Tulip Group Sec-69/70, Gurgaon 2,200 1,137

12 Purvanchal Heights Purvanchal Construction Zeta – 1, Greater Noida 2,350 1,830-2,770

13 Jaypee Aman Jaypee Group Sec 151, Noida 2,100 850-1,320

14 Mahagun Mascot Mahagun Pvt.Ltd NH 24, Ghaziabad 2,070 1,100-1,890

15 River Heights Landcraft Developers Nh 58, Raj Nagar Ext, Ghaziabad 1,794 965-1,750

16 Mahagunpuram Mahagun Group NH 24, Ghaziabad 1,725 900-1,300

17 GulmoharTower SVP Group Sec-6, Ghaziabad 1,990 1,260-1,560

18 Grand Savana KDP Group Nh 58, Raj Nagar Ext, Ghaziabad 1,900 825-1,550

19 Camellia Garden M-Tech Developers On NH-8, Alwar Road 1,890 1,200-1,900

20 Ashiana Aangan Ashiana group On NH-8, Alwar road 2,100 1,200-1,520

1 Omaxe Height Omaxe Ltd Sec 86,Faridabad 1,900 1,165-1,475

2 Omaxe New Height Omaxe Ltd Sec 78,Faridabad 1,720 850-1,350

3 Era Divine Court Era Group Sec 76,Faridabad 1,792 890-1,225

4 Redwood Residency Era Group Sec 78,Faridabad 1,900 1,150-1,470

5 Princess Park BPTP Ltd Sec 86,Faridabad 2,250 1,289-1,835

6 Park Floors II BPTP Ltd Sec 78, Faridabad 2,050 1,170-1,414

7 Imperial Estate SPR Buildtech Sec 82, Faridabad 1,950 1,881

8 ILD Spire Green ILD Group Sec 37C, Gurgaon 2,222 1,208-2,510

9 Park Serene BPTP Ltd Sec 37D, Gurgaon 2,250 1,488-2,450

10 Era Divine Era Group Sec-68, Gurgaon 2,550 1,290-1,700

11 Tulip Orange Tulip Group Sec-69/70, Gurgaon 2,200 1,137

12 Purvanchal Heights Purvanchal Construction Zeta – 1, Greater Noida 2,350 1,830-2,770

13 Jaypee Aman Jaypee Group Sec 151, Noida 2,100 850-1,320

14 Mahagun Mascot Mahagun Pvt.Ltd NH 24, Ghaziabad 2,070 1,100-1,890

15 River Heights Landcraft Developers Nh 58, Raj Nagar Ext, Ghaziabad 1,794 965-1,750

16 Mahagunpuram Mahagun Group NH 24, Ghaziabad 1,725 900-1,300

17 GulmoharTower SVP Group Sec-6, Ghaziabad 1,990 1,260-1,560

18 Grand Savana KDP Group Nh 58, Raj Nagar Ext, Ghaziabad 1,900 825-1,550

19 Camellia Garden M-Tech Developers On NH-8, Alwar Road 1,890 1,200-1,900

20 Ashiana Aangan Ashiana group On NH-8, Alwar road 2,100 1,200-1,520

Thursday, August 13, 2009

DLF Vs Unitech for 35 acre Gurgaon land

Haryana State Industrial and Infrastructure Development Corporation (HSIIDC) which had invited bids for a 350-acere plot in Gurgaon, has shortlisted top realty majors DLF and Unitech. This is the second time the state government agency has invited bids for the land.

The land is meant for setting up recreation and leisure project, comprising commercial, residential and sports complexes and has a reserve price of Rs 1,700 crore.

Earlier in April, HSIIDC had closed the bids for the same project, in which DLF was the sole bidder.

The land is meant for setting up recreation and leisure project, comprising commercial, residential and sports complexes and has a reserve price of Rs 1,700 crore.

Earlier in April, HSIIDC had closed the bids for the same project, in which DLF was the sole bidder.

Monday, August 10, 2009

Omaxe Sangam City - Allahabad

Omaxe, India's leading real estate developer, has launched its integrated township project -- Omaxe Sangam City -- in the holy city of Allahabad. The value of the project is around Rs 100 crore and it is going to be developed over an area of 96 acres.

Omaxe Sangam City will have plots in area ranging from 86 sq yards to 671 sq yards at a price Rs 5200 per sq yd and limited villas set amidst green environment and a host of recreational and entertainment facilities.

