Satyam Computers announcement to acquire two related promoter companies [Maytas Properties + Maytas Infrastructure] and final decision to drop this plan, have bought to light the company's earnings growth prospects.

Investors around the world America and India punished Satyam Computers management for valuing the Maytas companies at $1.6bn while they are not even worth $400 mn by dumping the stock of Satyam Computers which dropped by 35% in a single day in India and over 50% in New York.

The real question is who valued these property companies at 4 times the valuation ? the moral of the story is Investors don't like companies which don't have a business model and capacity to generate positive cash flow QoQ. Wait for beginning of Feb-2009 and you will see how banks will pressurise Realty developers to liquidate.

Tuesday, December 23, 2008

Sunday, December 21, 2008

Realty Brokers Views for Top Indian Cities

In our previous article we have discussed about the overall polling by property markets across India. Here is what property brokers in the most sought after realty market had to say about the direction of prices for the next 12 months.

Bangalore:

Price trend is stagnant with a negative bias and going forward outlook is mixed. In Whitefield / Marathalli: Prices appear to have stabilized. In Sarjapur and Kanakpura Road: Brokers unable to form a view but prices have set a negative bias. Yelahanka and Devanhalli: Prices have probably bottomed. While pain is expected to be continued in Jayanagar and Malleswaram areas.

Chennai:

Property prices have started falling lately. Annanagar/Guindy: 60% brokers have no view. OMR: 80% believe prices will continue to fall over 1 year. Sriperumbudur: Prices likely to drift lower.

Delhi / NCR:

80% brokers believe near term will be extremely painful. Gurgaon: 60% brokers feel that will decline in 3 months. Manesar: 80% brokers see price correction in next 3 months. Noida: Brokers expect stability at lower levels soon. Greater Noida: Unanimous near-term pessimism. Ghaziabad: Brokers expect prices to increase over 1 year

Mumbai Metropolitan Region:

Island City: Brokers believe prices will continue to fall. Bandra-Borivali: Brokers believe prices will stabilise at lower levels soon. Beyond Borivali: 80% brokers believe prices will be stable to rising over next one year. Mulund and Thane: Enquiries are steady; prices to remain firm over a one-year time frame. Vashi and Navi Mumbai: 80% brokers believe prices will be stable or increase over a one-year perspective. Panvel: Near term pessimistic; unanimous optimism over one year.

Bangalore:

Price trend is stagnant with a negative bias and going forward outlook is mixed. In Whitefield / Marathalli: Prices appear to have stabilized. In Sarjapur and Kanakpura Road: Brokers unable to form a view but prices have set a negative bias. Yelahanka and Devanhalli: Prices have probably bottomed. While pain is expected to be continued in Jayanagar and Malleswaram areas.

Chennai:

Property prices have started falling lately. Annanagar/Guindy: 60% brokers have no view. OMR: 80% believe prices will continue to fall over 1 year. Sriperumbudur: Prices likely to drift lower.

Delhi / NCR:

80% brokers believe near term will be extremely painful. Gurgaon: 60% brokers feel that will decline in 3 months. Manesar: 80% brokers see price correction in next 3 months. Noida: Brokers expect stability at lower levels soon. Greater Noida: Unanimous near-term pessimism. Ghaziabad: Brokers expect prices to increase over 1 year

Mumbai Metropolitan Region:

Island City: Brokers believe prices will continue to fall. Bandra-Borivali: Brokers believe prices will stabilise at lower levels soon. Beyond Borivali: 80% brokers believe prices will be stable to rising over next one year. Mulund and Thane: Enquiries are steady; prices to remain firm over a one-year time frame. Vashi and Navi Mumbai: 80% brokers believe prices will be stable or increase over a one-year perspective. Panvel: Near term pessimistic; unanimous optimism over one year.

Saturday, December 20, 2008

Status of Indian SEZs

We would like to write about the current state of SEZs in India. 270 SEZs have been notified as at 30th September 2008 while 531 SEZs have formal approval and 143 SEZs have in-principle approval.

There is a clear concentration of SEZs in the southern parts of the country with Andhra Pradesh, Tamil Nadu, Karnataka and Kerala accounting for 49% (133) of notified SEZs and 42% (222) of formally approved SEZs.

In terms of sectoral distribution of SEZs, IT/ITES SEZs far exceed other categories of SEZs, accounting for 66% (178) of notified SEZs and 63% (332) of formally approved SEZs. Given the slowdown in the economy and the IT/ITES sector, we believe the risk of SEZ supply getting delayed is high as developers pushback execution time lines.

Comparison of SEZ Exports from India & China:

SEZs in China are supposed to be growth engine for the manufacturing sector. However, in India it was the largest Real Estate Scam with Government sponsored violence as well for land grabbing.

Indian SEZs export 1/7th of just what three SEZs from China [Shenzhen, Xiamen and Zhuhai] do. In FY08, these Chinese SEZ exports totalled $110 bn while that of all the SEZs in India was mere $16 bn.

SEZ pricing in India: INR / sft / Month

Bangalore - 50

Chennai -40

Hyderabad - 45

Delhi NCR - 65

Mumbai Metro Region - 110

Pune - 45

There is a clear concentration of SEZs in the southern parts of the country with Andhra Pradesh, Tamil Nadu, Karnataka and Kerala accounting for 49% (133) of notified SEZs and 42% (222) of formally approved SEZs.

In terms of sectoral distribution of SEZs, IT/ITES SEZs far exceed other categories of SEZs, accounting for 66% (178) of notified SEZs and 63% (332) of formally approved SEZs. Given the slowdown in the economy and the IT/ITES sector, we believe the risk of SEZ supply getting delayed is high as developers pushback execution time lines.

Comparison of SEZ Exports from India & China:

SEZs in China are supposed to be growth engine for the manufacturing sector. However, in India it was the largest Real Estate Scam with Government sponsored violence as well for land grabbing.

Indian SEZs export 1/7th of just what three SEZs from China [Shenzhen, Xiamen and Zhuhai] do. In FY08, these Chinese SEZ exports totalled $110 bn while that of all the SEZs in India was mere $16 bn.

SEZ pricing in India: INR / sft / Month

Bangalore - 50

Chennai -40

Hyderabad - 45

Delhi NCR - 65

Mumbai Metro Region - 110

Pune - 45

Friday, December 19, 2008

Property Brokers Poll

Here is how the Property Brokers of Bangalore, Delhi NCR , Mumbai and Chennai forecast the property market for the forthcoming year.

The Bold Statement was,

Past Price Trend:

Three questions were asked - How have prices moved over the past one year ? How have prices moved over the past three months ? How have prices moved over the past one month ?

75% of the property brokers unanimously said prices have fallen over the past one year. 77% said they have fallen further in the past 3 months.

Business Volumes:

87% brokers have seen a drop in transactions over the past one month and a whopping 69% have witnessed steep fall in inquiries as well.

Property Brokers Outlook for the next 12 months:

63% brokers expect price trend to be negative over the next three months and 46% of the brokers expect price trend to be positive over the next one year.

In the next article we will cover property brokers views in specific pockets of most sought after realty markets in India.

The Bold Statement was,

Government support will not alleviate impact of external events. Consequently, we expect property volumes to remain muted and prices to decline.Here is an excerpt from the survey conducted by Edelweiss.

Past Price Trend:

Three questions were asked - How have prices moved over the past one year ? How have prices moved over the past three months ? How have prices moved over the past one month ?

75% of the property brokers unanimously said prices have fallen over the past one year. 77% said they have fallen further in the past 3 months.

Business Volumes:

87% brokers have seen a drop in transactions over the past one month and a whopping 69% have witnessed steep fall in inquiries as well.

Property Brokers Outlook for the next 12 months:

63% brokers expect price trend to be negative over the next three months and 46% of the brokers expect price trend to be positive over the next one year.

In the next article we will cover property brokers views in specific pockets of most sought after realty markets in India.

Saturday, December 13, 2008

Orange Properties - Buy 1 Get 2 Free

If October was the Month of Buy 1 , Get 1 Free!!!. December is the Month of Buy 1 and Get 2 FREE. Yes this is the Tagline by the Desperate Orange properties of Bangalore which we have covered earlier. This time around they are offering 2 pieces of land for FREE one near Devanhalli and other near Tumkur on booking an apartment in Electronics City. The cost of Apartment as advertised by Orange Properties is Rs 20.26 lakh.

Image Courtesy: TOI, B'Lore

Image Courtesy: TOI, B'Lore

Image Courtesy: TOI, B'Lore

Image Courtesy: TOI, B'Lore

Thursday, December 11, 2008

Where is the Transparency ?

Last week while publishing Public Opinion about Realty, I questioned the protection to home buyers and the absence of a powerful body like the SEBI. In a report released just minutes ago by KIM ENG Sec of Singapore, the analysts are concerned about the shady ways Indian Realty companies function. Excerpts from the report,

Of inventory, 40% is funded from customer advances. Construction does not usually begin until 14 months after pre-sales start. Sometimes projects are launched and pre-sold without securing land rights and despite ongoing legal conflicts. Customers have no protection. Their advances have been used for unrelated investment and actual construction funded by debt against property and shares. We believe that 8 out of 10 projects are currently running behind schedule.Don't you think it is time to start a powerful regulatory body to protect the interests of Indians who toil hard to BUY that dream home ?

