Unitech, which is facing an acute financial crunch, has sold off its 200-room budget hotel in Gurgaon to a high net individual.

The deal for the Gurgaon-based Courtyard by Marriot was estimated at Rs 230 crore. Roop Madan, the buyer of the hotel, has interests in imports, in premium liquor and cigarette trade with investments in many real estate projects, the report added.

Unitech, which has a debt of around Rs 8,200 crore, is contemplating raising around Rs 1,500 crore from sale of projects, the report stated.

Meanwhile, India's second largest realty major has withdrawn its proposal to mop up Rs 5,000 crore from the overseas market.

Jeez!!! These guys will never improve, had they been a little reasonable in their business a year ago they wouldn't be in such a situation. Going by the current market scenario, they have invited larger trouble on their doorstep.

Thursday, February 26, 2009

Wednesday, February 25, 2009

Special audit of DLF books - Government

Minister of State for Finance has informed in the Parliament that the government had ordered to conduct a special audit of the real estate giant DLF's books and would take necessary action after scrutiny suitable as such.

He said that a special audit under section 142(2A) of the I-T Act was ordered in the case of Delhi Lease and Financing (DLF) for the assessment year 2006-07.

The Income-Tax department can initiate special audit of books of accounts under section 142 (2A) of the Income Tax Act in the interest of revenue protection.

He said that a special audit under section 142(2A) of the I-T Act was ordered in the case of Delhi Lease and Financing (DLF) for the assessment year 2006-07.

The Income-Tax department can initiate special audit of books of accounts under section 142 (2A) of the Income Tax Act in the interest of revenue protection.

Wednesday, February 18, 2009

Popular Estate to invest Rs 8028 cr in Ahmedabad

Popular Estate Management has entered into a Memorandum of Understanding (MoU) with the Ahmedabad Urban Development Authority (AUDA) for setting up three integrated townships in Ahmedabad district and affordable housing for MIG at Ahmedabad City.

The proposed investment for the said projects is Rs 8028 crore. The projects are scheduled for completion by 2012.

Popular Estates was earlier known as Pioneer Technoparks - promoted by Ramanbhai and ChagganBhai Patels. It looks like these guys change the name of their company to suit according to the frenzy on Dalal Street. After 2000, IT Boom it was Real Estate and hence Patels followed :-) However, they've gotta be really influenctial to bag a project of this scale.

The proposed investment for the said projects is Rs 8028 crore. The projects are scheduled for completion by 2012.

Popular Estates was earlier known as Pioneer Technoparks - promoted by Ramanbhai and ChagganBhai Patels. It looks like these guys change the name of their company to suit according to the frenzy on Dalal Street. After 2000, IT Boom it was Real Estate and hence Patels followed :-) However, they've gotta be really influenctial to bag a project of this scale.

DLF Drops Bannerghatta Road Project Prices by 25%

In a bold move to win the hearts of Bangaloreans, DLF seeking an entry in Bangalore has gottten aggressive and announced priced cuts of 25% on its upcoming project on Bannerghatta Road, Bangalore.

In October 2008, the DLF Westend Heights new town project was launched for Rs 2,775 / sft. If reports from today's Business Standard are to be believed then the pricing is down to Rs 2,100 / sft ET says the rates are down to Rs 1,850 for a larger apartment [1,900 sft size].

Nitesh, Prestige and Sobha have projects in the vicinity and had priced at a whopping Rs 3,200 / sft to Rs 3,500 / sft just few weeks ago. With DLF dropping the bomb shell on pricing, other developers have no choice but to follow them :-)

Similarly for The Summit Project in Hyderabad, DLF dropped prices

In October 2008, the DLF Westend Heights new town project was launched for Rs 2,775 / sft. If reports from today's Business Standard are to be believed then the pricing is down to Rs 2,100 / sft ET says the rates are down to Rs 1,850 for a larger apartment [1,900 sft size].

Nitesh, Prestige and Sobha have projects in the vicinity and had priced at a whopping Rs 3,200 / sft to Rs 3,500 / sft just few weeks ago. With DLF dropping the bomb shell on pricing, other developers have no choice but to follow them :-)

Similarly for The Summit Project in Hyderabad, DLF dropped prices

The per sq. ft prices that were to open at Rs4,000 have been slashed to Rs1,850 for a 1,760 sq. ft flat and to Rs2,000 for a 1,185 sq. ft flat in the project. Construction hasn’t yet begun and the project is expected to finish in three yearsCongratulations to DLF for kicking off the pricing war :-) Welcome to the Reality.