Last month, Pancham Realcon, a subsidiary of the company, had entered into a memorandum of understanding (MoU) with Allahabad Development Authority (ADA) for the development of Omaxe Waterfront, a hi-tech township, to be built over an area of approximately 1,535 acres with a total investment of around Rs 1,800 crore.

This project is strategically located on the bank of the holy Ganga and it offers magnificent view of Sangam Triveni of the three holy rivers -- Ganga, Yamuna and Saraswati.

The villas will be aesthetically designed & furnished with imported modular kitchen, ultra modern chimney & hub, etc.

Apart from this, healthcare support, prominent educational institute, office spaces and retail opportunities are also built into the project design for the benefit of the residents.

Omaxe Sangam City will have plots in area ranging from 86 sq yards to 671 sq yards at a price Rs 5200 per sq yd and limited villas set amidst green environment and a host of recreational and entertainment facilities.

Last month, Pancham Realcon, a subsidiary of the company, had entered into a memorandum of understanding (MoU) with Allahabad Development Authority (ADA) for the development of Omaxe Waterfront, a hi-tech township, to be built over an area of approximately 1,535 acres with a total investment of around Rs 1,800 crore.

This project is strategically located on the bank of the holy Ganga and it offers magnificent view of Sangam Triveni of the three holy rivers -- Ganga, Yamuna and Saraswati.

The villas will be aesthetically designed & furnished with imported modular kitchen, ultra modern chimney & hub, etc.

Apart from this, healthcare support, prominent educational institute, office spaces and retail opportunities are also built into the project design for the benefit of the residents.

Wednesday, July 29, 2009

Projects Eligible Under Tax Holiday Incentive

The Government has offered tax holiday for Real Estate Developers. We checked with the management of these companies and the following projects are likely to qualify under the same.

Company, Project, City and Number of Apartments

DLF Garden City Chennai ~3000

DLF New Town Heights Kolkata ~780

DLF Riverside Kochi ~176

DLF New Town Heights Gurgaon ~3000

Unitech Gateway Kolkata na

Unitech Harmony Kolkata na

Unitech Uniworld City Mohali na

Unitech Uniworld City Gr Noida na

Parsvnath PrideAsia Chandigarh ~359

Parsvnath Parsvnath City Dharuhera ~1000

Parsvnath Parsvnath Royale Panchkula 440

Parsvnath Parsvnath Palacia Gr Noida 382

Parsvnath Parsvnath Castle Rajpura 196

Parsvnath Parsvnath Exotica Ghaziabad 858

Parsvnath Parsvnath City Indore na

Parsvnath Parsvnath Preston Sonepat ~1200

Omaxe The Forest Spa Noida ~176

Omaxe Royal Residency Ludhiana na

Puravankara Swanlake Chennai ~700

Puravankara Elita Garden Vista Kolkata 1278

Puravankara Hallmark Bangalore na

Puravankara Oceania Kochi na

Puravankara Jade Chennai na

Puravankara Moonreach Kochi na

Company, Project, City and Number of Apartments

DLF Garden City Chennai ~3000

DLF New Town Heights Kolkata ~780

DLF Riverside Kochi ~176

DLF New Town Heights Gurgaon ~3000

Unitech Gateway Kolkata na

Unitech Harmony Kolkata na

Unitech Uniworld City Mohali na

Unitech Uniworld City Gr Noida na

Parsvnath PrideAsia Chandigarh ~359

Parsvnath Parsvnath City Dharuhera ~1000

Parsvnath Parsvnath Royale Panchkula 440

Parsvnath Parsvnath Palacia Gr Noida 382

Parsvnath Parsvnath Castle Rajpura 196

Parsvnath Parsvnath Exotica Ghaziabad 858

Parsvnath Parsvnath City Indore na

Parsvnath Parsvnath Preston Sonepat ~1200

Omaxe The Forest Spa Noida ~176

Omaxe Royal Residency Ludhiana na

Puravankara Swanlake Chennai ~700

Puravankara Elita Garden Vista Kolkata 1278

Puravankara Hallmark Bangalore na

Puravankara Oceania Kochi na

Puravankara Jade Chennai na

Puravankara Moonreach Kochi na

Tuesday, July 28, 2009

New Incentives from the Govt - Complete Analysis

The Indian government has announced new incentives for the property sector, which should, at the margin, be beneficial for the developers (2-4% EPS upside for F10-12, plus better demand) and the home buyers (5-7% savings for certain affordable housing). More importantly, the incentives highlight the government's pro-consumer and pro-developer policy stance. Two key announcements are detailed below.