Before listing on the equity markets, some developers used customer advances to build up large land inventory to increase their assets quickly. We believe the expensive land banks will make it difficult to launch profitable projects while the property market continues to weaken.

We also believe that data in IPO documents for some developers did not accurately reflect the data found in annual reports and financial disclosures. Pre-sales have not been disclosed in a standardized format making it difficult to determine sales to end users and sales to speculators.

In many cases, inventory is reported net of customer advances, which results in understating the book value of liabilities. The accounting practice of capitalizing 60% of interest cost on land banks and unfinished projects is misleading, which has resulted in inflated earnings and inflated book values.

Sunday, December 07, 2008

Hyderabad - Commercial / Office Realty review

High level of interest from Indian and multinational companies in the IT/ITES sector has been driving the demand for office space in the city over the past few years. Madhapur, Manikonda, Gachibowli and Raidurga are the technology hubs. Office space supply has increased from 1.6 mn sft to 12 mn sft in 2010.

Commercial / Office Space Rentals INR /sft /Month are as follows,

Commercial / Office Space Rentals INR /sft /Month are as follows,

- CBD (Begumpet/ Raj Bhawan Rd, Banjara Hills) Rs 65

- Secondary market (Jubilee Hills, parts of Banjara Hills) Rs 55

- IT Corridor – Madhapur, Gachibowli, Hitec City - Rs 42

- Suburban – Himayat Nagar/Ameerpet/ SD Road - Rs 35

- Gachibowli, Hitec City Shamshabad, Pocharam - Rs 30

Saturday, December 06, 2008

Should Govt Bailout Realtors ?

The Economic Times asked whether the Government of India should bailout Real Estate Developers and a whopping 79% of Indians said "No".  Our Government if it bails out Realtors will be one of the shameless Govt to do so. Not a dozen, Not a hundred but tens of thousands of Home Buyers face the ire of delayed handover of residential projects anywhere between 10 to 16 months. Where the F*ck is our Government to protect the interests of Home Buyers ? Shouldn't all Home Buyers be protected by a powerful regulatory body like SEBI ?

Our Government if it bails out Realtors will be one of the shameless Govt to do so. Not a dozen, Not a hundred but tens of thousands of Home Buyers face the ire of delayed handover of residential projects anywhere between 10 to 16 months. Where the F*ck is our Government to protect the interests of Home Buyers ? Shouldn't all Home Buyers be protected by a powerful regulatory body like SEBI ?

Our Government if it bails out Realtors will be one of the shameless Govt to do so. Not a dozen, Not a hundred but tens of thousands of Home Buyers face the ire of delayed handover of residential projects anywhere between 10 to 16 months. Where the F*ck is our Government to protect the interests of Home Buyers ? Shouldn't all Home Buyers be protected by a powerful regulatory body like SEBI ?

Our Government if it bails out Realtors will be one of the shameless Govt to do so. Not a dozen, Not a hundred but tens of thousands of Home Buyers face the ire of delayed handover of residential projects anywhere between 10 to 16 months. Where the F*ck is our Government to protect the interests of Home Buyers ? Shouldn't all Home Buyers be protected by a powerful regulatory body like SEBI ?

Thursday, December 04, 2008

Review of Hyderabad Residential Market

Today we are going to have a look at Hyderabad's Residential Market.

- Central Zone - Areas under this zone are Begumet,, Banjara Hills, Jubilee Hill, Ramkti etc. Most of these locations, in and around Hussain Sagar Lake, are the traditional residential hubs of the city. Locations like Banjara Hills and Jubilee Hills are considered prime residential areas, catering to the high income segment. Prices have mostly held their ground. Most of the developments are stand-alone projects as opposed to townships due to scarcity of land parcels. Majority of these are redevelopment of existing properties in inner roads of Banjara Hills. Key upcoming notable projects include Aditya's Green park in Jubilee Hills, RRS towers on Raj Bhawan Raod and Prajay Riveria at Banjara Hills.

- Northern Zone - Areas under this zone are Nizamet, Kompally, Bowenpally, Qutbullapur - Region is witnessing an even mix of both apartment and villa projects. Considerable amount of demand is investor-driven. Many prominent developers have taken up projects in the region as there are large tracts of land available along with excellent infrastructure. Noticeable projects in the region include Ambience Neighborhood by Ambience Group, Casa Estebana (54 villas) by Koncept Ambience Group, Aditya's Grand Ville and A la Maison.

- Eastern Zone - Areas under this zone are Shameerpet, Yapral Cherlapalle, Pocharam abd some parts of Secundarabad. Region mainly consists of gated communities and villa development. Northern half of this region is witnessing active real estate development (Shammerpet, Yapral). Prajay Celebrity Villas and Prajay Boomingdale are two large projects in this micro market

- Western Zone - Areas include Cyberabad locations like BHEL, Madhapur,Gacchibowli etc. Majority of demand in the region is end-user-driven, primarily from people working in Hitec City. Bachupalli, Borampet are witnessing villa and row house developments whereas Gachibowli and Kukatpalli are witnessing more high-end residential apartments. Noticeable projects in the region include Hill Ridge in Gachibowli and Lanco Hills in Manikonda, Raintree Park at Kukatpaali on 35 acres, Silicon Country at Madhapur, Prajay Ridge Wood at Nagagandala and Maytas Hill Country at Bachupalli.

- Southern Zone - Areas include Himayat Nagar, Shamshabad, etc. Plotted sales are high in the region. These locations primarily cater to mid income housing at price point

Tuesday, December 02, 2008

Sobha Developers Offering 8% Discount

Its raining discount here in Bangalore on residential projects being developed by Sobha Developers. Residential demand in Bangalore is currently sluggish. Although the company plans to launch one new project in Bangalore in FY09, given the slowdown in demand, the company has pushed back time lines of its other planned projects. The company is evaluating plans to offer homes with smaller ticket sizes of about 1,000 sq ft at an average price of about Rs3,200/sq ft.

We have obtained the price list of various projects of Sobha Developers in Bangalore and Pune and they are offering 8% discount on the prices mentioned in the list. [PDF]

Mumbai - BKC Rentals Come Crashing Down:

With increasing supply and stagnating demand, overheated rentals are bound to correct . However, the corrction has now touched 50%. BCK, deals are now happening at Rs250-225/sq ft vs. Rs450-500/sq ft earlier, according to Mr. Panay Vakil, Chairman of Knight Frank India

We have obtained the price list of various projects of Sobha Developers in Bangalore and Pune and they are offering 8% discount on the prices mentioned in the list. [PDF]

Mumbai - BKC Rentals Come Crashing Down:

With increasing supply and stagnating demand, overheated rentals are bound to correct . However, the corrction has now touched 50%. BCK, deals are now happening at Rs250-225/sq ft vs. Rs450-500/sq ft earlier, according to Mr. Panay Vakil, Chairman of Knight Frank India

Friday, November 28, 2008

Unitech Management Selling Own Shares ?

Unitech: Are Mutual Funds / FIIs selling Unitech Stock or is it the management selling its own shares and delivering in the market ?

Trading Statistics of Unitech:

Unitech Limited-Promoter Stake 74%

Traded Volume BSE on November 24th: 1.6 crore shares

Delivery Volume: 27 per cent

Delivered Quantity: 50 lakh shares

Traded Volume NSE on November 21st: 4.6 crore shares

Delivery Volume: 29 per cent

Delivered Quantity: 1.36 crore shares

Who Delivered 1.86 crore shares except the Management? Or is it HSBC/LIC?

Unitech Ltd:

Shareholding belonging to the category

"Public" and holding more than 1% of the Total No.of Shares

No. Name of the Shareholder No. of Shares Shares as % of Total No. of Shares

Seepa Investment Consultants Pvt Ltd 39,789,360 2.45

Mukpreet Business Solutions Pvt Ltd 37,775,790 2.33

Narnil Infosolutions Pvt Ltd 32,698,770 2.01

HSBC Global Investment Funds A/C HSBC 26,338,690 1.62

Life Insurance Corporation of India 21,732,016 1.34

Trading Statistics of Unitech:

Unitech Limited-Promoter Stake 74%

Traded Volume BSE on November 24th: 1.6 crore shares

Delivery Volume: 27 per cent

Delivered Quantity: 50 lakh shares

Traded Volume NSE on November 21st: 4.6 crore shares

Delivery Volume: 29 per cent

Delivered Quantity: 1.36 crore shares

Who Delivered 1.86 crore shares except the Management? Or is it HSBC/LIC?

Unitech Ltd:

Shareholding belonging to the category

"Public" and holding more than 1% of the Total No.of Shares

No. Name of the Shareholder No. of Shares Shares as % of Total No. of Shares

Seepa Investment Consultants Pvt Ltd 39,789,360 2.45

Mukpreet Business Solutions Pvt Ltd 37,775,790 2.33

Narnil Infosolutions Pvt Ltd 32,698,770 2.01

HSBC Global Investment Funds A/C HSBC 26,338,690 1.62

Life Insurance Corporation of India 21,732,016 1.34

Tuesday, November 25, 2008

Highest + Lowest Fall Residential Prices

Which Pockets of your city have witnessed the highest and Lowest Fall in Residential Realty prices ? Here is how the data stands at the end of October-2008.

