There is a common myth amongst Indians - Property investment is a safe heaven compared to Equity. Maybe if you are willing to invest Big Amount in Prime Land, dealing with shady people with lost of Black Money transactions, etc

There is a common myth amongst Indians - Property investment is a safe heaven compared to Equity. Maybe if you are willing to invest Big Amount in Prime Land, dealing with shady people with lost of Black Money transactions, etcNow lets take for instance professionals like you and me passionate about our job straight away paying 30% tax to the Government and form the backbone of India [Be Proud]. We don't have huge money to invest in Land so the best of you might have thought of investing is an Apartment. Dream home is a must, but second home, third home speculation is totally uncalled for. The idea of this article is to show how smart professionals with Discipline and Patience have Punched a blow in the face of Speculative Property investors [No offence, just feeling extremely nice that RoI is far better than Realty Investors] For the sake of comparison, professional invested in Mutual Funds as they seldom gets time to Trade or Track a stock individually.

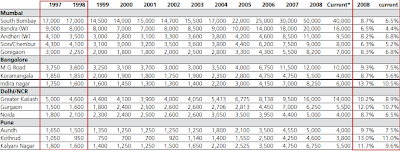

Real Estate Investment Returns in India from 1997-2008:

According to Kotak Report released in Jan-2009, the best residential realty investment RoI has been in Indiranagar, Bangalore - 13.7%, followed by Kothrud, Pune -13% and Gurgain, Delhi -12% [CAGR].

The following Chart Shows YoY Return in Real Estate in India between 1997 and 2008 + CAGR between 1997-2008in Delhi / NCR, Mumbai, Bangalore and Pune. [Expandable Chart]

Equity Returns in Indian Market between 1997 - 2008:

Equity Returns in Indian Market between 1997 - 2008:Now as assumed, investment has been in Mutual Fund - A diversified equity fund like HDFC Top 200 has delivered a whopping 21.94% in the same period as on Dec-2008. Other Equity Mutual Funds have also beaten Realty RoI.

So Equity has beaten Real Estate and is an opportunity for everybody Big or Small [as small as Rs 1,000 a month]. Bottom line, be productive, invest in the nation's manufacturing and industrial activity to create wealth. Of course, Patience is a must and see the returns you will enjoy after a decade :-)

No comments:

Post a Comment