Section 80IB (10) has been amended to extend (income) the tax holiday by one year to those housing projects approved in F08 (Apr 07-Mar 08) and get completed before Mar’12. Under this section, only housing units measuring up to 1000sf in Mumbai and Delhi and up to 1500sf elsewhere qualify. Developers can not avail this benefit for larger housing units.

In general, most property developers should directly benefit from this, depending on the extent of projects qualifying for the above. Even though not all the information is available, we estimate that DLF could benefit for its projects totaling 6-7 msf (Kolkata, Kochi, Chennai and New Gurgaon) and UT for 2-3 msf (Kolkata and Greater Noida). Assuming Rs400 psf tax benefit (to be realized over 3 years), we estimate this incentive could lift our earnings estimates by 2-4% for F10-12.

Interest subvention of 1% on all housing loans up to Rs1 mln to individuals, provided the cost of the house does not exceed Rs2 mln. This interest subsidy will be routed through the scheduled commercial banks and would be available for one year. The government has provided Rs10 bln for this incentive.

This incentive should, at the margin, facilitate demand for affordable housing (ASP Rs2000-2400 psf, 1000-800sf unit size). We estimate 5-7% lower outgo for the customer on the total mortgage outlay for 1% interest cost subvention. We believe developers that focus on affordable housing including UT, DLF, should benefit from this.

Section 80IB (10) has been amended to extend (income) the tax holiday by one year to those housing projects approved in F08 (Apr 07-Mar 08) and get completed before Mar’12. Under this section, only housing units measuring up to 1000sf in Mumbai and Delhi and up to 1500sf elsewhere qualify. Developers can not avail this benefit for larger housing units.

In general, most property developers should directly benefit from this, depending on the extent of projects qualifying for the above. Even though not all the information is available, we estimate that DLF could benefit for its projects totaling 6-7 msf (Kolkata, Kochi, Chennai and New Gurgaon) and UT for 2-3 msf (Kolkata and Greater Noida). Assuming Rs400 psf tax benefit (to be realized over 3 years), we estimate this incentive could lift our earnings estimates by 2-4% for F10-12.

Interest subvention of 1% on all housing loans up to Rs1 mln to individuals, provided the cost of the house does not exceed Rs2 mln. This interest subsidy will be routed through the scheduled commercial banks and would be available for one year. The government has provided Rs10 bln for this incentive.

This incentive should, at the margin, facilitate demand for affordable housing (ASP Rs2000-2400 psf, 1000-800sf unit size). We estimate 5-7% lower outgo for the customer on the total mortgage outlay for 1% interest cost subvention. We believe developers that focus on affordable housing including UT, DLF, should benefit from this.

Monday, July 06, 2009

Chronology of Events - No Recovery Yet

Excerpts from Morgan Stanley Indian Realty Research list the chronology of events in the Indian Real Estate space.

- Bad to Worse Market Conditions 20-Oct-08

- Sobha Blinks - First Official Price Cut in the Sector 23-Nov-08

- Price Softening Becomes More Widespread 7-Dec-08

- Price Cuts Accelerating, Land Bank Contraction Begins 19-Feb-09

- Price Cut Party Getting Bigger; New Launch Pickup 6-Mar-09

- Behold, Oversupply Coming In Mumbai, Gurgaon 8-Apr-09

- Price Correction Sets In Central Mumbai, Volumes Modest 10-May-09

- Vol Trends In New Launch look up 15-Jun-09

- Commercial/Retail Demand Remains Subdued 2-Jul-09

Tags: India Real Esate, Commercial Realty, Retail Mall, Office Spaces

Wednesday, July 01, 2009

Expectations for upcoming budget from Industry

Here is the wish list of Indian Real Estate Developers from the Finance Minister, Mr. Pranab Mukherjee for the forthcoming budget.

1.Reintroduce tax holiday for mass housing under Sec 80 (IB)

2. Tax holiday available to hotels under section 80ID to be extended 10 years from existing 5 yrs. Gestation period in hotel industry, itself, stretches from 4 to 5 yrs.

3. Re-introduce 'tax pass through' status for domestic venture capital funds that invest in the Indian real estate sector

4. Clarity on regulations/taxation on real estate mutual funds (REMFs)

5. Extend the external commercial borrowing scheme to the entire Indian real estate sector

6. Encourage states to reduce stamp duty to 5% and to provide a system of credit for each stage of sale i.e. levy on value addition.