Highest Fall in Residential Property Prices:

Highest Fall in Residential Property Prices:

- Bhayander, Vasai Road, Nallasopara and Virar in Mumbai West.

- Dombivili, Kalyan, Ambernath, Chembur, Ghatkopar, Mulund, Thane & Vikhroli in Mumbai suburbs and central.

- Noida, Ghaziabad, Gurgaon -Sohan Road, Gurgaon-Golf Course/DLF City and Faridabad in the National Capital Region / NCR

- Whitefield, Marthalli, Old Madras Road and Outer Ring Road - Sarjapur in Bangalore witnessed steep corrections. We CAUTION readers about the Prestige Shantiniketan located in Whitefield Bangalore.

- Baner, Aund, Pashan and Hinjewadi in Pune have suffered the worst

- MG Road, Brigade Road, Brunton Road, Lavelle Road, Richmond Road, RMV Extension, Sadashivnagar and Malleshwaram in Bangalore

- Chanakyapuri and Vasant Kunj in Delhi

- Marine Drive, MG Road and Banargee Road in Kochi

- Banjara Hills, Jubilee Hills in Hyderabad and Sainikpuri, Maredpally in Secundarabad

- Adyar, Saidapet, R K Puram in Chennai

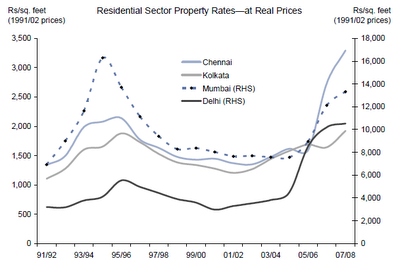

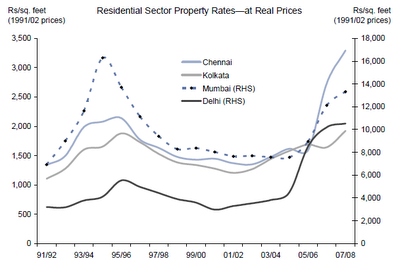

Historical Residential Property Prices of Indian Metros

The following chart shows Historical Grade-A Residential Prices in Delhi, Mumbai, Chennai and Kolkata between 1992 and 2007.

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman Research

Property prices may need to fall by up to 30% in some markets for affordability to improve. But this does not guarantee that they will begin to start moving up again and at the best arrest the FALL.

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman ResearchProperty prices may need to fall by up to 30% in some markets for affordability to improve. But this does not guarantee that they will begin to start moving up again and at the best arrest the FALL.

Monday, November 24, 2008

Past Fall and Recovery analysis in the past decade

In the previous housing downturn in 1996 when real residential prices fell 40% over three years following which the market witnessed a prolonged slump over five years before recovering. Although a sharp slowdown appears underway, mitigating factors such as favorable demographics, low mortgage penetration, falling interest rates and ongoing infrastructure demand may keep the downturn from being protracted.

Risks of a significant correction in primary residential prices mainly due to low affordability in residential sector.

The Real Estate Cycle - Fall and Rise of 10 Years in Mumbai, Delhi, Chennai, Bangalore, Kolkata and Pune

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman Research

What is the Likely Scenario of Correction this Time ?

Some arrogant Realtors are still licking the A$ of FM without any reduction in property prices. Like I said in my previous post, liquidity is really really tight for Realtors and Banks have said that they will not restructure the loans and want them to be recovered before Feb-09 otherwise they will end up as NPAs in bank's books closing March-09.

The big buyers in Indian Realty was the NRI community, first home in US / Europe, Second and sometimes even Third for speculation in India. But please be assured for now, NRIs are busy protecting their own jobs, forget about them BUYING in Indian Realty.

As we end 2008, Realtors will be under increased pressure and will start liquidating. Caution - Do not opt for the low cost housing which they have started to market [when they will be ready ? god knows]. Go for projects ready to occupy or atleast under execution but at your / CONSUMER rates :-)

Risks of a significant correction in primary residential prices mainly due to low affordability in residential sector.

The Real Estate Cycle - Fall and Rise of 10 Years in Mumbai, Delhi, Chennai, Bangalore, Kolkata and Pune

Source: Knight Frank, Goldman Research

Source: Knight Frank, Goldman ResearchWhat is the Likely Scenario of Correction this Time ?

Some arrogant Realtors are still licking the A$ of FM without any reduction in property prices. Like I said in my previous post, liquidity is really really tight for Realtors and Banks have said that they will not restructure the loans and want them to be recovered before Feb-09 otherwise they will end up as NPAs in bank's books closing March-09.

The big buyers in Indian Realty was the NRI community, first home in US / Europe, Second and sometimes even Third for speculation in India. But please be assured for now, NRIs are busy protecting their own jobs, forget about them BUYING in Indian Realty.

As we end 2008, Realtors will be under increased pressure and will start liquidating. Caution - Do not opt for the low cost housing which they have started to market [when they will be ready ? god knows]. Go for projects ready to occupy or atleast under execution but at your / CONSUMER rates :-)

Thursday, November 20, 2008

How Realty Stocks Destroy Investors Wealth

We have been tracking this sector for over 2 years now and here is how Real Estate Stocks in India destroyed Investors Wealth over the past 4 months. They have been halving like a Nuclear Fission but the only difference here is [Wealth is Destroyed] Expandable Image Comparing the Values of Realty Stocks Month Over Month.

In the above image [expandable] you see how Indian Realty Stocks have halved in months time :-)

Worst is Not Over for Real Estate:

Corporates have started Defaulting and withdrawing abnormal bids for Land. Citra Developers, a 100 per cent subsidiary of Indiabulls Real Estate, withdrew its Rs 6.76 bn bid for the 134-acre PALPeugeot land in the Dombivli-Kalyan region, about 100 km outside Mumbai.

Jet Airways, which had bid successfully for a prized Bandra-Kurla Complex (BKC) plot in Mumbai for a whopping Rs 8.26 bn, has walked away from the deal.

In the above image [expandable] you see how Indian Realty Stocks have halved in months time :-)

Worst is Not Over for Real Estate:

Corporates have started Defaulting and withdrawing abnormal bids for Land. Citra Developers, a 100 per cent subsidiary of Indiabulls Real Estate, withdrew its Rs 6.76 bn bid for the 134-acre PALPeugeot land in the Dombivli-Kalyan region, about 100 km outside Mumbai.

Jet Airways, which had bid successfully for a prized Bandra-Kurla Complex (BKC) plot in Mumbai for a whopping Rs 8.26 bn, has walked away from the deal.

Restructured Housing Loan is NPA- RBI

RBI in an exclusive directive to strengthen the Nations banking system has asked them to treat Restructured Loans to Builders and Real Estate Developers as NPAs.

What are Restructured Loans ?

When borrowers are facing difficulties in repaying loans, typically banks give borrowers more time to repay the loan by extending the loan tenure, and sometimes, even at reduced interest rates. Such an exercise enables banks to keep their non-performing assets (NPA) ratios under check.

Thus banks are putting pressure on Realty developers to be realistic to market forces on the selling price and dispose of the housing stock so that Banks balance sheet is not weakned, otherwise they will face a lot of difficulties. Mr. Naryansami of BOI said,

Update: Here is how Banks how disbursed Loans to Real Estate and Construction in H1-FY2009 despite slowing economy and Global Crisis. That is why Banks are on their toes to recover those loans before they become an NPA.

What are Restructured Loans ?

When borrowers are facing difficulties in repaying loans, typically banks give borrowers more time to repay the loan by extending the loan tenure, and sometimes, even at reduced interest rates. Such an exercise enables banks to keep their non-performing assets (NPA) ratios under check.

Thus banks are putting pressure on Realty developers to be realistic to market forces on the selling price and dispose of the housing stock so that Banks balance sheet is not weakned, otherwise they will face a lot of difficulties. Mr. Naryansami of BOI said,

Just banks reducing interest rates will not help in reviving sentiments; builders will have to bring down prices for buyers.Hopefully, bankers will kick the ass of these greedy and troubled Real Estate Developers and make them sell the housing stock at fair prices affordable by the Indian consumer.

Update: Here is how Banks how disbursed Loans to Real Estate and Construction in H1-FY2009 despite slowing economy and Global Crisis. That is why Banks are on their toes to recover those loans before they become an NPA.

Monday, November 17, 2008

SEZ Bubble Burst - DLF Selling its Noida SEZ

The Largest Real Estate Scam in the World -Special Economic Zones bubble has been burst. Thanks to former RBI Governor Dr. Reddy for keeping the Indian banking and Financial institutions away from these Land Scamsters.