Thursday, February 12, 2009

Parsvnath + Omaxe + Sobha - non-investment grade Fitch

Fitch has downgraded Parsvnath Developers (PDL) to BB- from A-. Fitch notes that developers' reluctance to reduce prices and customers' opting to postpone their purchases, in anticipation of a fall in prices, has led to new home sales coming to a standstill which will severly affect the prospects of the company.

Fitch has downgraded Omaxe to BB- from A-. The downgrade reflects Fitch's expectation that Omaxe's profitability and operational cash flow generation will be significantly impacted by the challenging industry environment. The rating action also relates to heightened concerns over Omaxe's short-term liquidity position, which has shown signs of weakening over recent months and has therefore created a degree of short-term refinancing risk.

Fitch has downgraded Sobha Developers to BB- from BBB+. The downgrade reflects significant erosion in the real estate sector and its expected impact on Sobha's operating performance.

Fitch has downgraded Omaxe to BB- from A-. The downgrade reflects Fitch's expectation that Omaxe's profitability and operational cash flow generation will be significantly impacted by the challenging industry environment. The rating action also relates to heightened concerns over Omaxe's short-term liquidity position, which has shown signs of weakening over recent months and has therefore created a degree of short-term refinancing risk.

Fitch has downgraded Sobha Developers to BB- from BBB+. The downgrade reflects significant erosion in the real estate sector and its expected impact on Sobha's operating performance.

Sunday, February 08, 2009

10 Year Returns in Indian - Equity Vs Real Estate

There is a common myth amongst Indians - Property investment is a safe heaven compared to Equity. Maybe if you are willing to invest Big Amount in Prime Land, dealing with shady people with lost of Black Money transactions, etc

There is a common myth amongst Indians - Property investment is a safe heaven compared to Equity. Maybe if you are willing to invest Big Amount in Prime Land, dealing with shady people with lost of Black Money transactions, etcNow lets take for instance professionals like you and me passionate about our job straight away paying 30% tax to the Government and form the backbone of India [Be Proud]. We don't have huge money to invest in Land so the best of you might have thought of investing is an Apartment. Dream home is a must, but second home, third home speculation is totally uncalled for. The idea of this article is to show how smart professionals with Discipline and Patience have Punched a blow in the face of Speculative Property investors [No offence, just feeling extremely nice that RoI is far better than Realty Investors] For the sake of comparison, professional invested in Mutual Funds as they seldom gets time to Trade or Track a stock individually.

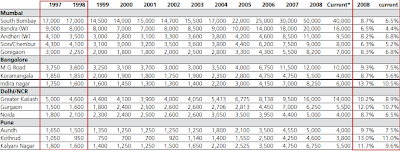

Real Estate Investment Returns in India from 1997-2008:

According to Kotak Report released in Jan-2009, the best residential realty investment RoI has been in Indiranagar, Bangalore - 13.7%, followed by Kothrud, Pune -13% and Gurgain, Delhi -12% [CAGR].

The following Chart Shows YoY Return in Real Estate in India between 1997 and 2008 + CAGR between 1997-2008in Delhi / NCR, Mumbai, Bangalore and Pune. [Expandable Chart]

Equity Returns in Indian Market between 1997 - 2008:

Equity Returns in Indian Market between 1997 - 2008:Now as assumed, investment has been in Mutual Fund - A diversified equity fund like HDFC Top 200 has delivered a whopping 21.94% in the same period as on Dec-2008. Other Equity Mutual Funds have also beaten Realty RoI.

So Equity has beaten Real Estate and is an opportunity for everybody Big or Small [as small as Rs 1,000 a month]. Bottom line, be productive, invest in the nation's manufacturing and industrial activity to create wealth. Of course, Patience is a must and see the returns you will enjoy after a decade :-)

Friday, February 06, 2009

BPTP to opt out of India's biggest land deal

BPTP - the over hyped real estate company with its promoters under the esctasy of Land havinally tasted the reality of Realty. We had called BPTP deal the sub-prime of India and they indeed are :-)

BPTP has applied for surrender of a 95-acre commercial plot at Sector 94 in Noida which it had bought for Rs50bn, making it India's largest land deal. The company has already paid Rs13bn, but is unable to pay the balance amount and, under a new policy of the Uttar Pradesh government, has applied for retaining ~25% of the land it has paid for. The new policy allows developers to either get payment of their land dues rescheduled or surrender the plot after paying a penalty of 10% of the amount deposited and get land elsewhere for the remaining amount. Developers have been allowed time up to June 2009 to submit their proposal to surrender their land.