7. Increase the tax break on home loan interest under section 24(b) to Rs 300,000 from the existing limit of Rs 150,000 for self occupied houses.

8. Service tax on renting immovable property should be abolished

9. Reduction/ rationalization of customs duty (exemption from special additional duty) and excise duty (8% to 4%)

10. Extension of STPI clause. Current deadline expires by Mar-10.

11. Introduction of a real estate regulator

1.Reintroduce tax holiday for mass housing under Sec 80 (IB)

2. Tax holiday available to hotels under section 80ID to be extended 10 years from existing 5 yrs. Gestation period in hotel industry, itself, stretches from 4 to 5 yrs.

3. Re-introduce 'tax pass through' status for domestic venture capital funds that invest in the Indian real estate sector

4. Clarity on regulations/taxation on real estate mutual funds (REMFs)

5. Extend the external commercial borrowing scheme to the entire Indian real estate sector

6. Encourage states to reduce stamp duty to 5% and to provide a system of credit for each stage of sale i.e. levy on value addition.

7. Increase the tax break on home loan interest under section 24(b) to Rs 300,000 from the existing limit of Rs 150,000 for self occupied houses.

8. Service tax on renting immovable property should be abolished

9. Reduction/ rationalization of customs duty (exemption from special additional duty) and excise duty (8% to 4%)

10. Extension of STPI clause. Current deadline expires by Mar-10.

11. Introduction of a real estate regulator

Friday, June 26, 2009

Residential + Apartment Prices to Fall by 10%

Crisil in a report released yesterday has said that Residential real estate: Capital values to fall further by 8-10 per cent in 2009 before stabilising in 2010.

End users also have had to put their purchasing plans on hold due to fall in affordability levels and job-related uncertainties. Average residential capital values declined by 18-20 per cent in March 2009 from the highs witnessed during the first half of 2008.

The following Bar Chart shows the Real Estate absorption between - Real End Users and Investors /Speculators in the Indian Residential / Apartment sector.

It is evident from Graph that Realty speculators are active in Kochi and Chandigarh / Tricity [50% + Consumption]. Pune and Delhi NCR offer the second opportunity [30-35%] for Investors while Bangalore Kolkata and Hyderabad offer the third [20%].

It is evident from Graph that Realty speculators are active in Kochi and Chandigarh / Tricity [50% + Consumption]. Pune and Delhi NCR offer the second opportunity [30-35%] for Investors while Bangalore Kolkata and Hyderabad offer the third [20%].

Between now and 2011, Developers will add 700 mn sft of saleable area while absorption is expected to be around 500mn sft. The highest and lowest fall in Realty is as expected as shown in the table below.

End users also have had to put their purchasing plans on hold due to fall in affordability levels and job-related uncertainties. Average residential capital values declined by 18-20 per cent in March 2009 from the highs witnessed during the first half of 2008.

The following Bar Chart shows the Real Estate absorption between - Real End Users and Investors /Speculators in the Indian Residential / Apartment sector.

It is evident from Graph that Realty speculators are active in Kochi and Chandigarh / Tricity [50% + Consumption]. Pune and Delhi NCR offer the second opportunity [30-35%] for Investors while Bangalore Kolkata and Hyderabad offer the third [20%].

It is evident from Graph that Realty speculators are active in Kochi and Chandigarh / Tricity [50% + Consumption]. Pune and Delhi NCR offer the second opportunity [30-35%] for Investors while Bangalore Kolkata and Hyderabad offer the third [20%].Between now and 2011, Developers will add 700 mn sft of saleable area while absorption is expected to be around 500mn sft. The highest and lowest fall in Realty is as expected as shown in the table below.

Saturday, June 20, 2009

Historical Prices of New Launches

Friday, June 19, 2009

Producers + Consumers - Spectrum

Wednesday, June 17, 2009

Opto Circuits to set up SEZ at Hassan

The manufacturer of medical diagnostics and interventional products, Opto Circuits India (OCIL), is looking to develop a single-product special economic zone (SEZ) at Hassan in Karnataka while shelling out around Rs 150 crore. The company has already acquired 250 acres of land from Karnataka Industrial Area Development Board (KIADB) for Rs 40 crore.

The greenfield manufacturing facility to be developed at the industrial growth centre in Hassan will require investment of Rs 100 crore for building up the new plant and machinery.