DLF is all set to SELL its IT SEZ in Noida according to reports. Three more developers are seeking to SELL their IT SEZs and several asking them to be de-notified [withdrawl of permission]. Thanks to the global economic crisis :-)

K.P.Singh of DLF seems to have gone Wooly in the head said a blogger,

DLF is all set to SELL its IT SEZ in Noida according to reports. Three more developers are seeking to SELL their IT SEZs and several asking them to be de-notified [withdrawl of permission]. Thanks to the global economic crisis :-)

K.P.Singh of DLF seems to have gone Wooly in the head said a blogger,

Minister of Commerce Kamal Nath inspired the biggest post-Independence land grab in the country through earmarking of Special Economic Zones...But a fallacious premise that SEZs will facilitate Tax Breaks Ad Infinitum made Realtors scrounge up Land at atrocious price across the country. Now, that few can afford the same DLF's Singh has asked the Banks to fund over-priced Reality at low interest rates such that Land Banks can be parceled out to the public. How crazy can the Real Estate mafia get? How far low can Ministers stoop.Finally the world has realized [2 years after we dedicated this blog to expose the SEZ Land Scam] what a big scam SEZs in India are. Hopefully all these land grabbers will perish soon.

Friday, November 14, 2008

Unitech Downgrade + Cash Crunch

Unitech's Debt rating has been downgraded from A+ to A- by rating agency Fitch. Unitech is all set to offload its Delhi office of over 200,000 sft located near Sheraton Hotel at Saket, Delhi. According to reports, Unitech is expected to sell the building between Rs 20,000 to Rs 25,000 / sft to HDFC as the former owes to HDFC in the form of loans.

Arrogant Indian Builders thought that the prices will only rise and are now caught on the wrong foot. They are facing severe cash crunch due to substantial drop in sales. Bankers have turned cautions and stopped lending as Realtors are unwilling to lower the value of their land bank which they deposit as co-lateral guarantee in case of defaults.

Property Prices in Saket, Delhi are expected to be down between 20-30% from the peak in Jan-2008.

Arrogant Indian Builders thought that the prices will only rise and are now caught on the wrong foot. They are facing severe cash crunch due to substantial drop in sales. Bankers have turned cautions and stopped lending as Realtors are unwilling to lower the value of their land bank which they deposit as co-lateral guarantee in case of defaults.

Property Prices in Saket, Delhi are expected to be down between 20-30% from the peak in Jan-2008.

Wednesday, November 12, 2008

Bandra-Kurla Office Price Crash 30%

Price in Mumbai's prestigious Grade - A office space, Bandra Kurla Complex has crashed by a whopping 33% according to latest reports.

Price in Mumbai's prestigious Grade - A office space, Bandra Kurla Complex has crashed by a whopping 33% according to latest reports.StanChart has bought close to 250,000 sft of office space in BKC for Rs 750 crore. The previous and most expensive transaction was that of Rs 45,000 / sft by the British Council.

Sunday, November 09, 2008

Orange Properties - Desperate Move to Raise Cash

India witnesses a different boom every few years - Finance companies, Garment Exporters, BPO & Technology etc. This time around the property boom is quite widespread and with global economic crisis, builders are desperate to raise crash.

Have a look at these Big Advertisements from Bangalore based Orange Properties who is seeking desperate bookings. Until the last week of October-08, Orange offered Rs 15,000 returns / Month on investment of Rs 3.75 Lakhs. Today they are offering Rs 7,500 on Rs 1.00 Lakh till the date of project completion.

Image Courtesy: TOI, B'Lore edition

Image Courtesy: TOI, B'Lore edition

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

Have a look at these Big Advertisements from Bangalore based Orange Properties who is seeking desperate bookings. Until the last week of October-08, Orange offered Rs 15,000 returns / Month on investment of Rs 3.75 Lakhs. Today they are offering Rs 7,500 on Rs 1.00 Lakh till the date of project completion.

Image Courtesy: TOI, B'Lore edition

Image Courtesy: TOI, B'Lore edition At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

At last, the severe shake out has begun, which implies,FALL in property prices or bankruptcy by Realty Developers.

Saturday, November 08, 2008

Mumbai Property Update

Mumbai is witnessing a steep decline in property prices for the second time, the first being in Mid-90s.

According to Mr. Mufatraj Munot of Kalpataru, new projects are not viable, sales are slow and buyers are sitting on the fence. Every developer is looking at his own cash flow and many projects have slowed down. Even the once lucrative TDR (Transfer of Development Rights) market has lost its sheen. Till about 6-months ago, builders used to purchase slum TDR at Rs4,000/sq ft but now there are only a few takers although prices have come down to Rs1,200/sq ft. Moreover, builders who have bought TDR have been unable to pay sellers. It is estimated that about 100 builders owe close to Rs2bn to TDR owners and traders.

Oberoi Constructions is offering new projects in Goregaon East from Rs7,500/sq ft onwards as against Rs12,000/sq ft for ready flats. Lok Group too plans to offer discounts of 20% on new constructions in Malad and Khar. Last month Orbit Corp offered a 20% discount on bookings for a new project at Lower Parel but received a lukewarm response.

Home Loan Defaults on the Rise:

According to ARCIL [Asset Reconstruction Company India Ltd], between Apr-Sept-2008, 20% of the Loan Defaults occurred in the Home Loan Segment. Asset reconstruction companies expect a further jump in housing loan defaults in the coming quarters.

According to Mr. Mufatraj Munot of Kalpataru, new projects are not viable, sales are slow and buyers are sitting on the fence. Every developer is looking at his own cash flow and many projects have slowed down. Even the once lucrative TDR (Transfer of Development Rights) market has lost its sheen. Till about 6-months ago, builders used to purchase slum TDR at Rs4,000/sq ft but now there are only a few takers although prices have come down to Rs1,200/sq ft. Moreover, builders who have bought TDR have been unable to pay sellers. It is estimated that about 100 builders owe close to Rs2bn to TDR owners and traders.

Oberoi Constructions is offering new projects in Goregaon East from Rs7,500/sq ft onwards as against Rs12,000/sq ft for ready flats. Lok Group too plans to offer discounts of 20% on new constructions in Malad and Khar. Last month Orbit Corp offered a 20% discount on bookings for a new project at Lower Parel but received a lukewarm response.

Home Loan Defaults on the Rise:

According to ARCIL [Asset Reconstruction Company India Ltd], between Apr-Sept-2008, 20% of the Loan Defaults occurred in the Home Loan Segment. Asset reconstruction companies expect a further jump in housing loan defaults in the coming quarters.

Thursday, November 06, 2008

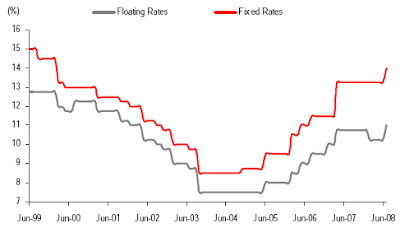

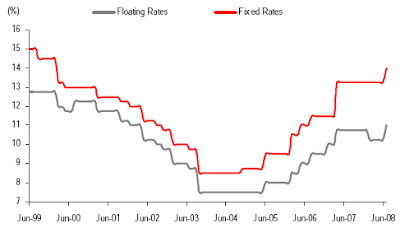

Residential Prices + Retail Rentals to Fall

According to latest research report released by Macquarie on the Indian Real Estate sector, they expect Retail Rentals and Residential Prices to fall across India. The chart below shows how various pockets of Real Estate - Residential, Commercial Office Space, Retail are expected to perform in various Indian cities. [Expandable Image] We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

This is not Mr. Chidambaram's Reserve Bank. Dream Home Buyers can hit the street and remember there is only one mantra in this scenario - Reject all Gifts by developers and squeeze them to come down to your price. Show Realty Developers CASH and they will drool.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.

We will not agree with our Finance Minister's view about falling interest rates, especially for the troubled Realty Developers. None of the Private Banks have cut Home Loan rates because its simply not viable and they are not under the control and influence of South Block Ministry.This is not Mr. Chidambaram's Reserve Bank. Dream Home Buyers can hit the street and remember there is only one mantra in this scenario - Reject all Gifts by developers and squeeze them to come down to your price. Show Realty Developers CASH and they will drool.

Wednesday, November 05, 2008

Prestige Shantiniketan Whitefield Tower Collapse

Tuesday, November 04, 2008

Hyderabad + Pune + Kolkata - Office Rentals

In Hyderabad, demand has been low in Banjara Hills, Jubilee Hills, Secunderabad and Himayatnagar. Demand has also been subdued in the IT corridor of Madhapur and Gachibowli and rentals have remained stable.

Begumpet, Rajbhavan Rd, Jubilee Hills and Banjara Hills Grade A Office Rentals have been stable at Rs 65. INR 42 at Hitech City, Gachibowli. Rs 30 - Rs 35 at Ameerpet, Pocharam, Shamshabad, Himayatnagar.

Pune is witnessing a slowdown. Some IT SEZ developers have deferred their decision to commence construction. Going forward rentals are expected to remain either stable or undergo a

correction in certain pockets.

Grade A Offices in Shivaji Nagar, Bund Garden Rd commanded rentals of Rs 100. Kalyani Nagar, Shankarsheth Rd were next in line at INR 70 while IT corridors of Hinjewadi, Kharadi, Hadapsar can fetch Rs 50.

Kolkata - The city which witnessed the shifting of Tata's Nano car is likely to undergo some deeper correction according to industry insiders. We have already written how Land Prices crashed in the vicinity of Singur and Salt Lake.