Dirty Real Estate Developers who ignored Indian consumers and targeted NRIs have started converting 3 BHK lifestyle Apt projects into 2 BHK affordable Housing. But the price /sft has remained the same. Without any doubt the Realty sector is headed for another 15-20% correction and ENAM Securities in its report has said that India is headed for a hung Parliament [Means no will to liberalize the economy further, no big FDIs etc] So wait and watch, but if you get a DEAL, squeeze the Developer and BUY it.

BPTP has applied for surrender of a 95-acre commercial plot at Sector 94 in Noida which it had bought for Rs50bn, making it India's largest land deal. The company has already paid Rs13bn, but is unable to pay the balance amount and, under a new policy of the Uttar Pradesh government, has applied for retaining ~25% of the land it has paid for. The new policy allows developers to either get payment of their land dues rescheduled or surrender the plot after paying a penalty of 10% of the amount deposited and get land elsewhere for the remaining amount. Developers have been allowed time up to June 2009 to submit their proposal to surrender their land.

Dirty Real Estate Developers who ignored Indian consumers and targeted NRIs have started converting 3 BHK lifestyle Apt projects into 2 BHK affordable Housing. But the price /sft has remained the same. Without any doubt the Realty sector is headed for another 15-20% correction and ENAM Securities in its report has said that India is headed for a hung Parliament [Means no will to liberalize the economy further, no big FDIs etc] So wait and watch, but if you get a DEAL, squeeze the Developer and BUY it.

Thursday, February 05, 2009

Mumbai Realtors Start Dropping Prices to Unload

Developers in Mumbai have started unloading properties across the city at whatever discount they can push it off the block. Here is the latest comparison between Oct-08 and Jan-09 prices in key pockets as showcased by developers in the ET Realty Expo.

Godrej Properties

Planet Godrej, Mahalaxmi 35,000-39,000 25,000 -32%

Godrej Riverside, Kalyan 3,000 2,250 -25%

Kalpataru

Ghatkopar 8,200 6,600-6,800 -18%

Andheri (E) 10,000-12,000 8,650 -21%

Riverside, Panvel 3,800 2,800 -26%

Kalpataru Towers, Kandivali (E) 7,700 6,500 -16%

Kalpataru Gardens, Kandivali (E) 7,900 6,600 -16%

Royal Palms

Goregaon 6,500-7,200 4,000-4,800 -36%

Lok Group

Nirman, Khar (W) 20,000 15,000-18,000 -18%

Rustomjee

Elanza, Malad (W) 9,000 9,000 0%

Urbania, Thane (W) 5,000 3,330 -33%

Godrej Properties

Planet Godrej, Mahalaxmi 35,000-39,000 25,000 -32%

Godrej Riverside, Kalyan 3,000 2,250 -25%

Kalpataru

Ghatkopar 8,200 6,600-6,800 -18%

Andheri (E) 10,000-12,000 8,650 -21%

Riverside, Panvel 3,800 2,800 -26%

Kalpataru Towers, Kandivali (E) 7,700 6,500 -16%

Kalpataru Gardens, Kandivali (E) 7,900 6,600 -16%

Royal Palms

Goregaon 6,500-7,200 4,000-4,800 -36%

Lok Group

Nirman, Khar (W) 20,000 15,000-18,000 -18%

Rustomjee

Elanza, Malad (W) 9,000 9,000 0%

Urbania, Thane (W) 5,000 3,330 -33%

Wednesday, February 04, 2009

ICICI's Bogus Affordable Homes Spam with Ozone Group Bangalore

If you are one of those premium customers, then chances are that you would have got ICICI Home Search's Evergreen Apartments by Ozone Group of Bangalore on Sarjapur Road.

The offer is Rs 2.9 mn for a 2 BHK of 902 sft which translates to a whopping Rs 3,220 / sft and these slackers call this affordable housing. The completion date is 2011. ICICI needs to do a reality survey of Realty before sending any such self reputation knocking e-mails.

Current price for ready to occupy apartments is less than Rs 3,222 quoted by ICICI and is only headed down. DLF's Rajeev Singh has gone on record to say that Realty prices will correct by another 15% :-) So don't go by these ICICI Home Loans folks unless you get a FANTASTIC deal.

The offer is Rs 2.9 mn for a 2 BHK of 902 sft which translates to a whopping Rs 3,220 / sft and these slackers call this affordable housing. The completion date is 2011. ICICI needs to do a reality survey of Realty before sending any such self reputation knocking e-mails.

Current price for ready to occupy apartments is less than Rs 3,222 quoted by ICICI and is only headed down. DLF's Rajeev Singh has gone on record to say that Realty prices will correct by another 15% :-) So don't go by these ICICI Home Loans folks unless you get a FANTASTIC deal.

Subscribe to:

Comments (Atom)