The Bangalore-based company is now waiting for clear indications on the SEZ guidelines from the government as the incentives provided for the export oriented units (EoU) are expiring in March 2010 and the proposal for extending the same is currently under consideration.

The company will start working on the proposed SEZ without more ado if the EoU incentives are not extended by the government and will shift its entire new product manufacturing work to this SEZ.

OCIL has lined up for around 4-5 products for exports market which will be unveiled once they get requisite approvals from the respective regulators, apart from this the company is also expected to launch its five new products in invasive and non-invasive products range under the regulated markets in next 8-12 weeks time.

It will be launching some of its new product in domestic market as well in the last quarter of this year for which the approval is due from the Drugs Controller General of India (DCGI).

The company has already planned for an qualified institutional placement (QIP) of up to Rs 400 crore and the funds raised in the process will be utilized for setting up of the SEZ and executing other expansion plans along with reducing its debt burden which currently stands at Rs 300 crore.

The greenfield manufacturing facility to be developed at the industrial growth centre in Hassan will require investment of Rs 100 crore for building up the new plant and machinery.

The Bangalore-based company is now waiting for clear indications on the SEZ guidelines from the government as the incentives provided for the export oriented units (EoU) are expiring in March 2010 and the proposal for extending the same is currently under consideration.

The company will start working on the proposed SEZ without more ado if the EoU incentives are not extended by the government and will shift its entire new product manufacturing work to this SEZ.

OCIL has lined up for around 4-5 products for exports market which will be unveiled once they get requisite approvals from the respective regulators, apart from this the company is also expected to launch its five new products in invasive and non-invasive products range under the regulated markets in next 8-12 weeks time.

It will be launching some of its new product in domestic market as well in the last quarter of this year for which the approval is due from the Drugs Controller General of India (DCGI).

The company has already planned for an qualified institutional placement (QIP) of up to Rs 400 crore and the funds raised in the process will be utilized for setting up of the SEZ and executing other expansion plans along with reducing its debt burden which currently stands at Rs 300 crore.

Tuesday, June 16, 2009

Government's Anti-Consumer Policies Favor Developers

The Government of India under Dr. Manmohan Singh is not bent upon making the Real Estate market lucrative to Indian consumers but has vested interest in pampering the developers. In short, the Government lacks the will to curb Foreign money in Real Estate which our Developers are raising and once have comfortable cash position, begins their wave of arrogance towards the Indian consumer without any reduction in prices.

We had demanded the Government to ban or have a 10 year lock in for Foreign investment in Residential Real Estate, but they don't oblige. Here are some recent updates that proves our claim.

In January and February, FDI into India increased by 127% to Rs 27.5bn as against Rs 12.1bn in the same period last year. FDI in housing and real estate also increased to 6% of total FDI for these two months as against the average of 5.7% in FY09 (excluding March data).

One need not worry as even this major[attracting foreign money] will fail and Realty Developers will have to reduce the prices further by 10-15% from current levels.Why do we say so ? Realty Developers completely ignored locals and were pampering the NRIs between 2004 and 2007. In 2008, the NRI buyers crashed out. Now for short term, QIPs and Foreign Investors will come, however, this won't sustain for long as they need to SELL the properties they build and the only possiblity is to reduce further and SELL.

One need not worry as even this major[attracting foreign money] will fail and Realty Developers will have to reduce the prices further by 10-15% from current levels.Why do we say so ? Realty Developers completely ignored locals and were pampering the NRIs between 2004 and 2007. In 2008, the NRI buyers crashed out. Now for short term, QIPs and Foreign Investors will come, however, this won't sustain for long as they need to SELL the properties they build and the only possiblity is to reduce further and SELL.

We had demanded the Government to ban or have a 10 year lock in for Foreign investment in Residential Real Estate, but they don't oblige. Here are some recent updates that proves our claim.

In January and February, FDI into India increased by 127% to Rs 27.5bn as against Rs 12.1bn in the same period last year. FDI in housing and real estate also increased to 6% of total FDI for these two months as against the average of 5.7% in FY09 (excluding March data).

One need not worry as even this major[attracting foreign money] will fail and Realty Developers will have to reduce the prices further by 10-15% from current levels.Why do we say so ? Realty Developers completely ignored locals and were pampering the NRIs between 2004 and 2007. In 2008, the NRI buyers crashed out. Now for short term, QIPs and Foreign Investors will come, however, this won't sustain for long as they need to SELL the properties they build and the only possiblity is to reduce further and SELL.