Park Street and Camac Street havs witnessed fall in Grade A office space rentals from Rs 150 to Rs 120 while Salt Lake and Rajarhat have been stable at least until Sept around 50.

Begumpet, Rajbhavan Rd, Jubilee Hills and Banjara Hills Grade A Office Rentals have been stable at Rs 65. INR 42 at Hitech City, Gachibowli. Rs 30 - Rs 35 at Ameerpet, Pocharam, Shamshabad, Himayatnagar.

Pune is witnessing a slowdown. Some IT SEZ developers have deferred their decision to commence construction. Going forward rentals are expected to remain either stable or undergo a

correction in certain pockets.

Grade A Offices in Shivaji Nagar, Bund Garden Rd commanded rentals of Rs 100. Kalyani Nagar, Shankarsheth Rd were next in line at INR 70 while IT corridors of Hinjewadi, Kharadi, Hadapsar can fetch Rs 50.

Kolkata - The city which witnessed the shifting of Tata's Nano car is likely to undergo some deeper correction according to industry insiders. We have already written how Land Prices crashed in the vicinity of Singur and Salt Lake.

Park Street and Camac Street havs witnessed fall in Grade A office space rentals from Rs 150 to Rs 120 while Salt Lake and Rajarhat have been stable at least until Sept around 50.

Monday, November 03, 2008

20% Price Fall - According to Citi

According to Citigroup Analysts tracking the Indian Real Estate Space, till now there has been 20% correction in Realty Prices which they account for in estimating the NAV of various Realty stocks. What is really surprising is Sobha Developers land bank has fallen from around 4,000 acres to about 3,300 acres as the company is reconsidering some of its land deals where it has not fully paid up, given current difficult markets.

Here are the excerpts from the reports,

Citi on Bangalore / Chennai based Purvankara Projects,

Here are the excerpts from the reports,

Citi on Bangalore / Chennai based Purvankara Projects,

....NAV estimate of Rs104 is based on the following assumptions: 1) 20% decline in property prices; 2) 15-24month delay in project execution.....Similarly for Delhi NCR and North India based Parsvnath Developers and Ansal Properties and Infrastructure,

....Our NAV estimate assumes: a) 20% decline to current market prices; b) development....Goldman Sachs in its report said 2Q earnings reflect slowdown. Citi has cut the target prices substantially for all Realty Stocks. DLF's new target is Rs 340 from Rs 585 and that for Unitech is Rs 57 from Rs 193 :-)

Sunday, November 02, 2008

Bangalore + Chennai - Office Rentals

Bangalore / Bengaluru CBD Office Space has hardly witnessed corrections like that in Mumbai. However, peripheral business districts have seen a fall due to pathetic infrastructure and continuous negligent attitude from successive state Governments in improving the same. There is huge supply coming up in Whitefield, Outer Ring Road, Electronics City and North Bangalore. ~5m sq ft of office space is currently available in Whitefield and much more is under construction and will be ready for occupancy by 1Q09.

Grade A office Rentals in Bengaluru June-08 to Sept-08 [INR / SFT / Month]

Grade A office Rentals in Chennai:

Grade A office Rentals in Bengaluru June-08 to Sept-08 [INR / SFT / Month]

- MG Road, Residency Road - Stable at Rs 85

- Koramangala, Indiranagar - Down from rs 70 to Rs 65

- Outer Ring Road stable around Rs 45

- Whitefield, Electronic City Stable around Rs 30

- North Bangalore - Witnessed a Rise in early 2008 but now stable around Rs 45

Grade A office Rentals in Chennai:

- Annai Salai, Nungambakkam - Stable between Rs 70 to Rs 80

- Velachery, Taramani - Stable at Rs 40

- Siruseri, Ambattur, GST Rd - Rs 30 to Rs 35

Saturday, November 01, 2008

Mumbai Commercial / Office Rentals

Mumbai, the aspiring financial capital of Asia which had rentals comparable to New York and Tokyo is now witnessing corrections. Excerpts from CB Richard Ellis

In CBD, rentals across premium buildings have witnessed a correction and this trend is likely to continue over the next quarter. In BKC, new enquiries have slowed and some developers are showing more flexibility in structuring commercial terms. Andheri-Kurla Road, Powai and Malad have not seen substantial activity in the office sector in the current quarter while Thane and Navi Mumbai remain the preferred locations for IT and back office operations are the only locations in Mumbai that have not witnessed a correction in rentals so far.

Mumbai Grade A Office Space Rentals Jun-08 and Sept-08 [INR / SFT / Month]

In CBD, rentals across premium buildings have witnessed a correction and this trend is likely to continue over the next quarter. In BKC, new enquiries have slowed and some developers are showing more flexibility in structuring commercial terms. Andheri-Kurla Road, Powai and Malad have not seen substantial activity in the office sector in the current quarter while Thane and Navi Mumbai remain the preferred locations for IT and back office operations are the only locations in Mumbai that have not witnessed a correction in rentals so far.

Mumbai Grade A Office Space Rentals Jun-08 and Sept-08 [INR / SFT / Month]

- Nariman Point, Fort, Cuffe Parade - Down from Rs 475 to Rs 415

- Worli, Lower Parel, Prabhadevi - Down from Rs 375 to Rs 315

- BKC, Kalina - Down from Rs 415 to Rs 375

- Andheri, Vile Parle, Jogeshwari - Down from Rs 220 to Rs 200

- Malad, Powai - Down from rs 100 to Rs 80

- Thane, Navi Mumbai - Stable around Rs 50

Commercial / Office Rentals - Delhi - NCR

The realty sector has finally witnessed the much needed correction for genuine industries and offices to expand and help the Indian economy grow. Here is an excerpt from CB Richard Ellis recent report on Delhi NCR Commercial / office Space Realty World.

There has been some correction in rentals, and leasing volumes have been low. In Gurgaon, pre-leasing has been quite slow, a situation that was uncommon before but which clearly highlights lower demand. IT/ITES rentals are expected to be under pressure while rentals for commercial office space are likely to remain stagnant. Noida has significant supply but slow leasing activity because of which rentals are expected to remain low in the next 2-3 quarters.

Delhi NCR - Grade A Office Space Rentals - In June-2008 and Sept-2008

There has been some correction in rentals, and leasing volumes have been low. In Gurgaon, pre-leasing has been quite slow, a situation that was uncommon before but which clearly highlights lower demand. IT/ITES rentals are expected to be under pressure while rentals for commercial office space are likely to remain stagnant. Noida has significant supply but slow leasing activity because of which rentals are expected to remain low in the next 2-3 quarters.

Delhi NCR - Grade A Office Space Rentals - In June-2008 and Sept-2008

- Connaught Place - Down from Rs 340 to Rs 300

- Nehru Place - Down from Rs 270 to Rs 240

- Jasola - Down from Rs 175 to Rs 160

- Gurgaon - Commercial - Stable around Rs 90

- Gurgaon - IT - Stable around Rs 50

- Noida IT - Down from Rs 50 to Rs 42

Friday, October 31, 2008

Who Bought The Real Estate Fall ?

It makes perfect sense to go bargain hunting, especially in the Indian Realty space which corrected more than any other industry vertical in the recent crash. Here is the data on who bought into recent the fall.

- Pan Atlantic in Sobha Developers $10 mn invstment in SPV developing residential project in Bangalore

- LTG International pumped $12 mn in Subsidiary of Prozone Enterprises, Provogue's real estate arm

- Samara Capital invested $12 mn in Shriram Land Development

- Kotak Realty Fund & Sun- Apollo Ventures bought 50% stake in Janapriya Projects and 65% stake in Janapriya Townships respectively. Funding details was not disclosed.

- AIG Global Real Estate pumped into 8.5 mn sft Velankani Tech Park which is a notified IT SEZ in Sriperumbudur, Chennai

- Orient Global bought 1.2% stake in HDIL through the stock market route

Thursday, October 30, 2008

AIM Listed India Realty Funds in Trouble

Indian Realty developers moved to London Stock Exchange's AIM offering part of their Realty cake. Investors bought these funds as if there was no tomorrow and now these scrips are quoting at deep discount to NAVs.

Neerav Investments - Niraj and Ravi Raheja's investment arm has picked up 35% stake in Ishaan Real Estate.

It is time to go and pick up Realty from distressed Sellers if you believe in Realty or want your Dream House.

- Unitech Corporate Park is trading at 75% discount to its NAV

- K Raheja's Ishaan Real Estate is quoting at 65% to NAV

- Hiranandani promoted Hirco is quoting at 80% discount to its NAV

Neerav Investments - Niraj and Ravi Raheja's investment arm has picked up 35% stake in Ishaan Real Estate.

It is time to go and pick up Realty from distressed Sellers if you believe in Realty or want your Dream House.

Tuesday, October 28, 2008

Kolkatta Property Market Review

In the residential sector, prices are stagnating at Rs2,500-3,000, while resale prices are down 15-20%; volumes are end-user-driven and are down 30-40% and the pace of pre-sales slowed sharply in Aug-Sep 08. Most projects are running 6-12 months behind schedule, and Phase-II time-lines are being pushed back on demand slowdown.

Demand for IT and non-IT space has cooled off over the past 2-3mnts, following the Singur episode and downturn in global markets. Rentals are holding at Rs32-38/sqft for IT Parks and Rs38-42/sqft for IT SEZs, but absorption has fallen significantly. Most retail malls have been put on the slow track.

Land Prices Correct Sharply: Post the exit of the Tatas from Singur, land prices in peripheral areas have corrected sharply from 10-20 mn/acre to less than 3mn / acre. But prices in key development zones like Rajarhat are holding at Rs120m/acre, though transactions are down.

DLF Residential project of ~800 units was sold-out shortly after launch at Rs3200/sqft; construction started in Jun 08, exploring more launches but nothing immediately in the pipeline.

Unitech's Uniworld City, the company's flagship project of ~3500 units, has seen sales of ~2200 at an average of Rs3,000 - resale prices are down 12-15%; fresh sales have, however, slowed to mere 25 units vs. ~60 units 6 months back. Additionally, cash starved Unitech has delayed construction by 6-8 months. Kona Gateway project launched a year back has seen significant delays, sales and prices have stagnated; management expect s construction to commence shortly. Phase-I construction of row house at houses at Kolkatta West International City, Howrah is underway.

Demand for IT and non-IT space has cooled off over the past 2-3mnts, following the Singur episode and downturn in global markets. Rentals are holding at Rs32-38/sqft for IT Parks and Rs38-42/sqft for IT SEZs, but absorption has fallen significantly. Most retail malls have been put on the slow track.

Land Prices Correct Sharply: Post the exit of the Tatas from Singur, land prices in peripheral areas have corrected sharply from 10-20 mn/acre to less than 3mn / acre. But prices in key development zones like Rajarhat are holding at Rs120m/acre, though transactions are down.

DLF Residential project of ~800 units was sold-out shortly after launch at Rs3200/sqft; construction started in Jun 08, exploring more launches but nothing immediately in the pipeline.

Unitech's Uniworld City, the company's flagship project of ~3500 units, has seen sales of ~2200 at an average of Rs3,000 - resale prices are down 12-15%; fresh sales have, however, slowed to mere 25 units vs. ~60 units 6 months back. Additionally, cash starved Unitech has delayed construction by 6-8 months. Kona Gateway project launched a year back has seen significant delays, sales and prices have stagnated; management expect s construction to commence shortly. Phase-I construction of row house at houses at Kolkatta West International City, Howrah is underway.

Monday, October 27, 2008

Residential - Buy 1 Get 1 Free

We have been shouting at the top of our voice how unrealistic residential real estate prices were. Developers have now launched BUY One House and Get One Free.

Cosmos Prime Projects Developers has launched the scheme in Mumbai for its projects in Thane. The Advertisement sent to us says,

Cosmos Prime Projects Developers has launched the scheme in Mumbai for its projects in Thane. The Advertisement sent to us says,

With the Purchase of a Bungalow of a 2 BHK, a 1 BHK comes FREE, While with a 2 BHK Flat, a 1 Room Kitchen is FREE.You can view the entire scanned copy of the advertisement here. Let realty prices crash and get a little bit REAL.

Sunday, October 26, 2008

Incentives Offered by Real Estate Developers

Our Analyst tracking the Realty players is filing this report about various freebies and incentives offered by Developers across India.

- DLF Free gold coin on booking of 3-Bedroom apartment

- Unitech Free LCD TV on every booking

- Pal Infrastructure Free jewellery up to Rs100,000 & more than 6% discount on booking of flat at Gurgaon

- SVP Free 50g Gold Coin on booking of apartment in Ghaziabad

- Jaypee Greens Free Economy/Luxury car with every apartment

- Mapsko Free Economy/Luxury car with a flat/villa

- Tulip Free Solitaire Diamond worth Rs125,000

- Gaursons Rs100,000 off on all spot bookings

- Dhingra Developers Free 32" Plazma TV on booking of flat

Friday, October 24, 2008

India Realty Stocks - New Low

Home Loan Customers Default at Vijaya Bank

Vijaya Bank has just a while ago informed in a flash to the BSE that it is witnessing increased defaults in Home Loans due to rising EMIs. The NPAs of Vijaya Bank in the second quarter jumped 131% to Rs 268 crore, against Rs 116 crore in the same period last year.

Vijaya Bank has just a while ago informed in a flash to the BSE that it is witnessing increased defaults in Home Loans due to rising EMIs. The NPAs of Vijaya Bank in the second quarter jumped 131% to Rs 268 crore, against Rs 116 crore in the same period last year.Retail loan portfolio is 25% of Vijaya Bank's books at Rs 9,000 crore. The Bank has said that it will continue to lend but very cautiously and try to negotiate with defaulters to make them regular customers.

Which Bank of Financial institution is next in the Queue ? ICICI or SBI ?

Tuesday, October 21, 2008

Realtors Face Downgrade - CRISIL

Before fingers can be pointed out at rating agency after the company collapses, CRISIL is playing safe and is set to downgrade all the Indian Realtors who are debt trapped and facing severe liquidity crunch.

Developers today have few options in terms of financing. Either they have to slow down construction or reduce property prices to catalyze demand. Crisil has assigned non-investment grade ratings to some of the developers, indicating weak financial profile of these companies.

In a related development, lenders - Banks and financial Institutions are constinuously mounting pressure on Developers to price the properties lower and SELL-off before its too late. Baanks are fearing defaults on interest payments in this quarter and hence are meeting the managements of various Realty companies on weekly basis. Banks have also asked the Realty companies to get their Land Bank re-valued due to the correction in prices as most of them are holding them as co-laterals.

Developers such as Parsvnath, Unitech, HDIL, Omaxe, Orbit Corporation, Sobha Developers etc have borrowed aggressively to support their unrealistic realty plans which are likely to come crashing very soon.

Developers today have few options in terms of financing. Either they have to slow down construction or reduce property prices to catalyze demand. Crisil has assigned non-investment grade ratings to some of the developers, indicating weak financial profile of these companies.

In a related development, lenders - Banks and financial Institutions are constinuously mounting pressure on Developers to price the properties lower and SELL-off before its too late. Baanks are fearing defaults on interest payments in this quarter and hence are meeting the managements of various Realty companies on weekly basis. Banks have also asked the Realty companies to get their Land Bank re-valued due to the correction in prices as most of them are holding them as co-laterals.

Developers such as Parsvnath, Unitech, HDIL, Omaxe, Orbit Corporation, Sobha Developers etc have borrowed aggressively to support their unrealistic realty plans which are likely to come crashing very soon.

Friday, October 17, 2008

Mumbai Residential Price Index

Here is Mumbai's Residential Price Index as published by Kotak Research with 1993 as the base year.

And in between 2003 and 2008, the NSE Index went from 900 levels to 6,000.

And in between 2003 and 2008, the NSE Index went from 900 levels to 6,000.

So sure Mumbaikars made lot of money on the NSE which later flowed into Realty. Now that NSE has melted down, what will be the Reality in Realty ?

And in between 2003 and 2008, the NSE Index went from 900 levels to 6,000.

And in between 2003 and 2008, the NSE Index went from 900 levels to 6,000.

So sure Mumbaikars made lot of money on the NSE which later flowed into Realty. Now that NSE has melted down, what will be the Reality in Realty ?

Wednesday, October 15, 2008

Mumbai Property Rates - Part-II

In continuing our coverage on Mumbai's Residential Property prices, here is Part-2 of the same.

The property exhibition received a lukewarm response from the buyers in comparison to previous year. Most of the attendees had come to check the extent of the property price correction rather than buy. The majority of the potential buyers we spoke to found the price points unaffordable and did not find the discounts attractive enough.

All are residential properties

Name of the Builder, Location, Price / sft and Tentative Possession Date

The property exhibition received a lukewarm response from the buyers in comparison to previous year. Most of the attendees had come to check the extent of the property price correction rather than buy. The majority of the potential buyers we spoke to found the price points unaffordable and did not find the discounts attractive enough.