One need not worry as even this major[attracting foreign money] will fail and Realty Developers will have to reduce the prices further by 10-15% from current levels.Why do we say so ? Realty Developers completely ignored locals and were pampering the NRIs between 2004 and 2007. In 2008, the NRI buyers crashed out. Now for short term, QIPs and Foreign Investors will come, however, this won't sustain for long as they need to SELL the properties they build and the only possiblity is to reduce further and SELL.

Thursday, June 11, 2009

Unitech Sales Collapsed in FY-09

Monday, June 08, 2009

Retail rentals declined 12-14% QoQ in 1Q09

Recent data indicate mall rentals across key cities on average declined 14% qoq in 1Q09, while main street rentals declined 12% qoq. Hyderabad and Noida witnessed the sharpest decline in mall rentals of 27% and 17%, respectively, while the fall in main street rentals was the highest in Mumbai (19%) and Delhi (15%).

With developers delaying mall projects, Mumbai, Bangalore, Chennai and Hyderabad did not have any new mall completions in 1Q09. Further delays in planned supply of retail space are likely.

Given high vacancy levels (15% in Mumbai and 20% in NCR) and subdued demand, rentals are likely to remain weak in the near-term. Developers are increasingly shifting to a

minimum guarantee + revenue sharing arrangement to attract/retain tenants.

With developers delaying mall projects, Mumbai, Bangalore, Chennai and Hyderabad did not have any new mall completions in 1Q09. Further delays in planned supply of retail space are likely.

Given high vacancy levels (15% in Mumbai and 20% in NCR) and subdued demand, rentals are likely to remain weak in the near-term. Developers are increasingly shifting to a

minimum guarantee + revenue sharing arrangement to attract/retain tenants.

Thursday, May 21, 2009

SEZs procedures to be simplified: Comm Ministry

Jittered over the fate of sagging exports and dismal state of exporters, the commerce ministry has speeded up efforts to reduce procedural time taken for developing Special Economic Zones (SEZs) and to simplify procedures to get the tax-free industrial enclaves after the new government is formally sworn in.

In order to boost the tax-free industrial enclaves on a fast track basis for increasing overseas sales of Indian goods and services, the ministry will enable developers to get their land classified as an SEZ at the initial stage of approval by only submitting legal documents that prove land ownership, instead of a numerous processes earlier including a non-encumbrance certificate.

The move by the commerce ministry would ensure increased and speedy investment flows in the SEZs apart from increasing employment in the region.

In order to boost the tax-free industrial enclaves on a fast track basis for increasing overseas sales of Indian goods and services, the ministry will enable developers to get their land classified as an SEZ at the initial stage of approval by only submitting legal documents that prove land ownership, instead of a numerous processes earlier including a non-encumbrance certificate.

The move by the commerce ministry would ensure increased and speedy investment flows in the SEZs apart from increasing employment in the region.

Tuesday, May 12, 2009

Price Correction In Central Mumbai

After sharp 30-40% price cuts in several new launches in suburban Mumbai (Thane, Chembur, Andheri, Kurla etc) over the last 2-3 months, we note price cuts in prestigious South-Central Mumbai (20 mins from CBD, Nariman Point) projects. Lodha Developers launched Primero (at Apollo Mills, NM Joshi Marg) at Rs15,000 psf BSP (Rs100 psf floor rise & car park extra), implying 20% discount to neighborhood. This is a 52-storey tower with roughly 200 apartments.

Several ongoing and partially (60-80%) sold projects in Central-South Mumbai, too, have officially reduced selling prices (10-30%). For instance – Bellisemo (now at Rs 21,000 psf for 32nd storey onwards apts, NM Joshi Marg), Ashok Garden (Rs15,000 psf, Sewri), Orbit Eternia (Rs17000-18000 psf, Lower Parel) and Orbit Arya (Rs40,000-50,000 psf, Napean Sea Road).

Overall, contrary to the market's view, our channel checks suggest lukewarm customer response to several projects.

Several ongoing and partially (60-80%) sold projects in Central-South Mumbai, too, have officially reduced selling prices (10-30%). For instance – Bellisemo (now at Rs 21,000 psf for 32nd storey onwards apts, NM Joshi Marg), Ashok Garden (Rs15,000 psf, Sewri), Orbit Eternia (Rs17000-18000 psf, Lower Parel) and Orbit Arya (Rs40,000-50,000 psf, Napean Sea Road).