All are residential properties

Name of the Builder, Location, Price / sft and Tentative Possession Date

- Rustomjee- Elanza Malad (W) 9,000, Urbanaia Thane (W) 5,130, Ozone Goregaon (W) 10,500

- Kalpatru Properties - Kalpataru Estate JVLR, Andheri 10,000

Kalpataru Riverside Navi Mumbai Panvel 3,800

Kalpatru Aura Ghatkopar (W) 7,800

Kamdhenu Mulund (E) 5,200

Shrusti Mira Road 4,750 - Dosti Group - Flamingos Sewree 15,000

Acres New Wadala 11,600

Vihar Thane(W) 5,750 Dec-2010 - Nirmal Lifestyle - City of Joy Mulund (W) 10,500

Galaxy Mulund (W) 10,500 June-2009 - Mahindra Lifespace - Eminente Goregaon (W) 8,500

Splendour Bhandup (W) 6,950 - Ahuja Construction - Clubbe Life Borivali (W) 7,500

Karma Kastle Tilak Nagar, Chembur (W) 7,200 Dec-09 - Lok Housing - Lok Surbhi Kalyan (W) 2,300

Lok Everest Mulund (W) 6,500

Lok Raunak Marol, Andheri (E) 6,600 - Buildtech Builders - Orient Ganesh Navi Mumbai Koperkhairene 3,000 Nov-08

Orient Ram Navi Mumbai Koperkhairene 2,700 Nov-08

Orient Star Navi Mumbai Kamothe 2,500 June-10

Orient Arcade Navi Mumbai Kamothe 2,500 June-09 - Royal Palms - Garden View Aarey Colony, Goregaon (E) 6,500 Jun-09

Lake View Aarey Colony, Goregaon (E) 7,200 Ready Possession

Summit Aarey Colony, Goregaon (E) 6,500 Ready Possession - Supreme Universal - Lake Homes Powai 9,000

Lake Primrose Powai 8,500 - Neptune - Color Scape Mulund (West) 8,991 Dec-09

Living Point Bhandup 7,991 - Nahar's Amrit Shakti - Vinca, Yucca, Yarrow Chandivili 12000 - 14000 Apr-09

Ivy, Mimosa, Tilia Chandivili 12000 - 14000 Mar-10 - Neelkanth - Kingdom Vidyavihar 7,500 Dec-09

Woods Phase II Thane 5,600 Jun-09 - Oberoi Construction - Oberoi Exquisite Goregaon (East) 7500-8500 3-4 years

Oberoi Splendor JVLR, Andheri East 14,000 Dec-09

Oberoi Springs Andheri (west) 20,765 Dec-08

Oberoi Woods Goregaon (East) 16,500

Property Prices to Fall 20% - Pujit Aggarwal

Property Prices which had touched the roof will fall inevitably by 15-20% very soon. This is backed by Orbit Corporation [Mumbai's Leading Developer] MD, Mr. Pujit Aggarwal. He said,

For instance, Parsvnath Developers promoters [Mr. Jain Family] pledged their own shares to raise immediate funding for a project, so tight is the liquidity situation. But due to the recent meltdown in Realty stocks, the lender invoked further co-lateral due to erosion in the stock value of Parsvnath. Had Mr. Jain defaulted, the pledged shares would end up in the market sending the stock prices further lower. To preserve the stock price, Parsvnath has to earn on a QoQ basis and this can happen only when they lower the price of the property and start resuming the stagnated sales.

It should come down in the festive season itself; people those who are ready to reduce it in the festive season itself it is where it will sell. If they don’t reduce the prices during that period, then it will not sell. There should be a correction of at least 15-20% from the top.Many Large Developers are facing extreme liquidity problems and may run into loss on a QoQ basis if they don't sell by lowering the prices.

For instance, Parsvnath Developers promoters [Mr. Jain Family] pledged their own shares to raise immediate funding for a project, so tight is the liquidity situation. But due to the recent meltdown in Realty stocks, the lender invoked further co-lateral due to erosion in the stock value of Parsvnath. Had Mr. Jain defaulted, the pledged shares would end up in the market sending the stock prices further lower. To preserve the stock price, Parsvnath has to earn on a QoQ basis and this can happen only when they lower the price of the property and start resuming the stagnated sales.

Tuesday, October 14, 2008

Mumbai Property Exhibition Rates

Our analyst tracking the Mumbai Property Market has an update on the rates at various projects as detailed in the Mumbai Property Exhibition. Many of the real estate developers gave discounts in the form of stamp duty and registration fees reimbursement to buyers, which accounts to a discount of 5-6%. No heavy discounts [20%] yet. So keep checking out before you BUY your dream home. If you are in for your second, you should be really RICH :-)

All are residential properties

Name of the Builder, Location, Price / sft and Tentative Possession Date

All are residential properties

Name of the Builder, Location, Price / sft and Tentative Possession Date

- Happy Home - Jade Garden Near BKC - Opp MIG Club 20,000 Oct-2010

- Kanakia Spaces - Niharika Thane (W) 5,000 Jun-2010

- Kohinoor - Kohinoor City - Phase III Kurla (west) 8,800 Dec-2009

- M S Shah Developers - Olive Andheri E 6,500

- Man Infraprojects - Valley Vista Navi Nerul 6,000 Apr-2011

- Mantri Real Estate - Mantri Park Goregaon (E) 5,550 Jun-2009

- Mayfair Housing - Silver Juhu 17,000 Dec-09

- NeelSidhi - Atlantis Navi Nerul 5,600 Dec-10

- Skyline Group - Skyline Oasis Vidyavihar (W) 9,000 Ready for Possession

- Bhoomi Rock Enclave Kandivali W 6,500, Rock Avenue Kandivali W 6,500, Elegant Kandivali E 5,700 - Ready for Possession

- Damji Shamji Shah Group - Mahavir Milestone Thane W 6,800, Mahavir Universe Bhandup W 6,561, Mahavir Millennium Thane W 4,951, Mahavir Platinum Cheda nagar 6,750, Mahavir Empress Ghatkopar W 8,000 Dec-2009

- Rajesh Builders - Raj Legacy Vikhroli W 10,400, Raj Maximus Borivli W 9,500, Raj Sunflower Borivli W 11,500 March-2010

- RNA Developers - RNA Sapphire Andheri W 11,000, RNA Royal Park Kandivali W 6,500. March 2009

- Godrej Properties - Kalyan 3,000 July-2010

Planet Godrej Mahalakshmi 35,000 - March-09 - Akruti City - Gardenia Mira Rd E 3,650, Vedant 9,500

- Hiranandani Estates - Villa Grand Thane 6,100, Canary Thane 6,600

- Acme - Ozone Thane W 7,500, Amrut Dahisar E 4,500

- Sheth - Grandeur Vasant Marvel, Borivali (E) 7,600, Polaris Goregaon W 11,000

Ivy Vasant Valley, Malad (E) 7,900, Vasant Pride Thakur Complex, Kandivili (E) 6,000, Silve Bell Off LBS Marg, Mulund(W) 6,200

Monday, October 13, 2008

Falling Land Prices - Mumbai

Its just not the realty stocks, but the Land Prices [a mini sub-prime bubble in Mumbai] has cracked. The Rail Land Development Authority (RLDA) recently reduced the minimum reserve price for 45,371 sq meters plot at Bandra (E), Mumbai by 14.4% from Rs46.28 bn to Rs39.6 bn. The location of the plot is near established business district of Bandra-Kurla Complex in Mumbai and the available FSI on the plot is 4.

Additionally, our Analyst tracking the deal said RLDA has removed the option of bullet payment for the land cost and extended the time lines for the installment option from 24 months to 60 months is enough evidence of tight market condition for real estate developers.

Finally, we believe that the revised reserve price of Rs39.6 bn is still on a higher side due to fall in rental values and will require developers to bid with aggressive rental assumptions[unfeasible] and other means of increasing the available FSI.

In another deal, MMRDA invited bids for commercial and cinema complex at Wadala in Central Mumbai, for which it got very a poor response. Real estate developers in the re bid meeting with MMRDA officials indicated that the reserve price for the plots is high as compared to the market prices. MMRDA has revised the last date for submission of bids from 23 September 2008 to 15 October 2008.

Additionally, our Analyst tracking the deal said RLDA has removed the option of bullet payment for the land cost and extended the time lines for the installment option from 24 months to 60 months is enough evidence of tight market condition for real estate developers.

Finally, we believe that the revised reserve price of Rs39.6 bn is still on a higher side due to fall in rental values and will require developers to bid with aggressive rental assumptions[unfeasible] and other means of increasing the available FSI.

In another deal, MMRDA invited bids for commercial and cinema complex at Wadala in Central Mumbai, for which it got very a poor response. Real estate developers in the re bid meeting with MMRDA officials indicated that the reserve price for the plots is high as compared to the market prices. MMRDA has revised the last date for submission of bids from 23 September 2008 to 15 October 2008.

Wednesday, October 08, 2008

Realty Stocks - All Time Low

The Indian Real Estate Stocks which have been crashing since few months now have hit a new Life Time Low. Their are no buyers for these stocks due to the flawed business model as earnings visibility of these companies has disappeared. [Evident from Advance Tax Nos]

First time Home Buyers can hit the street to look for bargains. Don't RUSH to close the deal as these Realtors will come down to more affordable pricing in existing projects. [Forget new ones, they have to clear the inventory to generate working capital]

First time Home Buyers can hit the street to look for bargains. Don't RUSH to close the deal as these Realtors will come down to more affordable pricing in existing projects. [Forget new ones, they have to clear the inventory to generate working capital]

First time Home Buyers can hit the street to look for bargains. Don't RUSH to close the deal as these Realtors will come down to more affordable pricing in existing projects. [Forget new ones, they have to clear the inventory to generate working capital]

First time Home Buyers can hit the street to look for bargains. Don't RUSH to close the deal as these Realtors will come down to more affordable pricing in existing projects. [Forget new ones, they have to clear the inventory to generate working capital]

Sunday, October 05, 2008

Bangalore Realty Roundup

Citi analysts were in Bangalore [ once upon a time known as Garden City]. Here is what they have to say about the top 3 companies operating in the market. Demand is lackluster with most buyers adopting a wait and watch approach. Oversupply of residential and commercial space continues in Eastern parts of the city (Whitefield and Sarjapur Outer Ring Road) and is unlikely to improve in the near-term.

Purvankara:

Purva Highlands project is on track. The project has 13 towers and foundation work has been completed for all 13 towers while the structure is up for 4-5 towers. 7 blocks were launched in the first phase ~2yrs ago and are 60%-70% sold. Possession of these 7 blocks will be handed over in Sep'09.

Sobha Developers:

Sobha launched two projects in Bangalore - one in North Bangalore (Petunia) and the other in Sarjapur Road (Celsia). In Celsia only ~30 out of 226 apartments have been sold while in Petunia, which is located in North Bangalore, ~107 of the 156 apartments have been sold.

Brigade:

Brigade Metropolis in Whitefield has 1,578 apartments of which ~1,100 are sold. The project has 12 residential towers. The structure is up for 10 towers and delivery of the first phase consisting of 7 towers will begin from Dec 2008. The project has 2 office towers and is likely to fetch a rental of mere Rs 40 / sft / month.

Purvankara:

Purva Highlands project is on track. The project has 13 towers and foundation work has been completed for all 13 towers while the structure is up for 4-5 towers. 7 blocks were launched in the first phase ~2yrs ago and are 60%-70% sold. Possession of these 7 blocks will be handed over in Sep'09.

Sobha Developers:

Sobha launched two projects in Bangalore - one in North Bangalore (Petunia) and the other in Sarjapur Road (Celsia). In Celsia only ~30 out of 226 apartments have been sold while in Petunia, which is located in North Bangalore, ~107 of the 156 apartments have been sold.

Brigade:

Brigade Metropolis in Whitefield has 1,578 apartments of which ~1,100 are sold. The project has 12 residential towers. The structure is up for 10 towers and delivery of the first phase consisting of 7 towers will begin from Dec 2008. The project has 2 office towers and is likely to fetch a rental of mere Rs 40 / sft / month.

Saturday, October 04, 2008

BPTP - Indian Sub-Prime Company ?

India's most expensive real estate deal is in trouble yet again, this time for mere Rs 230 crore second installment payment. Recall BPTP has defaulted in April over the Noida Land deal. Then the sum was Rs 1,251 crore but now its a paltry Rs 230 crore and the company has sough an extention to pay the same.

Due to global liquidity crunch the company has failed to stike a deal for diluting its own equity. It has already sold 40% of the four IT SEZs to raise $160 mn and another 3% stake in the parent company to JP Morgan Chase for Rs 250 cr.

What you should know is that the company is still struggling to pay for the land and has started its defaults right from the first installment, seeking extension and paying interest. Now consider a Base Case secnario, assuming BPTP begs and some how manages to pay off for the Land. What about the Development of the property ? If JP Morgan or the other investor who has bought 40% stake in IT SEZ [fully developed] and BPTP defaults on development [requires Cash] and the investor invokes his rights / clauses, this will lead to massive unwinding and trouble will spell to all those who are directly or in-directly exposed to this deal. [We can't say this for sure unless we get to see the facts, but on fair assumption, the towers will collapse on drawing broad even before they rise in Noida]

This is not just the case of BPTP, their are several small and mid-size developers in similar situation in every Tier-I and Tier-II cities. The listed companies are surviving because they kind of looted innocent investors money in IPO.

Due to global liquidity crunch the company has failed to stike a deal for diluting its own equity. It has already sold 40% of the four IT SEZs to raise $160 mn and another 3% stake in the parent company to JP Morgan Chase for Rs 250 cr.

What you should know is that the company is still struggling to pay for the land and has started its defaults right from the first installment, seeking extension and paying interest. Now consider a Base Case secnario, assuming BPTP begs and some how manages to pay off for the Land. What about the Development of the property ? If JP Morgan or the other investor who has bought 40% stake in IT SEZ [fully developed] and BPTP defaults on development [requires Cash] and the investor invokes his rights / clauses, this will lead to massive unwinding and trouble will spell to all those who are directly or in-directly exposed to this deal. [We can't say this for sure unless we get to see the facts, but on fair assumption, the towers will collapse on drawing broad even before they rise in Noida]

This is not just the case of BPTP, their are several small and mid-size developers in similar situation in every Tier-I and Tier-II cities. The listed companies are surviving because they kind of looted innocent investors money in IPO.

Wednesday, October 01, 2008

Realty Companies Advance Tax Nose Dives

The greedy and shady realty companies of India have taken a severe beating in Q2Fy09 as their advance tax numbers an indication of profits has nose dived. Here is the data which was circulated.

- DLF - Skipped to pay any advance tax in Q2

- HDIL - Skipped to pay any advance tax in Q2

- Unitech - Advance tax has declined by 50% in Q2

- Sobha Developers - Advance Tax declined by 60% to mere INR 5 crore

- Ansal API - Advance tax has dipped 50% to mere Rs 5 crore

It's general slowdown in the real estate sector which is showing in the advance tax figures.If you are planning to BUY your first home, hit the street with Cash and start negotiating. Also remember while negotiating that you are bailing them out in difficult times. Don't RUSH to close the deal as Realty market won't bounce back immediately. Try to squeeze the last drop from them.

Monday, September 29, 2008

Mumbai Reatly - Decline + Fall

The following chart [by Centrum Research] shows how Mumbai's Realty has faired over the past 16 years.

Centrum in the same report further makes a modest assumption of Realty prices correcting by 15% to 10% over the next 2 years while evaluating investment case for Mumbai focused realty companies like HDIL and Orbit.

Centrum in the same report further makes a modest assumption of Realty prices correcting by 15% to 10% over the next 2 years while evaluating investment case for Mumbai focused realty companies like HDIL and Orbit.

We present Residential Realty prices for few areas with the best construction in INR / SFT for FY08, FY09 and FY10

Centrum in the same report further makes a modest assumption of Realty prices correcting by 15% to 10% over the next 2 years while evaluating investment case for Mumbai focused realty companies like HDIL and Orbit.

Centrum in the same report further makes a modest assumption of Realty prices correcting by 15% to 10% over the next 2 years while evaluating investment case for Mumbai focused realty companies like HDIL and Orbit.We present Residential Realty prices for few areas with the best construction in INR / SFT for FY08, FY09 and FY10

- Cuffe Parade 40,000 - 36,000 - 34,000

- Worli 25,000 - 22,500 - 21,375

- Bandra 20,000 - 18,000 - 17,000

- Borivali 6,000 - 5,400 - 5,000

- Thane and Vashi 5,000 - 4,500 - 4,000

- Nariman Point 38,500 - 34,650 - 31,000

- Worli - 33,000 - 29,000 - 26,000

- Andheri 17,600 - 15,840 - 14,000

- Malad - 13,200 - 11,800 - 10,600

- Vashi - 5,500 - 4,950 - 4,450

- Thane - 6,600 - 5,940 - 5,400

Saturday, September 27, 2008

Mumbai commercial rentals Fall

Commercial Property Rentals are spiraling south in Mumbai as the US sinks deep into financial crisis. Barclays Bank took space at Cee Jay House in Worli for Rs725/sq ft/month in May 2008, the adjacent building with 80,000 sq ft of space is now receiving enquiries for Rs300-350. Property brokers are currently getting queries for Rs200-225 for One Indiabulls Centre compared to Rs275-325 earlier while in BKC (Bandra Kurla Complex) where rentals peaked at Rs450, clients are now negotiating for rates below Rs300.

Deals for office space have slowed by 30% in the last three months. Leading property brokers and consultants in Mumbai say things will be worse with prospective tenants asking for a 50% cut in rates.

Deals for office space have slowed by 30% in the last three months. Leading property brokers and consultants in Mumbai say things will be worse with prospective tenants asking for a 50% cut in rates.

Tuesday, September 23, 2008

Sobha Developers + Mahindra Lifespace Forthcoming Projects

Sobha Developers and Mahindra Lifespaces have the following forthcoming residential projects coming in India to cater to the housing needs.

Sobha Developers:

Bangalore - Apartments - 7 projects at various locations

Bangalore - Row houses - 2 projects

Thrissur - Apartments - 1 project

Mysore - Apartments - 2 projects

Mysore - Villas (Plots) - 1 project

Pune - Apartments - 3 projects

Gurgaon - Apartments - 2 projects

Gurgaon - Integrated Township

Mahindra Lifespaces:

Mahindra Chloris Faridabad, Haryana

Project Palam Vihar, Delhi NCR

JV MIHAN, Nagpur

JV with Alaya MWC, Chennai 55 acres

Sobha Developers:

Bangalore - Apartments - 7 projects at various locations

Bangalore - Row houses - 2 projects

Thrissur - Apartments - 1 project

Mysore - Apartments - 2 projects

Mysore - Villas (Plots) - 1 project

Pune - Apartments - 3 projects

Gurgaon - Apartments - 2 projects

Gurgaon - Integrated Township

Mahindra Lifespaces:

Mahindra Chloris Faridabad, Haryana

Project Palam Vihar, Delhi NCR

JV MIHAN, Nagpur

JV with Alaya MWC, Chennai 55 acres

Sunday, September 21, 2008

Parsvnath + DLF New Launches - Residential

Proposed new launches by Parsvnath Developers Ltd and DLF in India are as follows.

Parsvnath Developers:

Parsvnath Royal Villas Panipat Aug-08